Does Sea’s Soaring Three Year Return Still Match Its Long Term Potential in 2025?

- If you have ever wondered whether Sea's share price actually matches the story you are hearing about it, you are in exactly the right place to dig into what the numbers say about its value.

- Sea's stock is now trading around $137.83 after rising 2.7% over the last week, slipping 12.4% over the past month, but still sitting on gains of 31.4% year to date and 17.4% over the last year, with a striking 137.2% return over three years despite being down 32.0% over five years.

- Those swings sit against a backdrop of ongoing expansion in Sea's e commerce and digital financial services operations, alongside continued efforts to improve efficiency across key markets. Together, these developments have shifted how investors think about Sea's long term growth potential and risk profile.

- On our valuation checks, Sea currently scores a 3 out of 6 on value, as shown in our valuation summary. This means the market might be getting some parts of the story right and others wrong. Next, we will walk through the main valuation approaches investors are using to price Sea today, before finishing with a more holistic way to think about what the stock is really worth.

Approach 1: Sea Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it could generate in the future, then discounting those cash flows back into today’s dollars. For Sea, the latest twelve month Free Cash Flow stands at about $3.6 billion, forming the starting point for this analysis.

Analysts and internal estimates project Sea’s Free Cash Flow to rise steadily over the coming decade, reaching roughly $13.3 billion by 2035. The nearer term years, such as 2026 and 2027, are based on analyst forecasts, while the later years are extrapolated from those expectations using Simply Wall St’s 2 Stage Free Cash Flow to Equity model.

