How Analyst Downgrades and Caesars Lease Risks At VICI Properties (VICI) Have Changed Its Investment Story

- In recent days, multiple Wall Street firms, including Evercore ISI and Wells Fargo, downgraded VICI Properties after flagging concerns around its regional gaming lease with Caesars Entertainment and the tight rent coverage on those assets.

- Analysts now see the possible need for rent concessions or asset transfers on the Caesars regional portfolio, highlighting how crucial this single master lease has become for VICI’s income mix and risk profile.

- We’ll now examine how the potential Caesars lease restructuring, and associated analyst caution, reshapes VICI Properties’ broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

VICI Properties Investment Narrative Recap

To own VICI, you have to be comfortable with a landlord that leans heavily on long, triple net leases from a few big gaming tenants. The Caesars regional lease now sits at the center of that story, as any rent relief or asset transfer could influence near term income visibility and has become the key short term swing factor alongside the risk of tenant concentration.

Against this backdrop, VICI’s September 2025 dividend increase to US$0.45 per share each quarter, a 4% raise, stands out. It reinforces that management is still committing more cash to shareholders even as analysts grow more cautious about the Caesars lease and the company’s forward growth profile.

Yet behind the headline dividend growth, the concentration in a single master lease is a risk investors should be aware of...

Read the full narrative on VICI Properties (it's free!)

VICI Properties’ narrative projects $4.3 billion revenue and $2.8 billion earnings by 2028. This implies 3.4% yearly revenue growth with earnings remaining flat, requiring no change from current earnings of $2.8 billion.

Uncover how VICI Properties' forecasts yield a $36.09 fair value, a 28% upside to its current price.

Exploring Other Perspectives

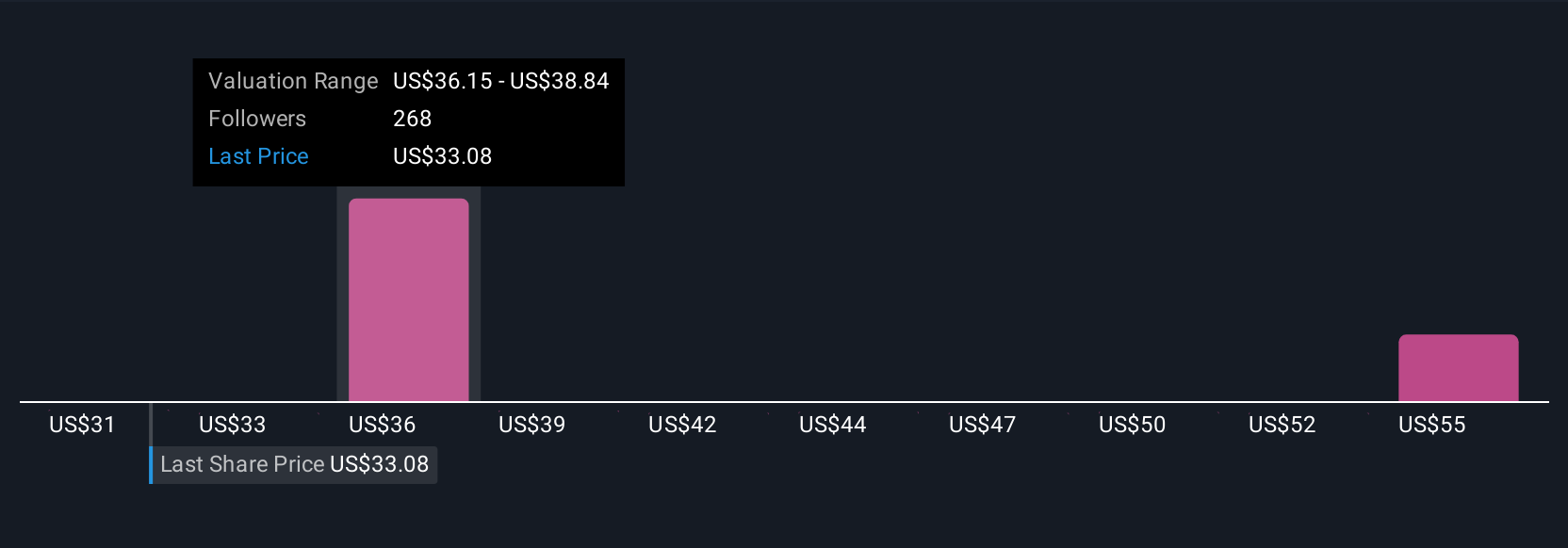

Eight fair value estimates from the Simply Wall St Community span roughly US$32 to US$55 per share, showing just how far apart individual views can be. You are weighing those against a Caesars lease that now accounts for roughly a quarter of VICI’s net operating income and could shape how reliable that income stream looks over time.

Explore 8 other fair value estimates on VICI Properties - why the stock might be worth as much as 94% more than the current price!

Build Your Own VICI Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VICI Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free VICI Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VICI Properties' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报