Intuitive Machines (LUNR) Faces New NASA Contract Decisions Can It Turn Moonshots Into Durable Revenue

- Cantor Fitzgerald recently reaffirmed its Overweight rating on Intuitive Machines, highlighting the completed Lanteris acquisition and several upcoming NASA-related contract decisions and missions as key near-term catalysts.

- This cluster of potential Lunar Terrain Vehicle and CLPS CT4 contract awards, alongside the planned IM-3 lunar mission, has sharpened investor focus on how quickly Intuitive Machines can convert technical capabilities into recurring revenue.

- Next, we’ll explore how the anticipated Lunar Terrain Vehicle contract decision could reshape Intuitive Machines’ broader investment narrative and risk profile.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Intuitive Machines Investment Narrative Recap

To own Intuitive Machines, you need to believe that government backed lunar and deep space infrastructure will turn into durable, recurring revenue, not just one off missions. The latest Cantor Fitzgerald update keeps investor attention firmly on the Lunar Terrain Vehicle decision, which still looks like the most important near term catalyst, while execution risk around large, concentrated NASA contracts remains the clearest business risk.

Among recent announcements, the expected Lunar Terrain Vehicle award before year end stands out as most relevant, because it could extend Intuitive Machines’ role beyond individual Commercial Lunar Payload Services missions into longer duration surface operations. How that decision lands, alongside the planned CLPS CT4 award and IM 3 mission timing, will likely influence how investors weigh the company’s contract concentration against its broader space infrastructure ambitions.

Yet while these contracts could reshape growth expectations, investors should be aware of how dependent current revenue is on a small number of large government programs...

Read the full narrative on Intuitive Machines (it's free!)

Intuitive Machines' narrative projects $502.2 million revenue and $41.2 million earnings by 2028.

Uncover how Intuitive Machines' forecasts yield a $15.50 fair value, a 52% upside to its current price.

Exploring Other Perspectives

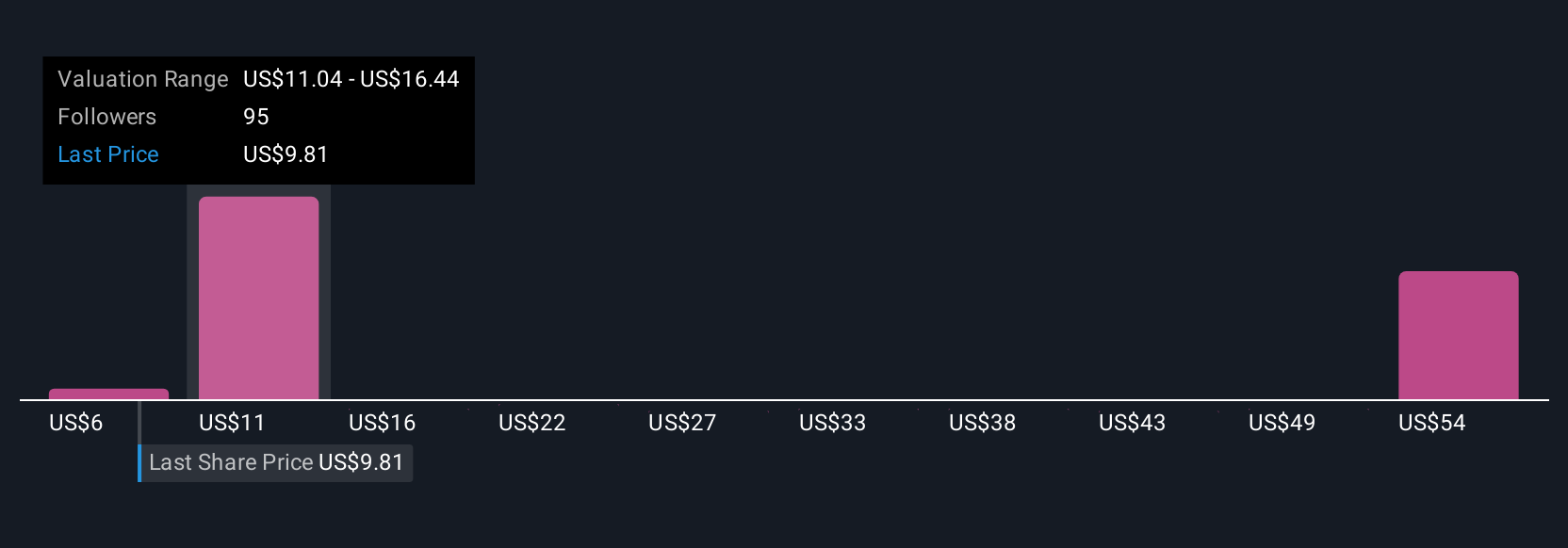

Simply Wall St Community members have published 29 fair value estimates for Intuitive Machines, ranging from US$5.69 to US$58.60 per share, underscoring how far apart views can be. Against that backdrop, the heavy reliance on a few large government contracts highlights why you may want to compare multiple risk and reward scenarios before forming your own view.

Explore 29 other fair value estimates on Intuitive Machines - why the stock might be worth 44% less than the current price!

Build Your Own Intuitive Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intuitive Machines research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Intuitive Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intuitive Machines' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报