What Resideo Technologies (REZI)'s Smart Thermostat Launch and Grid Exit Means For Shareholders

- Resideo Technologies recently launched the Honeywell Home X8S smart thermostat, a premium touchscreen device that streams live video from compatible doorbells while emphasizing precision comfort control and energy efficiency features.

- At the same time, the company exited its Grid Services demand response division to concentrate on core residential controls and sensing, underlining a clearer focus on smart home innovation without altering its 2025 financial outlook.

- Now we’ll examine how the X8S launch, with integrated multi-brand doorbell video streaming, potentially reshapes Resideo’s investment narrative and positioning.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Resideo Technologies Investment Narrative Recap

To own Resideo, you need to believe its Honeywell Home brand can keep a meaningful foothold in connected home comfort, even as Big Tech crowds the category and housing remains uneven. The X8S launch and grid-services exit sharpen the story around smart thermostats and sensing, but do not materially change the near term catalyst, which still hinges on sustained adoption of its next generation thermostat family, or the key risk from intensifying competition and installer channel pressure.

Among recent announcements, the Honeywell Home X2S thermostat unveiled at CES 2025 looks particularly relevant alongside the X8S. Together, the X2S at a US$79.99 price point and the higher end X8S suggest Resideo is trying to cover both mass retail and premium installer channels, which could support its catalyst around expanding the smart thermostat installed base while still leaving it exposed to competing ecosystems from larger, cash rich rivals.

Yet even as the X8S broadens Resideo’s presence in the smart home, investors should be aware that...

Read the full narrative on Resideo Technologies (it's free!)

Resideo Technologies' narrative projects $8.0 billion revenue and $597.5 million earnings by 2028. This requires 2.6% yearly revenue growth and a $1,413.5 million earnings increase from $-816.0 million today.

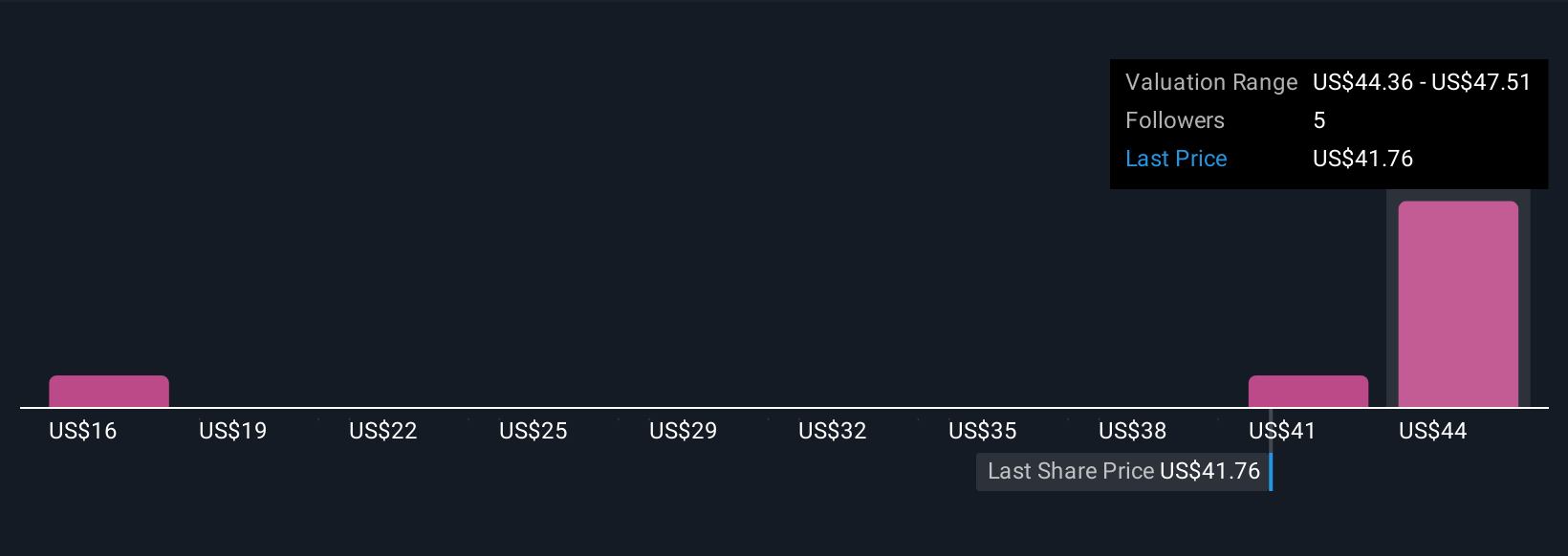

Uncover how Resideo Technologies' forecasts yield a $41.50 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for Resideo cluster tightly around US$41.30 to US$41.50, underscoring how differently individual investors can view the same numbers. You may want to weigh those opinions against the risk that Big Tech rivals could pressure Resideo’s smart home market share and, in turn, its longer term earnings power.

Explore 2 other fair value estimates on Resideo Technologies - why the stock might be worth just $41.30!

Build Your Own Resideo Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Resideo Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Resideo Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Resideo Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报