Will MercadoLibre's (MELI) New Fixed-Rate Notes for Fintech and AI Expansion Change Its Risk-Reward Narrative?

- MercadoLibre, Inc. recently completed a fixed-rate senior unsecured notes offering, adding guaranteed, callable debt to its capital structure to support ongoing operations and growth.

- This move to tap fixed-income markets comes as the company continues expanding its e-commerce, fintech, and logistics ecosystem across Latin America while investing in AI-powered tools for sellers and payments users.

- We’ll now examine how MercadoLibre’s new fixed-income issuance shapes its investment narrative, particularly around funding expansion and managing fintech-related risks.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MercadoLibre Investment Narrative Recap

To own MercadoLibre, you need to believe its blended e‑commerce and fintech ecosystem can keep scaling in Latin America while managing rising credit and competition risks. The new fixed‑rate senior unsecured notes strengthen its funding toolkit, but do not materially change the key near term catalyst around fintech growth or the main risk of potential credit losses in volatile markets.

The most relevant recent announcement is the rollout of AI powered assistants for sellers and Mercado Pago users. These tools tie directly into the growth catalyst of deepening engagement across commerce and fintech, potentially supporting higher usage and cross sell within the ecosystem, even as investors weigh the balance between rapid expansion and risk control in the credit portfolio.

Yet behind this growth story, there is a less obvious fintech risk investors should be aware of...

Read the full narrative on MercadoLibre (it's free!)

MercadoLibre's narrative projects $46.9 billion revenue and $5.1 billion earnings by 2028. This requires 24.8% yearly revenue growth and a roughly $3.0 billion earnings increase from $2.1 billion today.

Uncover how MercadoLibre's forecasts yield a $2847 fair value, a 35% upside to its current price.

Exploring Other Perspectives

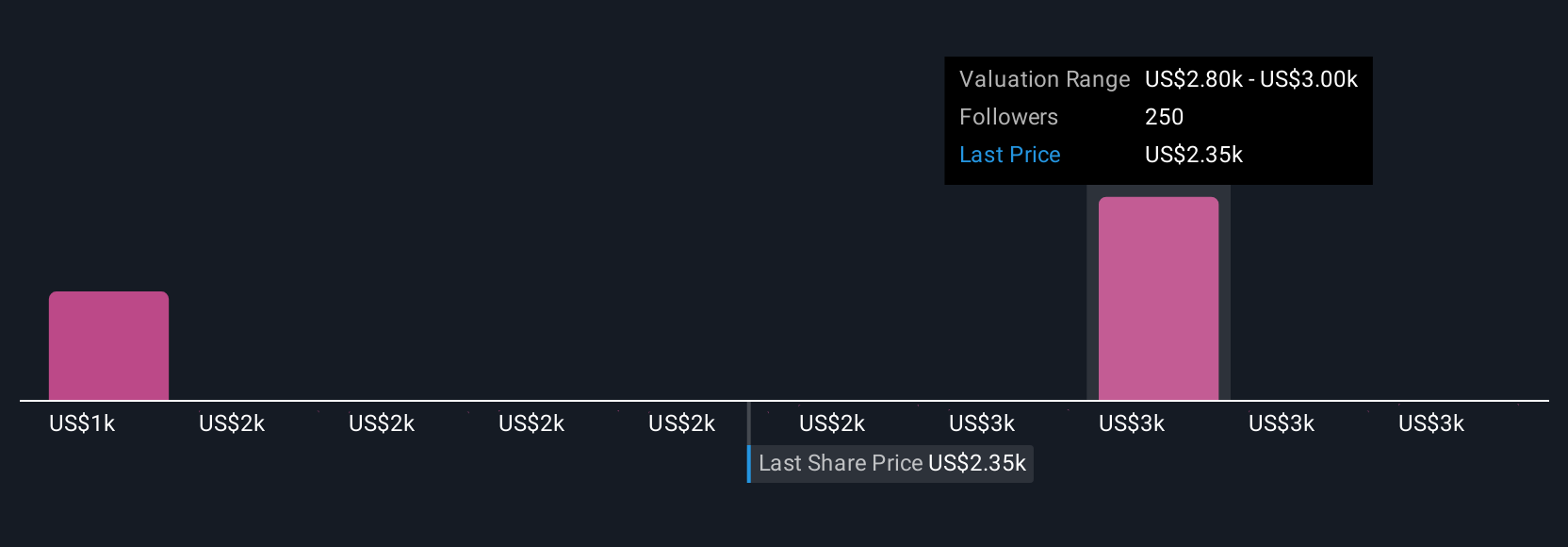

Twenty three fair value estimates from the Simply Wall St Community span roughly US$2,424 to US$3,406 per share, showing how far apart individual views can be. When you set those opinions against MercadoLibre’s use of new fixed income funding to back its fintech and credit expansion, it underlines why understanding both upside drivers and credit quality risks is essential before forming your own view.

Explore 23 other fair value estimates on MercadoLibre - why the stock might be worth just $2424!

Build Your Own MercadoLibre Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MercadoLibre research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MercadoLibre's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报