Is Cimpress (CMPR) Quietly Recasting VistaPrint’s North America Strategy With Its New Category Chief?

- Cimpress’ VistaPrint business has appointed industry veteran Dave DeSandre as Senior Vice President of North America, Category Management, effective December 1, 2025, reporting directly to CEO Florian Baumgartner to lead product innovation, customer experience and commercial execution across the region.

- DeSandre’s background in scaling Wayfair’s B2B platform into a multi-billion dollar offering suggests Cimpress is reinforcing its push into higher-value, customer-centric categories and operational transformation.

- We’ll now examine how DeSandre’s remit over North American category transformation could influence Cimpress’ existing investment narrative and long-term positioning.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Cimpress Investment Narrative Recap

To own Cimpress, you need to believe VistaPrint can shift from legacy print into higher value, customer centric categories while protecting margins and eventually lifting free cash flow from today’s CapEx burden. DeSandre’s appointment directly addresses that category transformation effort in North America, but it does not materially change the near term risk that elevated investment and leverage could pressure cash generation if execution or demand disappoints.

The ongoing share buyback program, with roughly US$87.46 million spent to date under the current authorization, is the recent announcement that most clearly intersects with this news. It adds another layer of capital allocation on top of already high investment needs, which can amplify both the upside if VistaPrint’s transformation succeeds and the downside if returns on these investments fall short of expectations.

Yet against this potentially attractive repositioning, investors should be aware that Cimpress’ high maintenance CapEx and existing leverage could become far more uncomfortable if...

Read the full narrative on Cimpress (it's free!)

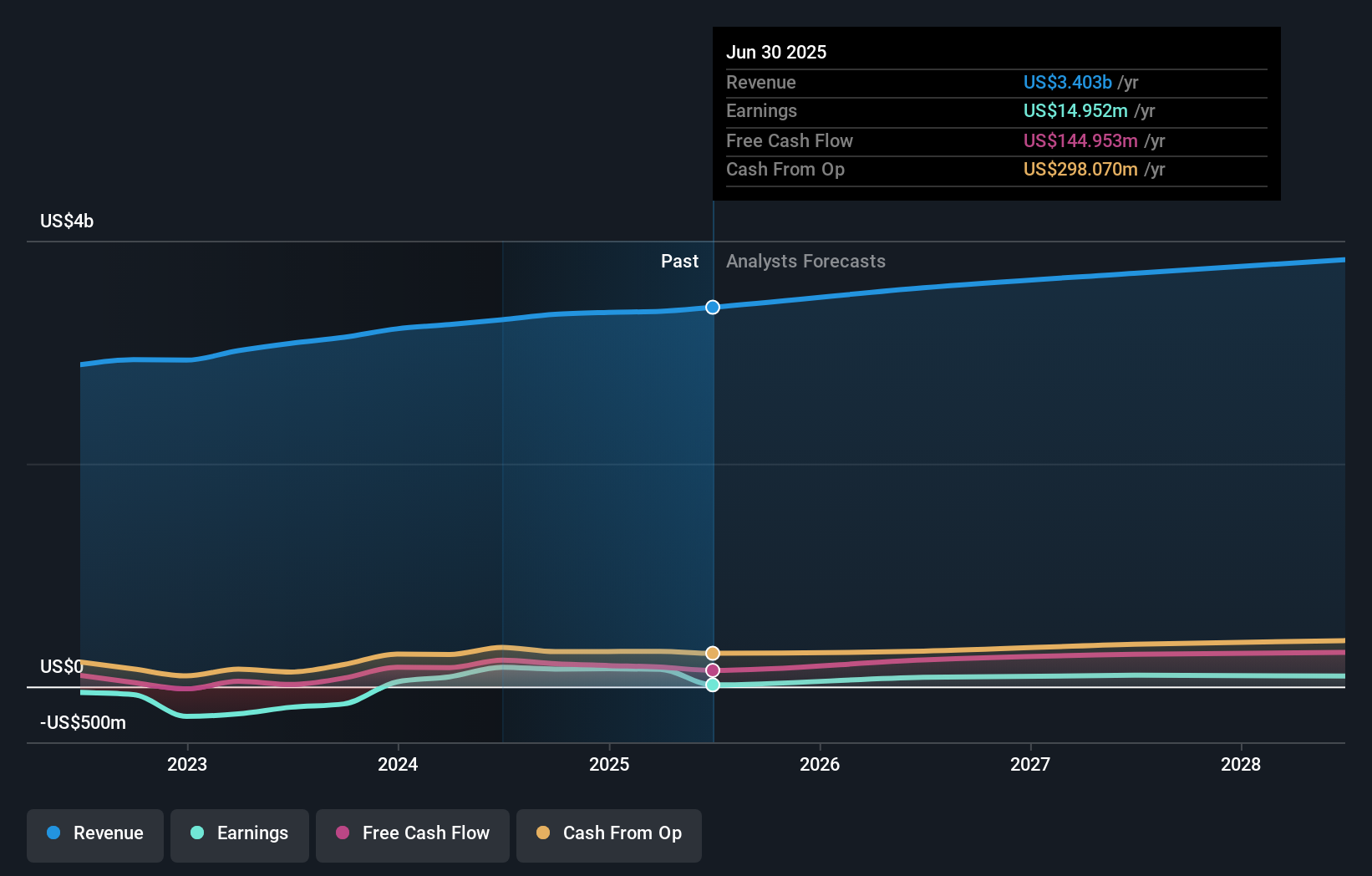

Cimpress’ narrative projects $3.8 billion revenue and $94.7 million earnings by 2028.

Uncover how Cimpress' forecasts yield a $86.50 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Cimpress span from US$86.50 to US$3,107.51, showing how far apart individual views can be. Set those views against the risk that high CapEx and leverage could constrain Cimpress’ options if execution on VistaPrint’s category transformation falls short, and it becomes even more important to compare multiple perspectives before forming your own view.

Explore 3 other fair value estimates on Cimpress - why the stock might be worth just $86.50!

Build Your Own Cimpress Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cimpress research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cimpress research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cimpress' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报