3 TSX Penny Stocks With Market Caps Under CA$300M To Watch

As the Canadian market navigates through policy shifts and global uncertainties, it's easy to overlook the positive strides made this year, including strong equity gains that have rewarded patient investors. In this context, penny stocks—though an outdated term—remain a relevant investment area for those looking to uncover hidden opportunities. These smaller or newer companies can offer unique value propositions when backed by solid financials, making them worth watching for potential growth and stability.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.10 | CA$53.09M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.22 | CA$243.64M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.42 | CA$143.13M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.43 | CA$3.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$54.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.26 | CA$838.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.87 | CA$145.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.09 | CA$197.77M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 393 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Sailfish Royalty (TSXV:FISH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sailfish Royalty Corp. focuses on acquiring precious metals royalty and streaming agreements, with a market cap of CA$243.64 million.

Operations: The company's revenue is derived entirely from royalties and stream interests, totaling $2.91 million.

Market Cap: CA$243.64M

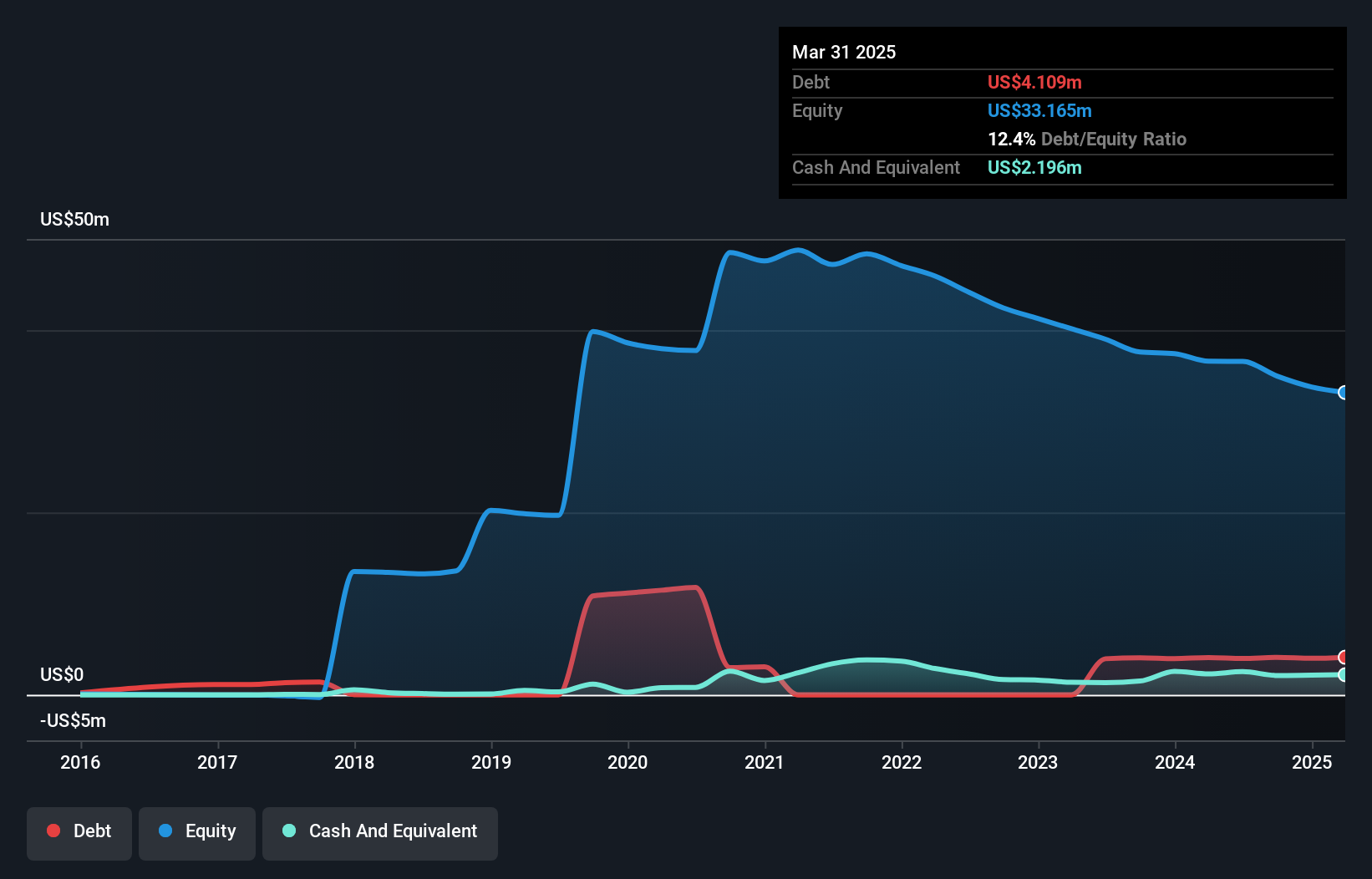

Sailfish Royalty Corp., with a market cap of CA$243.64 million, has shown mixed financial performance typical of penny stocks. Its revenue, primarily from royalties and stream interests, reached US$2.91 million but lacks significant growth momentum. Despite achieving profitability over the past five years with earnings growing at 33.4% annually, recent negative earnings growth (-66.1%) poses challenges against industry averages. The company remains debt-free and its short-term assets comfortably cover liabilities, yet its dividend yield is not well supported by current earnings or cash flows. Recent strategic moves include acquiring a gold stream and NSR royalty on the Mt. Hamilton project to potentially bolster future revenues.

- Click here to discover the nuances of Sailfish Royalty with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Sailfish Royalty's future.

Nations Royalty (TSXV:NRC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nations Royalty Corp. is a royalty company that acquires royalties in the Canadian resource sector, with a market cap of CA$131.73 million.

Operations: The company's revenue segment is primarily derived from the acquisition, exploration, and development of mineral properties, amounting to CA$1.11 million.

