Should Super Micro’s AI Expansion And Margin Concerns Require Action From Super Micro Computer (SMCI) Investors?

- In late November 2025, Super Micro Computer, Inc. presented its AI-focused server and data centre solutions at the UBS Global Technology and AI Conference in Scottsdale, highlighting its Data Centre Building Block Solutions and partnerships with NVIDIA and AMD.

- At the same time, the company’s push toward a US$36.00 billion fiscal 2026 revenue target, ongoing international capacity expansion, and shifting short interest underscored the tension between ambitious growth plans and market concerns over margins and AI hardware competition.

- We’ll now examine how Super Micro’s aggressive expansion amid sector-wide AI sentiment cooling could influence its existing investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Super Micro Computer Investment Narrative Recap

To own Super Micro Computer today, you need to believe its AI focused server platforms and Data Centre Building Block Solutions can translate booming GPU demand into durable, profitable growth despite recent margin pressure. November’s 36.8% share price drop, tied to competition and rising costs, directly affects the key near term catalyst of executing on its US$36.00 billion fiscal 2026 revenue goal, while reinforcing the central risk that AI hardware “price wars” could keep profitability under strain.

The company’s raised fiscal 2026 sales guidance to at least US$36.00 billion is the announcement that most directly intersects with this backdrop, because it increases the execution bar just as sector wide AI enthusiasm has cooled and AI server competition has intensified. How effectively Super Micro ramps its Blackwell era systems and DCBBS offerings with NVIDIA and AMD will likely shape whether the recent pullback looks like a bump in the road or a warning sign for investors focused on...

Read the full narrative on Super Micro Computer (it's free!)

Super Micro Computer's narrative projects $48.2 billion revenue and $2.4 billion earnings by 2028.

Uncover how Super Micro Computer's forecasts yield a $48.53 fair value, a 47% upside to its current price.

Exploring Other Perspectives

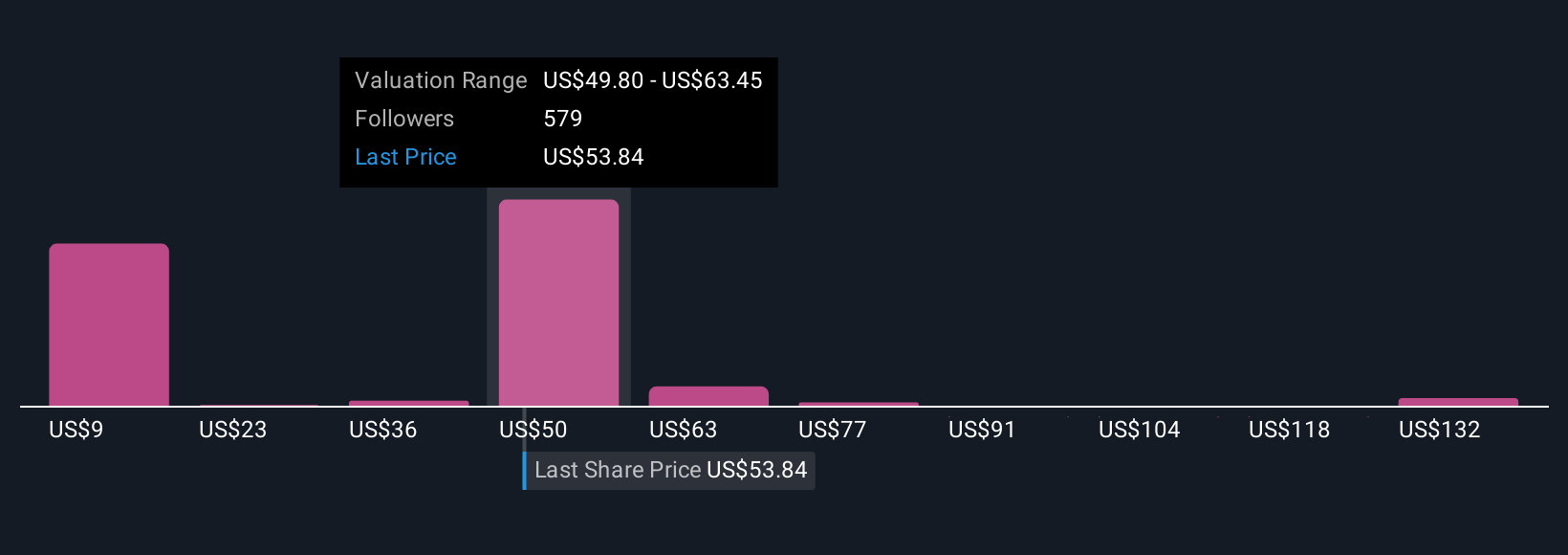

Thirty seven members of the Simply Wall St Community currently place Super Micro’s fair value between US$48.53 and US$82.39, highlighting wide dispersion in expectations. Against this range, the recent share price slide and ongoing concerns about AI server margin pressure show why it can be useful to compare several independent views on what might drive the company’s performance next.

Explore 37 other fair value estimates on Super Micro Computer - why the stock might be worth over 2x more than the current price!

Build Your Own Super Micro Computer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Super Micro Computer research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Super Micro Computer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Super Micro Computer's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报