How Investors May Respond To ICL Group (ICL) Balancing New Water Fees With Cash Dividends

- ICL Group Ltd. recently announced a cash dividend of US$0.048 per share (about US$62,000,000 in total), payable on December 17, 2025, with varying Israeli withholding tax rates depending on shareholder residency and type.

- On top of this payout, an Israeli Supreme Court ruling now requires ICL to pay retroactive Dead Sea water extraction fees from 2018, adding US$70,000,000–US$90,000,000 in one-off costs and higher ongoing operating expenses through 2030.

- We will now examine how this new water fee obligation reshapes ICL Group’s investment narrative, including its cost structure and cash returns.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

ICL Group Investment Narrative Recap

To own ICL Group, you need to believe in its ability to translate specialty minerals and chemicals into steady cash generation, even as regulatory and cost pressures evolve. The new Dead Sea water fee ruling looks material for short term margins, while the key near term catalyst remains how effectively ICL manages its cost base and capital allocation. The main risk now is a structurally higher cost structure alongside already pressured profitability.

The latest US$0.048 per share dividend, totaling about US$62,000,000, underlines ICL’s ongoing cash returns to shareholders despite these added water fee obligations. For investors, this pairing of continued dividends with rising regulatory and environmental costs creates a clearer tension around future payout capacity and reinvestment needs.

Yet behind the regular dividend stream, investors should be aware that rising Dead Sea extraction fees could...

Read the full narrative on ICL Group (it's free!)

ICL Group's narrative projects $8.1 billion revenue and $714.9 million earnings by 2028. This requires 5.2% yearly revenue growth and a roughly $311 million earnings increase from $404.0 million today.

Uncover how ICL Group's forecasts yield a $6.74 fair value, a 28% upside to its current price.

Exploring Other Perspectives

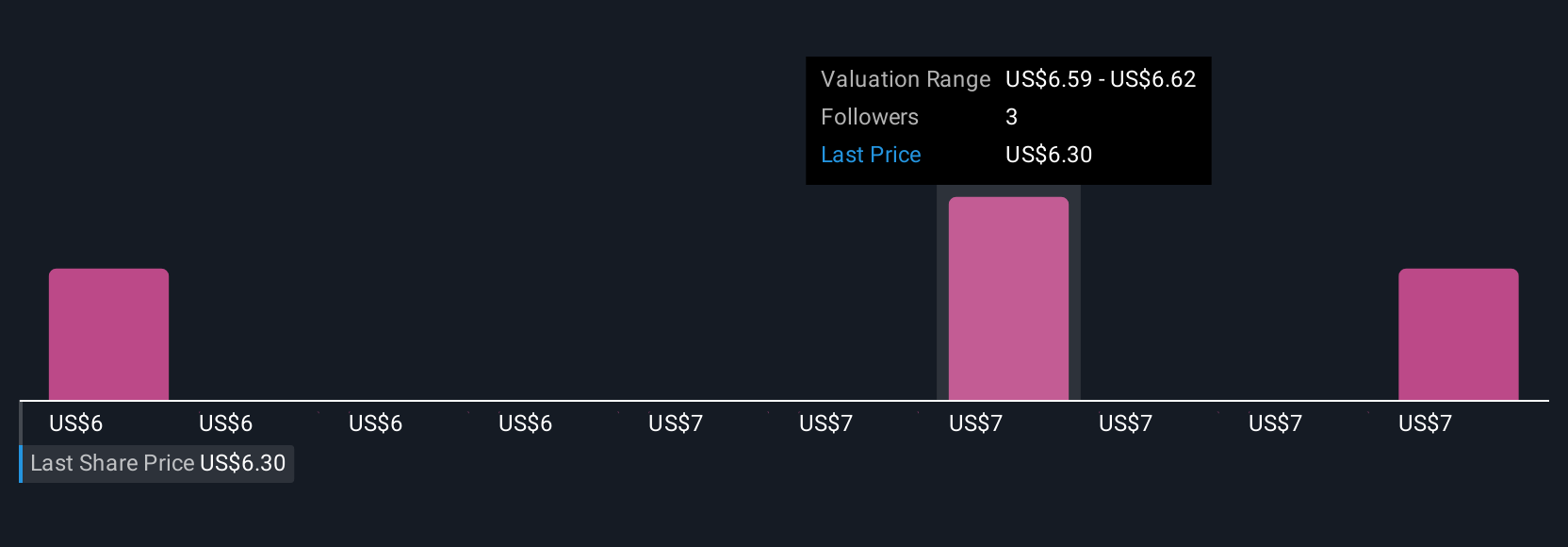

Three members of the Simply Wall St Community value ICL Group between US$5.84 and US$6.74 per share, underscoring how widely opinions can differ. You should weigh these views against the new, higher Dead Sea water fees that could pressure costs and explore several alternative viewpoints on how that might affect future performance.

Explore 3 other fair value estimates on ICL Group - why the stock might be worth just $5.84!

Build Your Own ICL Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICL Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free ICL Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICL Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报