BW LPG (OB:BWLPG) Q3 2025 Margin Compression Reinforces Bearish Sustainability Narrative

BWG (OB:BWLPG) has just posted its Q3 2025 scorecard, reporting total revenue of $943.8 million and basic EPS of $0.38 as net income reached $57.1 million for the quarter. The company has seen quarterly revenue move from $805.0 million in Q3 2024 to $943.8 million in Q3 2025, while EPS shifted from $0.79 to $0.38 over the same period. This underscores a quarter where topline scale held up even as margins compressed.

See our full analysis for BWG.With the headline numbers on the table, the next step is to weigh these results against the dominant market narratives around BWG and see which stories the latest margins and earnings actually support.

See what the community is saying about BWG

Margins Slide as LTM Profitability Halves

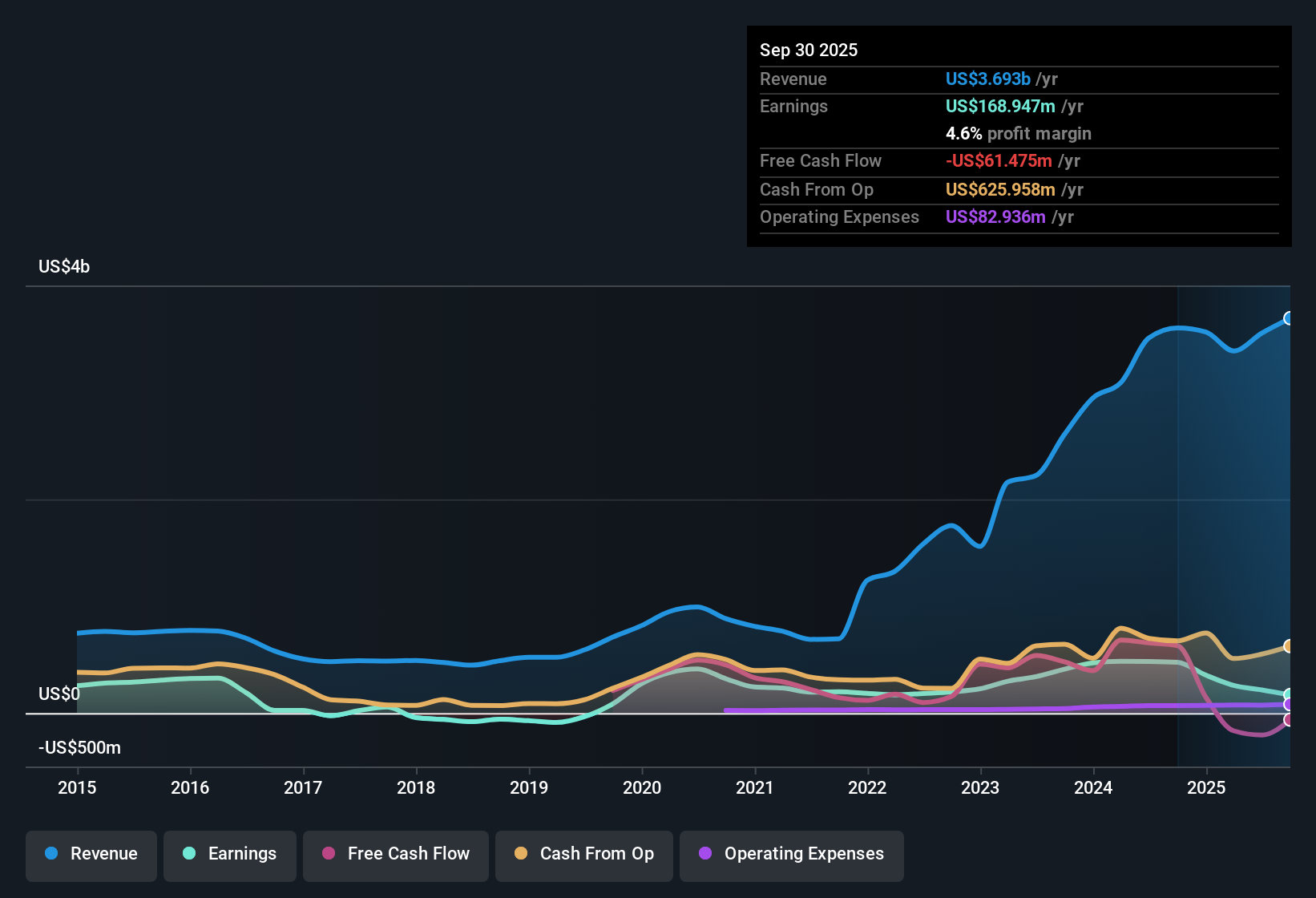

- Over the last 12 months, net profit margin moved from 13.8% to 6.1%, even though trailing revenue stayed around $3.7 billion.

- Bears point to this margin compression as a key problem, and the data reinforces that concern:

- Trailing 12 month net income fell from $474.9 million to $168.9 million while revenue stayed broadly similar, so more of each sales dollar is being eaten up by costs.

- The combination of weaker margins and a dividend yield of 20.66% that is not well covered by free cash flow supports the cautious view that recent payouts may be difficult to sustain.

TTM Earnings Trend Points Down

- Trailing 12 month EPS fell from $3.69 a year ago to $1.14 now, as TTM net income dropped from $483.2 million to $168.9 million despite revenue remaining above $3.5 billion.

- Analysts with a bearish tilt highlight this earnings slide and the forecasts as a signal that growth is stalling:

- Consensus expects earnings to decline by about 9.6% per year and revenue by roughly 73% per year over the next three years, which lines up with the step down in TTM EPS.

- Even though five year earnings grew around 9.4% per year, the recent negative one year earnings growth shows the business moving in the opposite direction of that longer term trend.

Cheap Multiples Versus Downbeat Forecasts

- At a share price of NOK126.50, BWG trades on a price to earnings ratio of 8.2 times compared with the European Oil and Gas industry at 13 times and peers at 8.7 times, while the DCF fair value sits higher at NOK427.81.

- Bulls argue the valuation gap offers upside, but the numbers cut both ways:

- Against an analyst price target of NOK146.29, the current price implies potential upside, and analysts in aggregate expect around 32.2% price improvement from here.

- At the same time, forecasts for multi year revenue decline and falling earnings explain why the multiple stays low despite the DCF fair value being well above the market price.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BWG on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the numbers that others might be missing? Turn that view into your own concise narrative in just a few minutes, starting with Do it your way.

A great starting point for your BWG research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Explore Alternatives

BWG is struggling with sharply lower margins, falling trailing earnings, and an overstretched dividend that raises doubts about how sustainable shareholder returns really are.

If you want payout strength backed by sturdier fundamentals, use our these 1944 dividend stocks with yields > 3% to quickly focus on companies offering yields that look far more defensible than BWG's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报