AI-Powered English-Learning Push Could Be A Game Changer For Duolingo (DUOL)

- Recently, Sands Capital’s Technology Innovators Fund highlighted Duolingo as a dominant global language-learning platform, emphasizing its over 90% share of monthly active users and emerging AI-powered conversational tools aimed at English learners seeking professional or academic advancement.

- The fund’s commentary underscores how Duolingo’s AI-driven features could deepen engagement and unlock a larger, currently less-monetized user base, potentially reshaping perceptions of its long-term growth opportunity.

- We’ll now examine how this focus on AI-driven monetization and English-learning use cases may influence Duolingo’s existing investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Duolingo Investment Narrative Recap

To own Duolingo, you likely need to believe its dominant user base can be monetized more effectively through AI, without eroding engagement or brand goodwill. Sands Capital’s spotlight on AI-powered English-learning tools aligns with this thesis but does not materially change the near term story, where conversion and pricing experiments remain key catalysts and competition from AI-native language tools, along with possible user fatigue, still look like the most immediate risks.

The most relevant recent development is Duolingo’s Duocon 2025 product update, which showcased AI-driven conversations, enhanced speaking practice with Lily, and improved Video Call across multiple courses for Max subscribers. This ties directly to the idea that smarter, more conversational AI features could support higher engagement and Max-tier adoption, reinforcing the existing catalyst around AI-enabled monetization while still leaving open questions about how competitors’ AI offerings might pressure Duolingo’s pricing and margins.

However, investors should also weigh how rising competition from large tech firms using AI could challenge Duolingo’s pricing power and long term profitability...

Read the full narrative on Duolingo (it's free!)

Duolingo's narrative projects $1.7 billion revenue and $368.7 million earnings by 2028. This requires 23.7% yearly revenue growth and an earnings increase of about $251.5 million from $117.2 million today.

Uncover how Duolingo's forecasts yield a $271.05 fair value, a 48% upside to its current price.

Exploring Other Perspectives

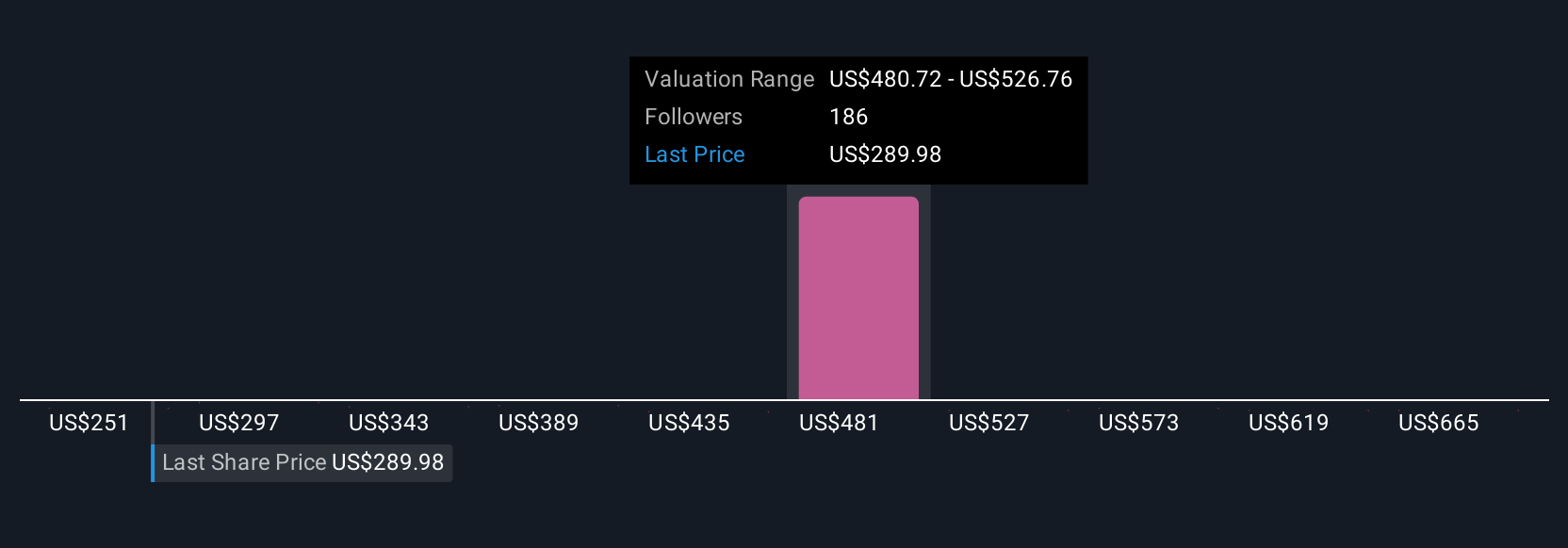

Simply Wall St Community members offer 23 fair value views on Duolingo, ranging from US$245.48 to US$619.51, highlighting how widely opinions can differ. Against this spread, the big open question is whether Duolingo’s AI driven English learning push can offset competitive and regulatory pressures, so it is worth exploring several of these community perspectives in more detail.

Explore 23 other fair value estimates on Duolingo - why the stock might be worth just $245.48!

Build Your Own Duolingo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Duolingo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Duolingo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Duolingo's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报