Southern Silver Exploration (TSXV:SSV) Is Up 22.0% After Bonanza-Grade Puro Corazon Drill Results And C$5M Financing - Has The Bull Case Changed?

- Southern Silver Exploration Corp. recently announced a bought-deal private placement with Red Cloud Securities to sell 10,000,000 common shares at C$0.50 each, raising C$5,000,000 with an option for an additional 2,000,000 shares, alongside reporting bonanza-grade, near-surface silver mineralization at its Puro Corazon claim in Durango, Mexico.

- This combination of fresh capital and very high-grade drilling results at the newly acquired Puro Corazon claim could materially influence plans to update the Cerro Las Minitas project’s Mineral Resource Estimate and Preliminary Economic Assessment in early 2026.

- We’ll now examine how these bonanza-grade Puro Corazon drill results may shape Southern Silver Exploration’s investment narrative in the near term.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Southern Silver Exploration's Investment Narrative?

To own Southern Silver Exploration, you have to believe that Cerro Las Minitas can be transformed from an exploration story into a robust silver project, and that management can fund that journey without eroding too much shareholder value. The latest bought-deal financing at C$0.50 and bonanza-grade, near-surface silver at Puro Corazon slot directly into that thesis, giving the company fresh capital and a more compelling case for its planned 2026 resource and PEA updates. These results appear material for the near term: they sharpen the key catalysts around drilling news flow, index inclusion and technical de-risking, while potentially justifying the strong recent share price run despite persistent losses and zero revenue. The flip side is that dilution, execution risk in Mexico and the absence of cash flow remain front and center.

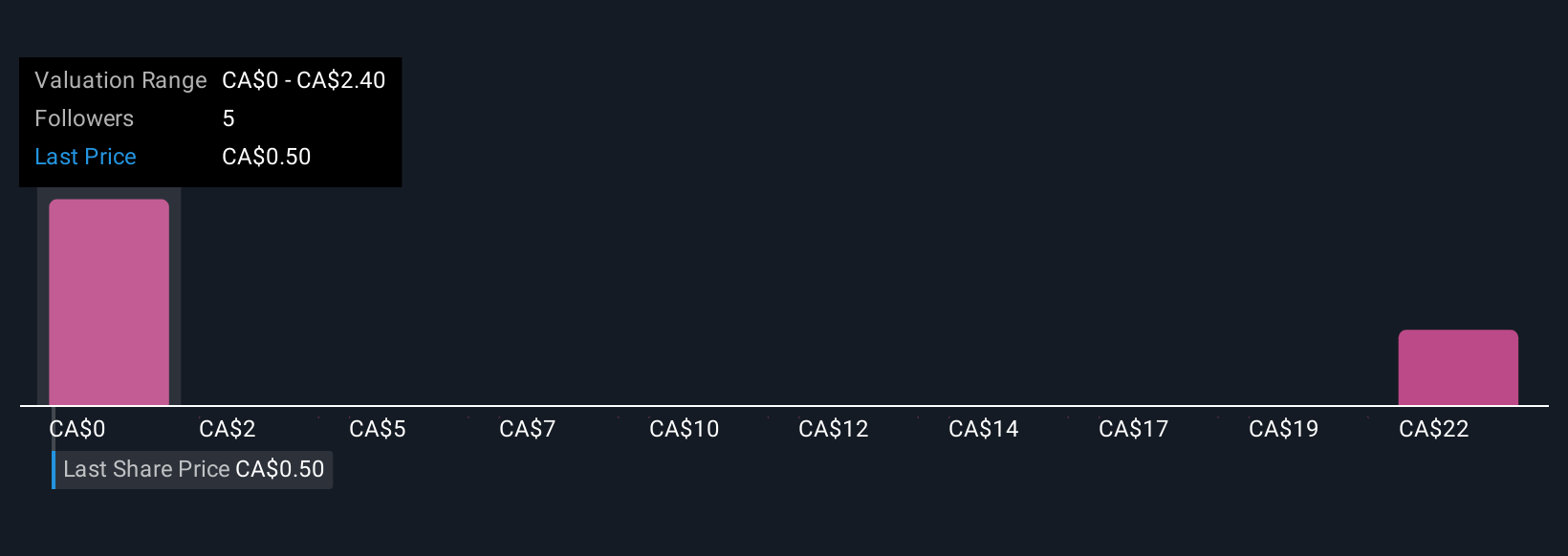

However, one risk in particular could catch new shareholders off guard. Our expertly prepared valuation report on Southern Silver Exploration implies its share price may be too high.Exploring Other Perspectives

Explore 3 other fair value estimates on Southern Silver Exploration - why the stock might be a potential multi-bagger!

Build Your Own Southern Silver Exploration Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Silver Exploration research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Southern Silver Exploration research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Silver Exploration's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报