TMC the metals (TMC) Is Up 26.9% After U.S. Critical Minerals Focus Meets Deep-Sea Losses

- In recent days, TMC the metals company has drawn attention as U.S. efforts to secure critical minerals for AI and other advanced technologies refocused investors on its deep-sea mining ambitions, even as the company reported a very large year-over-year increase in third-quarter net loss driven by non-cash and non-recurring items.

- Added scrutiny from disappointing earnings, insider share sales, and profit-taking now sits alongside optimism that U.S. critical minerals policy and ongoing deep-sea mining discussions could reshape TMC’s long-term role in nickel, cobalt, copper, and manganese supply chains.

- We’ll now examine how renewed U.S. critical minerals policies and deep-sea mining negotiations influence TMC’s investment narrative for investors.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is TMC the metals' Investment Narrative?

To own TMC today, you need to believe deep-sea nodules can eventually translate into commercial-scale production and that policy tailwinds will outweigh execution and financing risks. The renewed U.S. push on critical minerals and TMC’s earlier expression of interest through its U.S. subsidiary reinforce the idea that the company sits inside a politically important conversation, but the latest headlines do not change the fact that short term catalysts are still largely regulatory approvals, pilot mining milestones, and funding. The sharp widening of quarterly net losses, ongoing equity issuance, and fresh insider selling tilt the near-term focus back to balance sheet strength, dilution risk, and whether management can keep capital flowing without clear revenue. The recent rally and pullback mainly underline how sentiment-driven this story remains.

However, that policy excitement sits beside real dilution and cash burn risks investors should understand. The analysis detailed in our TMC the metals valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

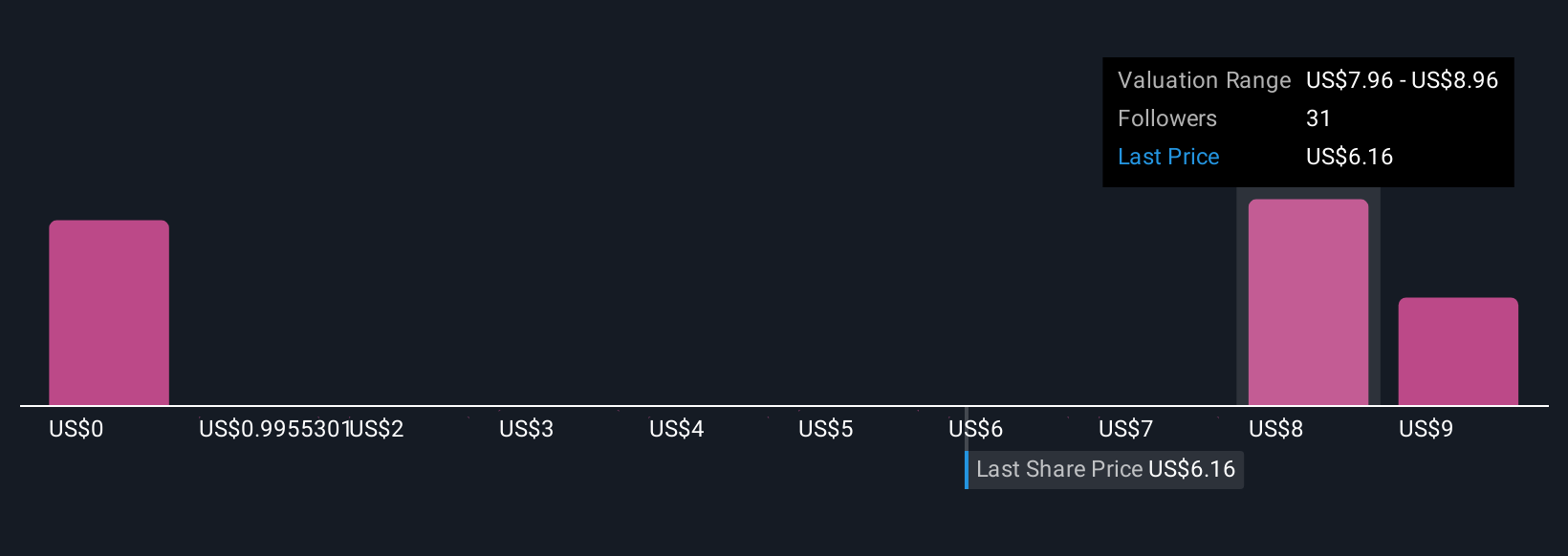

Thirty three Simply Wall St Community members place TMC’s fair value anywhere between US$1.05 and US$10.50, underscoring how far apart individual views run. When you set those estimates against widening losses and frequent equity raises, it highlights just how much of TMC’s future still depends on regulation, capital markets appetite and progress toward any commercial revenue at all.

Explore 33 other fair value estimates on TMC the metals - why the stock might be worth less than half the current price!

Build Your Own TMC the metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TMC the metals research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free TMC the metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TMC the metals' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报