Market Cap: CA$131.73M

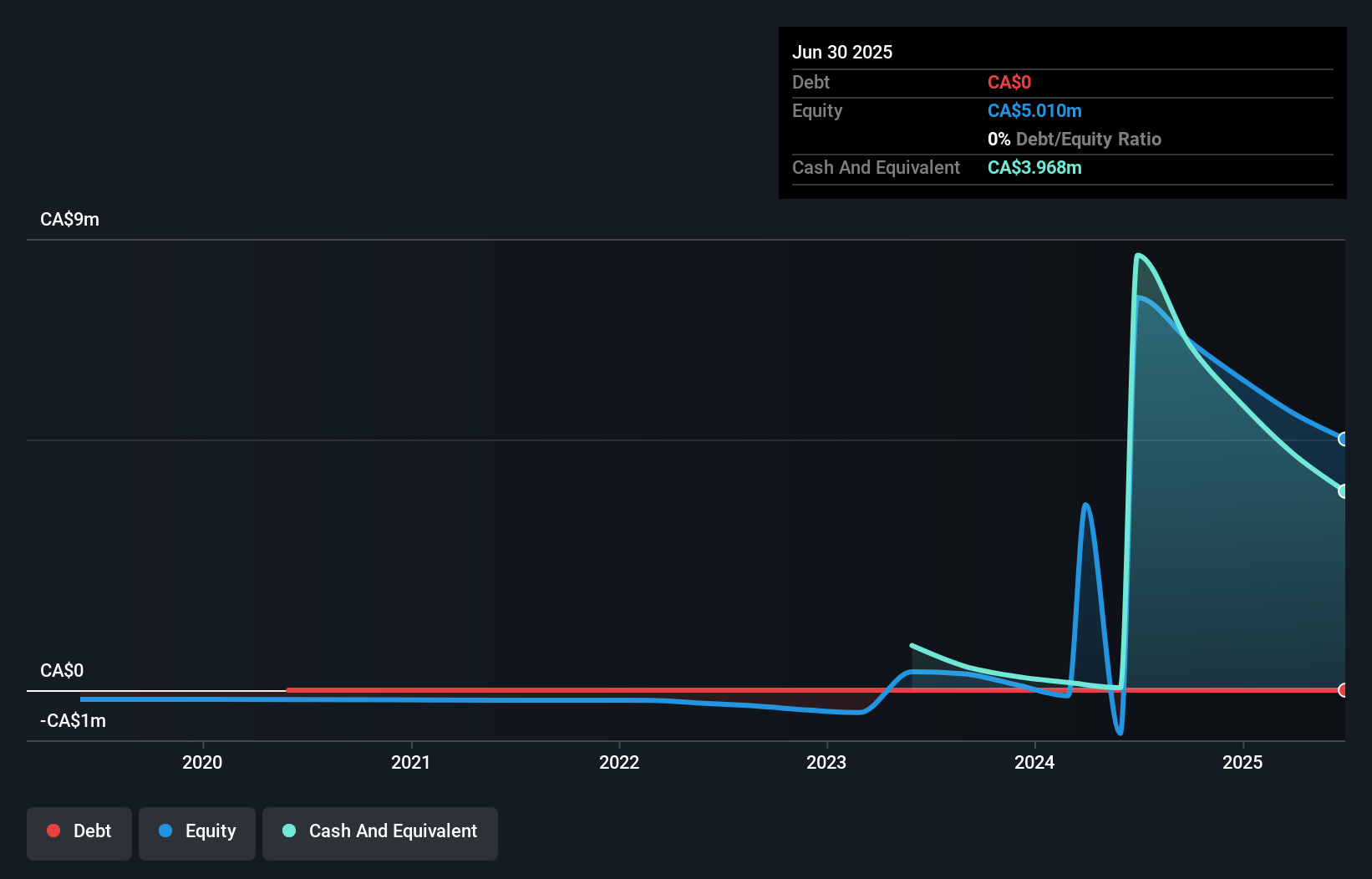

Nations Royalty Corp., with a market cap of CA$131.73 million, operates in the Canadian resource sector but remains pre-revenue, generating less than US$1 million. Despite being debt-free and having short-term assets of CA$4.8 million that exceed its liabilities, the company faces challenges typical of penny stocks, including a history of losses and an inexperienced board with an average tenure of 1.5 years. Recent earnings reports highlight ongoing net losses; however, these have decreased significantly from previous periods. With sufficient cash runway for over a year and no long-term liabilities, Nations Royalty maintains financial flexibility amidst volatility concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Nations Royalty.

- Gain insights into Nations Royalty's historical outcomes by reviewing our past performance report.

WonderFi Technologies (TSX:WNDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WonderFi Technologies Inc, along with its subsidiaries, develops and acquires technology platforms to support investments in digital assets and has a market cap of CA$182.76 million.