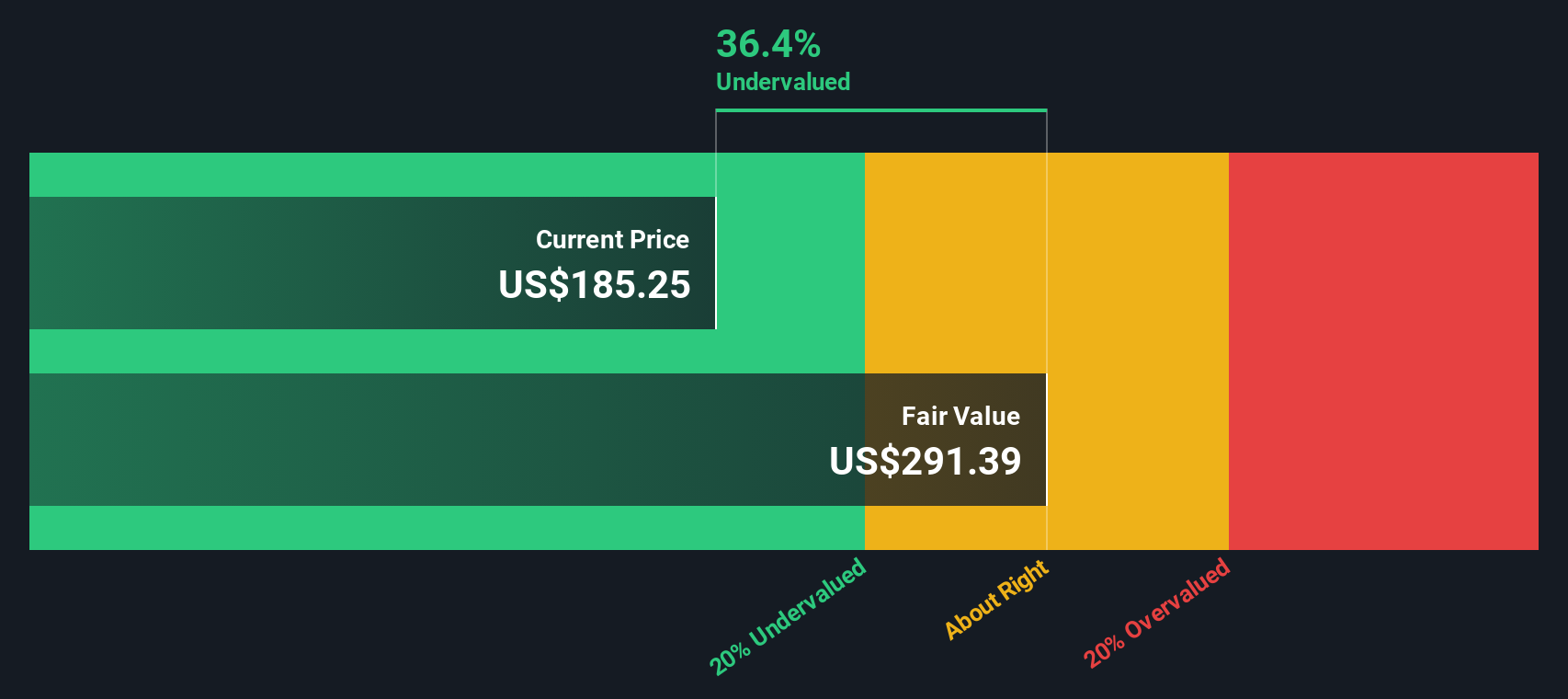

When all projected cash flows are discounted back to today using an appropriate rate, the model arrives at an intrinsic value of about $314.71 per share. Compared with the current share price around $137.83, this implies Sea is trading at roughly a 56.2% discount to its estimated fair value. This suggests the market may be underpricing its long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sea is undervalued by 56.2%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Sea Price vs Earnings

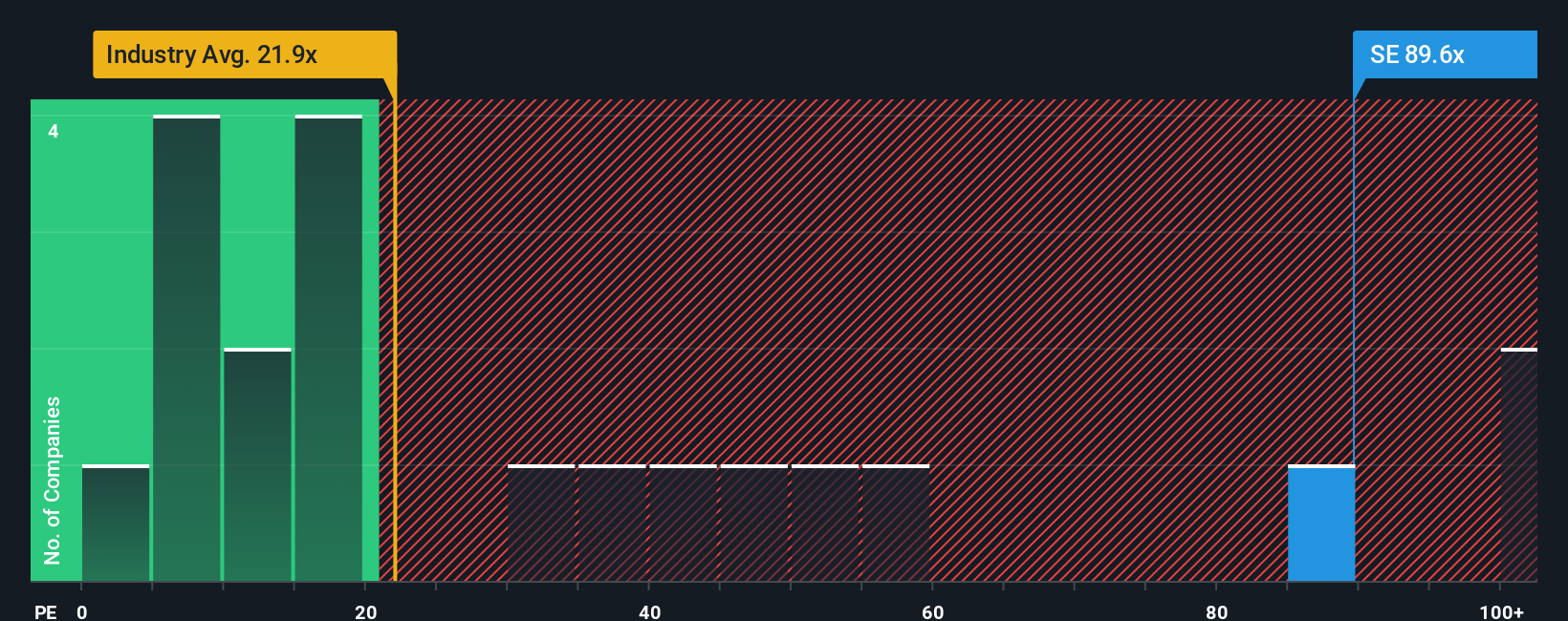

For profitable companies like Sea, the Price to Earnings (PE) ratio is a practical way to gauge valuation because it links what investors pay today to the earnings the business is already generating. In general, stronger and more reliable growth can justify a higher PE, while higher risk or more volatile results should cap how far that multiple stretches before it starts to look excessive.

