Should NEC’s Agentic AI “Client Zero” Sales Push Require Action From NEC (TSE:6701) Investors?

- NEC Corporation has announced a new Agentic AI-powered sales support solution in Japan, launched earlier in 2025, which automatically generates customer-specific proposals and discussion sheets by drawing on sales activity records and standard templates to streamline sales workflows.

- A key differentiator is NEC’s “Client Zero” roll-out approach, using its own operations as a proving ground to validate the solution’s real-world effectiveness before wider commercialization.

- We’ll now examine how NEC’s Agentic AI sales support launch could reshape its investment narrative around digital transformation-led services growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

NEC Investment Narrative Recap

To own NEC today, I think you need to believe its shift toward higher margin digital and AI driven services can offset pressure on legacy domestic IT and telecom hardware. The new Agentic AI sales support rollout looks directionally aligned with this thesis but does not materially change the near term catalyst, which is execution in BluStellar and consulting DX, nor does it remove key risks around revenue pressure in shrinking legacy units and rising investment needs.

The recent expansion of NEC’s partnership with Broadcom to offer VMware Cloud Foundation powered BluStellar private cloud services is, in my view, the most directly connected announcement to this Agentic AI news. Both moves point to NEC trying to deepen its role in mission critical, software heavy infrastructure for large enterprises, which ties back to the core catalyst of DX led services growth while still leaving open questions about how fast this can offset declines in traditional IT and telecom equipment...

Yet before leaning on these community fair values, you should be aware that...

Read the full narrative on NEC (it's free!)

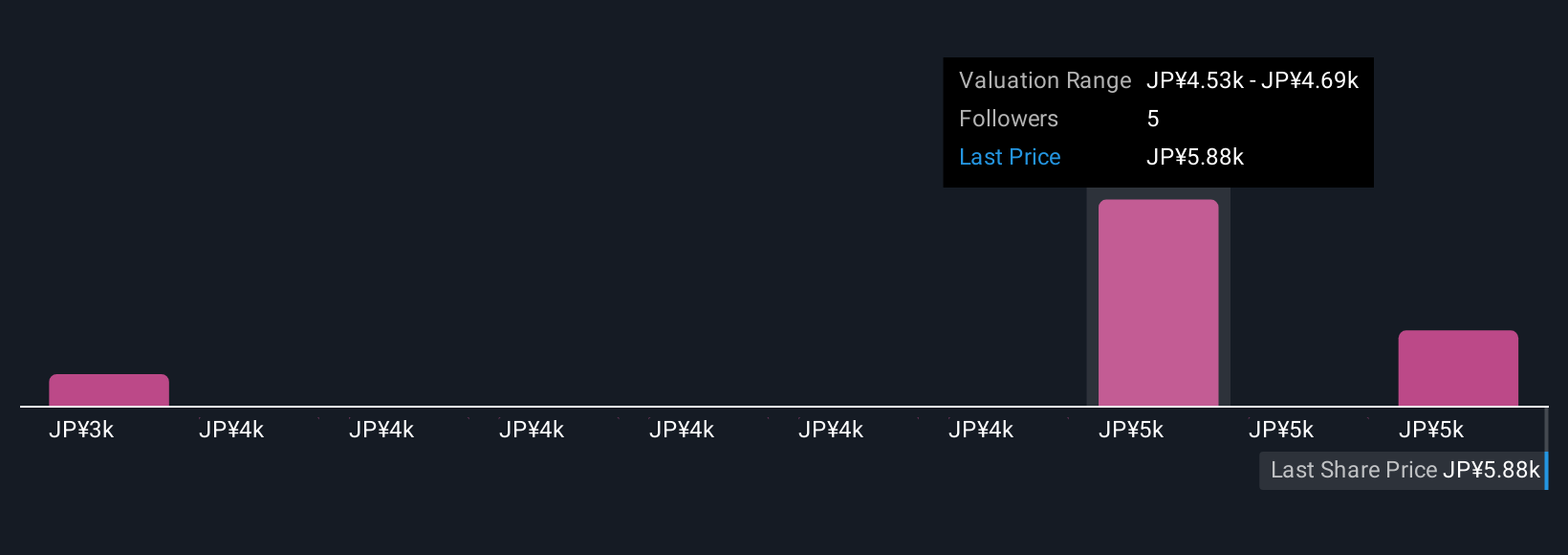

NEC’s narrative projects ¥3,787.0 billion revenue and ¥291.3 billion earnings by 2028. This requires 3.2% yearly revenue growth and about a ¥91.0 billion earnings increase from ¥200.3 billion today.

Uncover how NEC's forecasts yield a ¥5860 fair value, in line with its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for NEC range from ¥3,436.64 to ¥5,860, highlighting very different views on upside. You see this diversity of opinion set against NEC’s DX driven catalysts and legacy business risks, which makes it important to weigh several perspectives before forming your own view on the company’s potential performance.

Explore 3 other fair value estimates on NEC - why the stock might be worth as much as ¥5860!

Build Your Own NEC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NEC research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NEC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NEC's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报