Cognex (CGNX) Valuation Check After JP Morgan Downgrade and Weak Multi‑Year Shareholder Returns

JP Morgan’s downgrade of Cognex (CGNX) to a more cautious rating has put the stock back under the microscope, as investors reassess how its automation story lines up with near term growth expectations.

See our latest analysis for Cognex.

The downgrade lands after a choppy stretch, with a 30 day share price return of minus 9.62 percent and a 5 year total shareholder return of minus 47.58 percent, signaling that momentum has been fading despite recent operational progress.

If this shift in sentiment around factory automation has you rethinking your exposure to tech, it could be a good moment to explore high growth tech and AI stocks for fresh ideas.

With shares trading below both intrinsic and Street targets but weighed down by years of lagging returns, is Cognex now a quietly mispriced automation play, or is the market accurately discounting its future growth?

Most Popular Narrative: 22.9% Undervalued

With Cognex last closing at $37.69 versus a narrative fair value near the high 40s, the story leans toward a recovery that markets have yet to fully price.

Company wide cost optimization and continued operating leverage, evidenced by expanding EBITDA margins and disciplined expense management, are driving long term increases in net margins and free cash flow conversion, supporting strong earnings and capital returns.

Want to see what is hiding behind that margin makeover, and how future growth, profitability, and multiples all connect to that fair value jump?

Result: Fair Value of $48.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this recovery case could unravel if machine vision hardware keeps commoditizing, or if a slower shift to higher margin AI software undermines earnings momentum.

Find out about the key risks to this Cognex narrative.

Another View: Multiples Flash a Warning

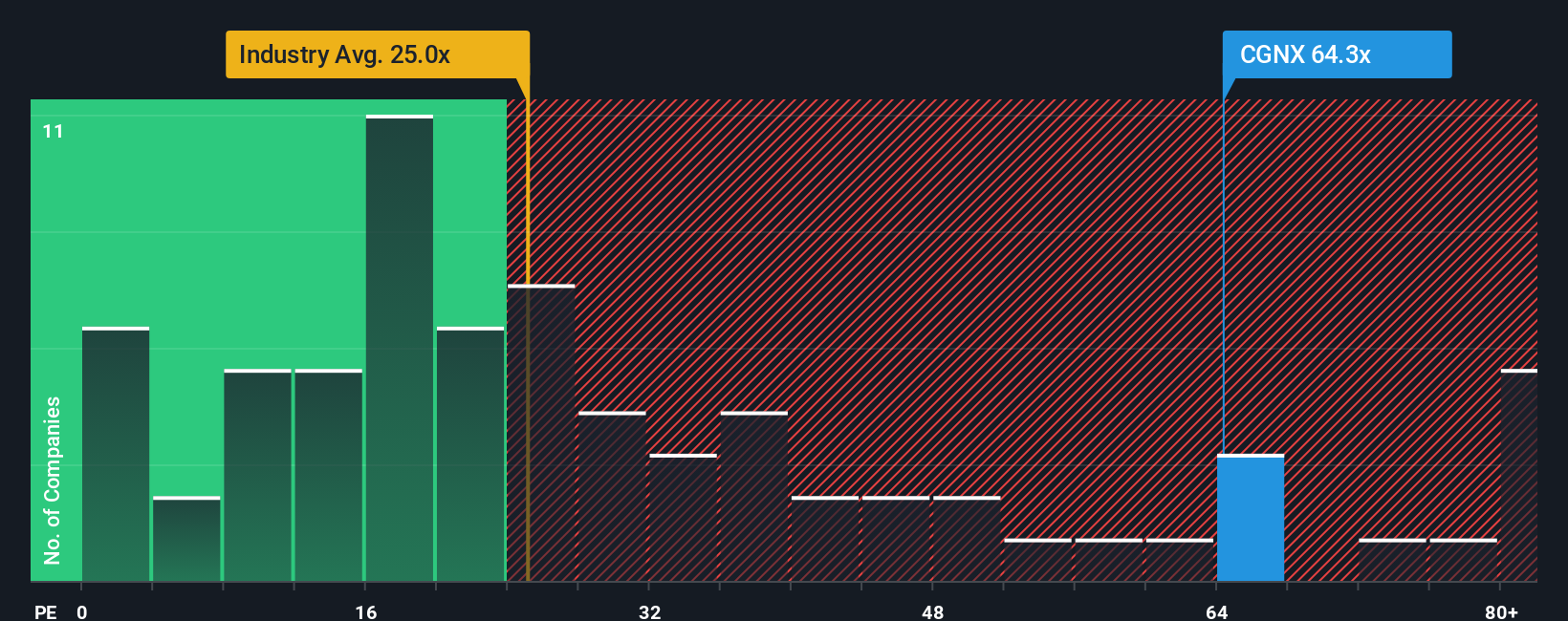

While narrative fair value points to upside, the earnings multiple tells a different story. Cognex trades on a 57.3 times P/E, well above its 32 times fair ratio and far richer than both peers at 42.5 times and the US Electronic industry at 23.5 times. If sentiment cools or growth disappoints, it raises the question of how much room there is for the multiple to compress.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cognex Narrative

If you want to challenge these assumptions or prefer to dive into the numbers yourself, you can craft a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cognex.

Looking for more investment ideas?

Before you move on, lock in your next set of opportunities by using the Simply Wall St Screener to surface focused, data backed ideas that others may be missing.

- Position your portfolio for potential mispricings by scanning these 919 undervalued stocks based on cash flows that the market may not be fully recognizing yet.

- Tap into powerful secular trends in automation and data by reviewing these 25 AI penny stocks building real businesses around artificial intelligence.

- Strengthen your income stream by targeting these 14 dividend stocks with yields > 3% that combine attractive payouts with solid underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报