Sea currently trades on a PE of about 57.53x, which is well above the Multiline Retail industry average of roughly 20.15x and also higher than its peer group average of around 50.88x. Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE Sea should command, based on factors such as its earnings growth outlook, profitability, industry, market cap, and specific risks. For Sea, this Fair Ratio is calculated at 36.86x, making it a more tailored benchmark than broad industry or peer comparisons that may not fully reflect the company’s unique profile.

Comparing Sea’s current 57.53x PE to the 36.86x Fair Ratio suggests the stock is trading above what its fundamentals and risk profile would typically support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

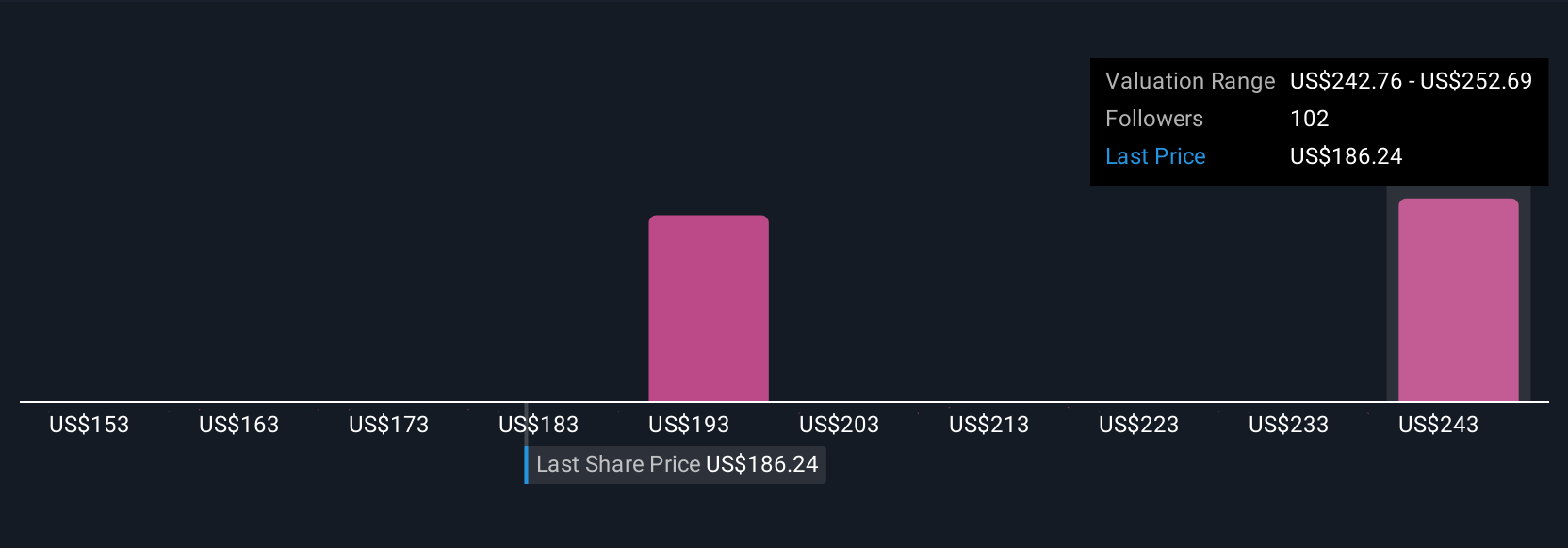

Upgrade Your Decision Making: Choose your Sea Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you connect your story about a company with a concrete forecast and fair value, then compare that to today’s share price to decide whether to buy, hold, or sell. A Narrative is your own interpretation of Sea’s future, where you spell out assumptions for revenue growth, profit margins, and risks, and the platform automatically turns those inputs into projected financials, an estimated fair value, and an ongoing comparison with the live market price. Narratives are dynamic, updating as new data like earnings reports, guidance changes, or major news is released, so your thesis and fair value estimate evolve automatically rather than sitting still. For Sea, for example, one investor might build a bullish Narrative around faster e commerce and fintech growth that points to fair value near the high analyst target of about $241 per share, while another might emphasise competitive and regulatory risks, leading to a more cautious Narrative with fair value closer to the low target of roughly $165 per share.

Do you think there's more to the story for Sea? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报