Should Capstone Copper’s Americas-Focused Expansion Strategy Reshape the Investment Case for Capstone Copper (TSX:CS)?

- In recent months, Capstone Copper has expanded its multi-metal mining footprint across the Americas, advancing long-range development projects spanning the United States, Mexico, Canada, and Chile, with copper remaining its core industrial metal focus.

- This broader continental platform not only diversifies Capstone Copper’s operational base but also underscores its ambition to build a long-term, cross-border resource portfolio around copper’s industrial importance.

- Next, we’ll examine how this Americas-wide expansion, particularly its growing multi-metal production base, may reshape Capstone Copper’s investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Capstone Copper Investment Narrative Recap

To own Capstone Copper, you need to believe in copper’s industrial role and the company’s ability to turn its Americas-wide growth projects into sustained cash generation without overstretching its balance sheet. The latest news about expanding its continental, multi-metal footprint does not materially change the near term focus on executing Mantoverde Optimized and managing project capital needs, nor does it reduce the key risks around operational concentration and potential cost overruns at large developments.

Among recent announcements, the expanded US$1,000,000,000 revolving credit facility, extended to 2029, stands out in this context. It supports refinancing at Mantoverde and adds flexibility as Capstone progresses multi-asset growth, which is closely tied to the main catalysts investors are watching: ramp up at existing operations and the path toward funding and sanctioning Santo Domingo.

Yet, beneath this growth story, investors should be aware of how dependent Capstone still is on a handful of large mines and what that could mean if...

Read the full narrative on Capstone Copper (it's free!)

Capstone Copper's narrative projects $3.0 billion revenue and $413.5 million earnings by 2028. This requires 15.2% yearly revenue growth and about a $338 million earnings increase from $75.6 million today.

Uncover how Capstone Copper's forecasts yield a CA$15.01 fair value, a 26% upside to its current price.

Exploring Other Perspectives

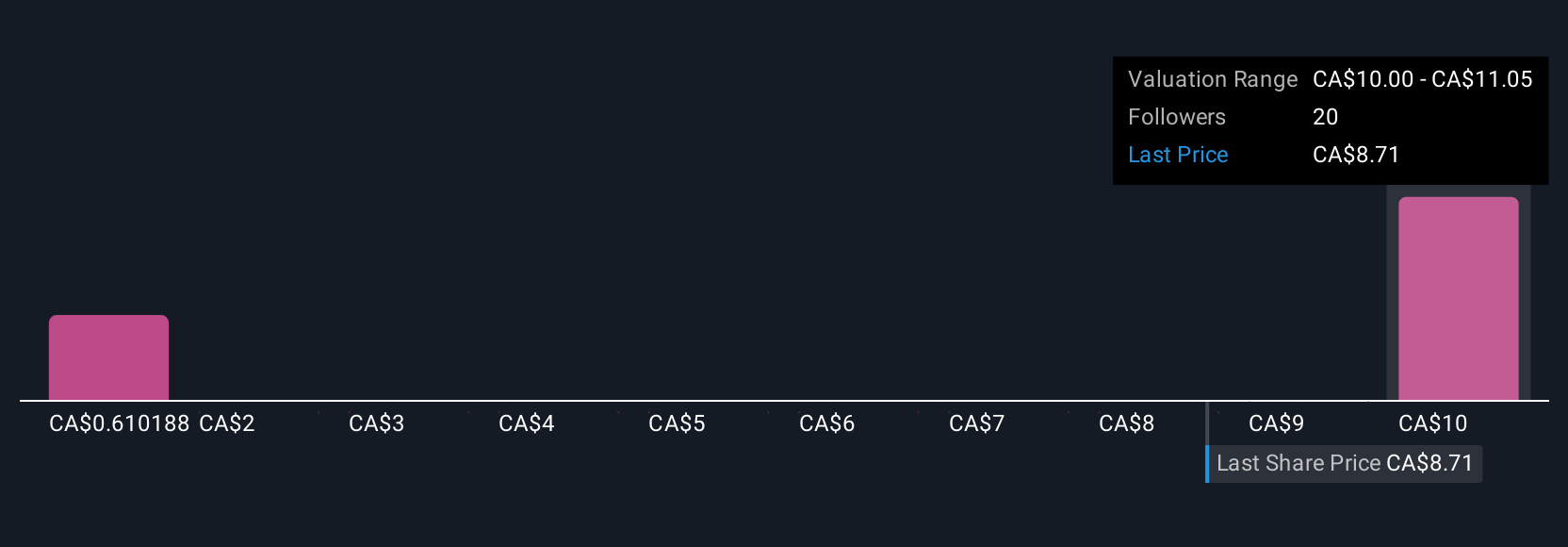

Four Simply Wall St Community fair value estimates, ranging from CA$1 to CA$15.01, show how far opinions can stretch on Capstone Copper. Set this against the company’s sizeable project funding needs and operational concentration, and you can see why it pays to compare several viewpoints before deciding what the growth story is worth to you.

Explore 4 other fair value estimates on Capstone Copper - why the stock might be worth as much as 26% more than the current price!

Build Your Own Capstone Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capstone Copper research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Capstone Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capstone Copper's overall financial health at a glance.

No Opportunity In Capstone Copper?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报