Sigma Lithium (NasdaqCM:SGML): Valuation Check After COP30 Spotlight on Its ‘Quintuple Zero’ ESG Model

Sigma Lithium (SGML) is back in the spotlight after its high profile push at COP30, where management showcased a Quintuple Zero ESG model that directly ties Brazil’s lithium ambitions to cleaner, lower impact production.

See our latest analysis for Sigma Lithium.

The COP30 spotlight has coincided with a sharp 30 day share price return of 87.02% from Sigma Lithium. Yet its year to date share price return remains negative, and the three year total shareholder return of 71.59% is still deeply underwater, suggesting momentum is rebuilding from a beaten down base rather than launching from peak optimism.

If this ESG driven story has your attention, it could be a good moment to broaden your search and discover auto manufacturers linked to the electric vehicle supply chain.

With the stock still down over the year despite rapid recent gains and trading only slightly below analyst targets, investors now face a key question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative: 4.6% Undervalued

With Sigma Lithium closing at $10.02 versus a narrative fair value of $10.50, the prevailing view sees modest upside supported by structural earnings improvements.

Upward revisions to EBITDA estimates reflect expectations for stronger lithium pricing and support improved profitability projections.

Bullish analysts believe that, despite liquidity concerns, a potential equity raise could serve as a catalyst for value creation, especially if the lithium cycle continues to rebound.

Curious how aggressive revenue growth, a sharp shift in margins, and a compressed future earnings multiple can still add up to upside from here? The numbers behind this fair value might surprise you.

Result: Fair Value of $10.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, liquidity pressures and heightened exposure to volatile lithium prices could quickly undermine these margin gains if conditions turn against Sigma Lithium.

Find out about the key risks to this Sigma Lithium narrative.

Another Take on Valuation

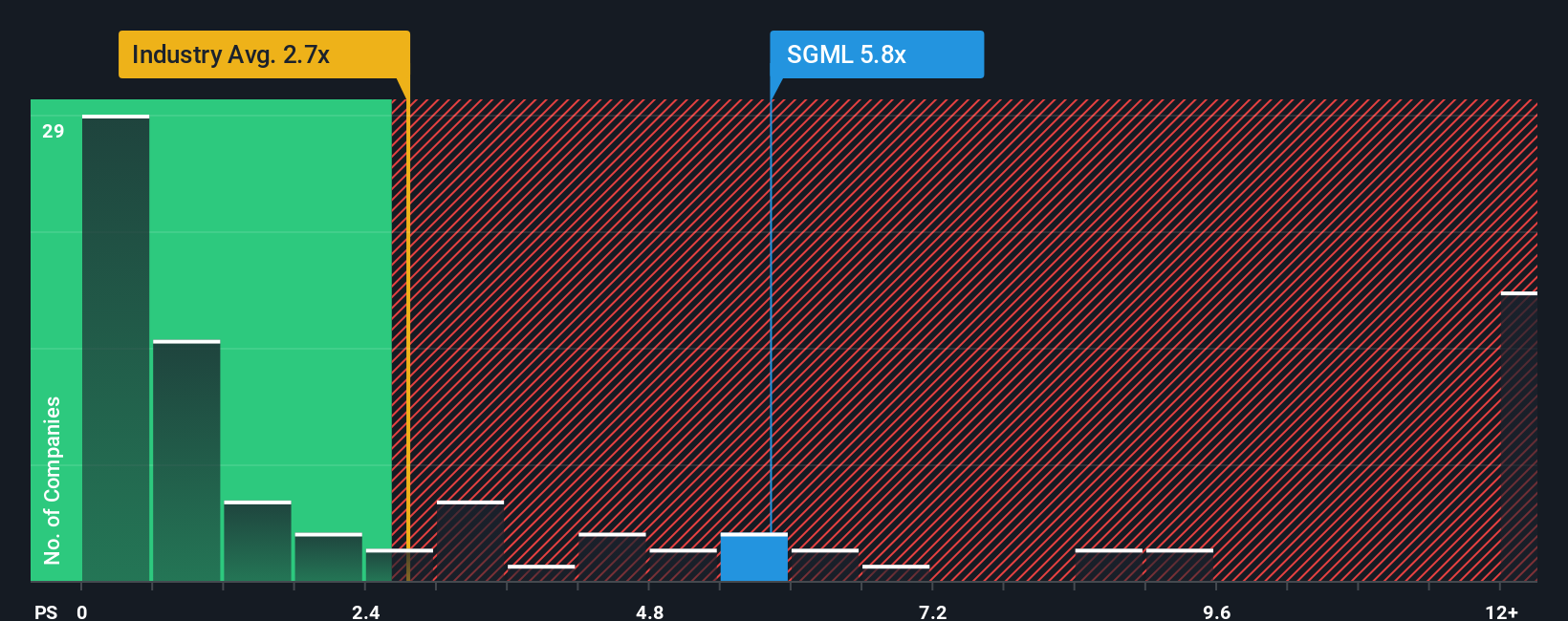

While the narrative fair value suggests modest upside, the price to sales ratio tells a tougher story. SGML trades at about 8 times sales versus an industry average of 1.9 times and a fair ratio of 1.6 times, signaling real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sigma Lithium Narrative

If this perspective does not quite match your view, dive into the data yourself and shape a personalized narrative in minutes, Do it your way.

A great starting point for your Sigma Lithium research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, put your research to work by quickly scanning fresh ideas in the Simply Wall St Screener that match your goals and risk appetite.

- Capture potential bargains by targeting companies priced below their cash flow potential through these 919 undervalued stocks based on cash flows, giving you a head start on mispriced opportunities.

- Ride the next wave of intelligent automation by focusing on innovative businesses at the intersection of medicine and algorithms with these 30 healthcare AI stocks.

- Boost your income stream by zeroing in on established companies offering attractive yields using these 14 dividend stocks with yields > 3%, ahead of any changes in how the market may view their stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报