The Bull Case For Cisco Systems (CSCO) Could Change Following New Middle East AI Networking Push – Learn Why

- In late November, Asiacell announced it had deployed Cisco’s AI-driven Provider Connectivity Assurance platform across its Iraqi networks, while Cisco also partnered with AMD and HUMAIN on an AI data center joint venture in Saudi Arabia and presented its outlook at the UBS Global Technology and AI Conference 2025.

- Together, these moves highlight Cisco’s expanding role at the heart of AI-optimized networking, from self-healing telecom networks to large-scale regional AI infrastructure buildouts.

- We’ll now examine how Cisco’s planned role as an exclusive technology partner in a Saudi AI infrastructure joint venture influences its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cisco Systems Investment Narrative Recap

To own Cisco today, you need to believe it can stay central to AI‑driven networking while managing reliance on big cloud and AI buyers. The recent Asiacell deployment and the Saudi AI joint venture reinforce the AI infrastructure catalyst but do not materially change the key short term swing factor, which remains the pace and volatility of large AI infrastructure orders versus hyperscale customers internalizing more of their own networking.

Among the latest announcements, the planned AMD, Cisco and HUMAIN joint venture in Saudi Arabia stands out as most relevant. By acting as an exclusive technology partner for up to 1 GW of AI infrastructure, Cisco is tying its growth story even more closely to large scale AI data center builds, which supports the AI networking catalyst while also heightening exposure to the risk that a handful of hyperscale and webscale buyers drive a disproportionate share of demand.

Yet investors also need to weigh how concentrated AI orders can amplify Cisco’s exposure if spending patterns suddenly shift or if major cloud players decide to...

Read the full narrative on Cisco Systems (it's free!)

Cisco Systems’ narrative projects $65.2 billion revenue and $14.0 billion earnings by 2028.

Uncover how Cisco Systems' forecasts yield a $84.81 fair value, a 10% upside to its current price.

Exploring Other Perspectives

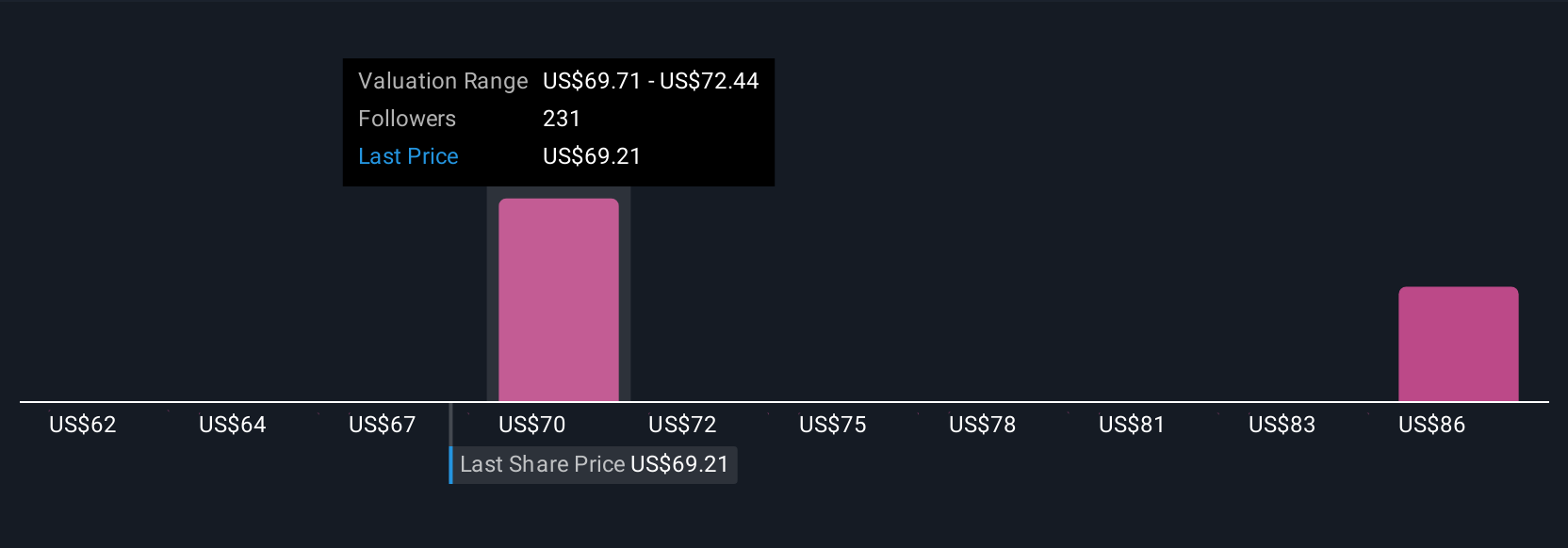

Eleven members of the Simply Wall St Community currently value Cisco between US$61.52 and US$84.81 per share, reflecting a wide spread of expectations. Against this, Cisco’s growing dependence on large AI infrastructure orders from a small group of hyperscale customers could meaningfully affect how those different valuation views play out over time, so it makes sense to review several of these perspectives side by side.

Explore 11 other fair value estimates on Cisco Systems - why the stock might be worth as much as 10% more than the current price!

Build Your Own Cisco Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cisco Systems research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cisco Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cisco Systems' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报