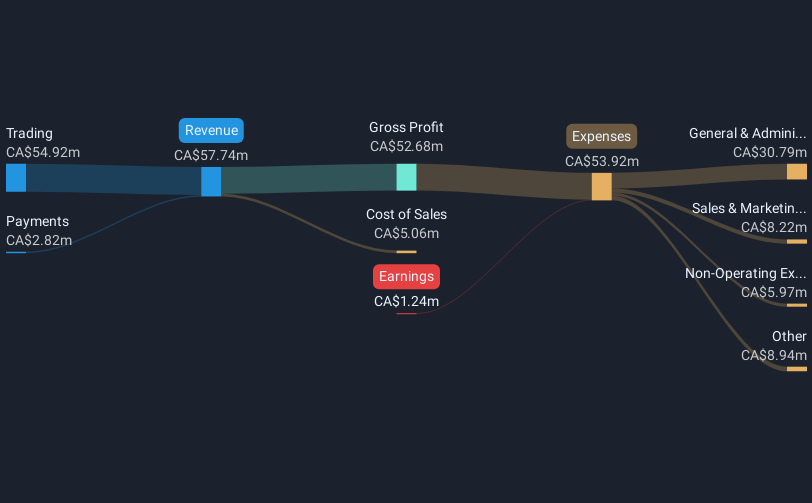

Operations: The company generates revenue primarily from its trading segment, amounting to CA$56.30 million.

Market Cap: CA$182.76M

WonderFi Technologies Inc., with a market cap of CA$182.76 million, is navigating the challenges typical of penny stocks. The company reported third-quarter sales of CA$10.89 million, up from CA$6.9 million last year, yet it remains unprofitable with net losses increasing to CA$10.22 million from CA$4.23 million a year ago. Despite short-term assets exceeding liabilities and a cash runway over one year, WonderFi's financial position is strained by negative return on equity and an inexperienced board averaging 1.8 years in tenure. Revenue growth is forecasted at 5.88% annually, but profitability remains elusive in the near term.

- Dive into the specifics of WonderFi Technologies here with our thorough balance sheet health report.

- Gain insights into WonderFi Technologies' outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Jump into our full catalog of 393 TSX Penny Stocks here.

- Want To Explore Some Alternatives? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报