What WEBTOON Entertainment (WBTN)'s User Metrics Lawsuit Means For Shareholders

- In late 2025, Grabar Law Office announced an investigation on behalf of WEBTOON Entertainment shareholders after a U.S. District Court declined to dismiss a securities fraud class action alleging misstatements around Monthly Active Users at the June 27, 2024 IPO.

- The legal scrutiny centers on whether WEBTOON’s leadership misled investors on a core engagement metric, raising questions about governance and data transparency at a time when user figures underpin the company’s growth story.

- We’ll now examine how this shareholder litigation risk, tied to WEBTOON’s alleged Monthly Active User disclosures, may reshape its investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

WEBTOON Entertainment Investment Narrative Recap

To own WEBTOON Entertainment, you need to believe its global storytelling platform can convert a large, engaged user base into sustainable profits through better monetization and IP expansion. The new MAU‑related securities case adds uncertainty around data trust and governance, but it does not yet change the near term focus on stabilizing user trends and addressing recent revenue guidance for a Q4 2025 decline.

The most relevant recent update here is WEBTOON’s Q3 2025 earnings, where revenue grew to US$378.04 million but profitability slipped to an US$11.65 million net loss and Q4 revenue was guided lower. Against that backdrop, any litigation that questions reported Monthly Active Users could complicate how investors interpret these figures and weigh the path toward the company’s expected move toward profitability in the next few years.

But while the growth story is tied closely to MAU, one underappreciated risk investors should be aware of is...

Read the full narrative on WEBTOON Entertainment (it's free!)

WEBTOON Entertainment's narrative projects $2.0 billion revenue and $30.0 million earnings by 2028. This requires 13.8% yearly revenue growth and a $130.1 million earnings increase from -$100.1 million today.

Uncover how WEBTOON Entertainment's forecasts yield a $18.31 fair value, a 32% upside to its current price.

Exploring Other Perspectives

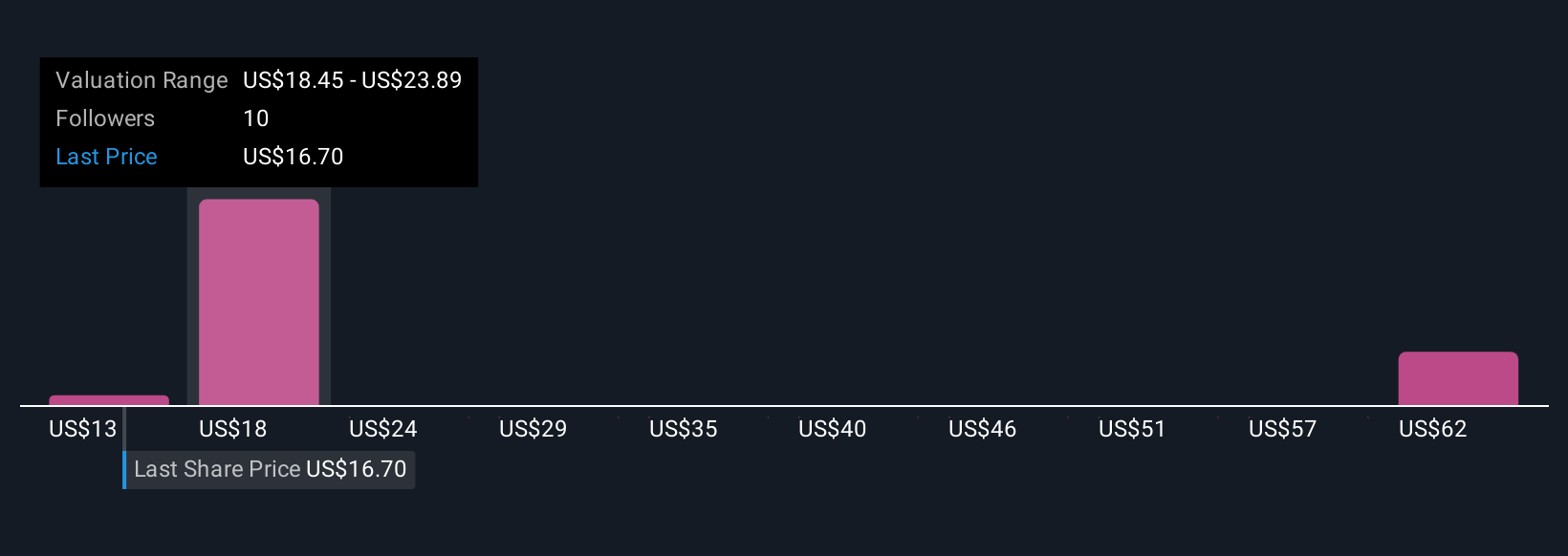

Three fair value views from the Simply Wall St Community span roughly US$17.39 to US$28.18, showing a wide dispersion in expectations. As you weigh those, remember that any uncertainty around WEBTOON’s reported Monthly Active Users could influence how sustainable its growth and eventual profitability turn out to be, so it is worth exploring several of these viewpoints before deciding how to interpret the stock today.

Explore 3 other fair value estimates on WEBTOON Entertainment - why the stock might be worth just $17.39!

Build Your Own WEBTOON Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WEBTOON Entertainment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free WEBTOON Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WEBTOON Entertainment's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报