Rivian (RIVN) Is Up 6.5% After Unveiling Gen 2 Cost Cuts And CEO Megapayout Plan

- Rivian recently outlined plans to cut material costs by 45% with its Gen 2 platform by 2026, target positive adjusted EBITDA by 2027, and expand production capacity by 400,000 vehicles at a new Georgia plant, while its CEO RJ Scaringe sold more than 17,450 shares and received a new performance-linked compensation package potentially worth up to US$4.60 billion.

- The combination of ambitious long-term margin and free cash flow targets with a Tesla-style CEO pay plan tightly tied to profit and share price milestones raises fresh questions about how quickly Rivian can improve its cost base, scale production, and align management incentives with shareholder outcomes.

- We’ll now assess how Rivian’s aggressive 45% material cost-cut goal under its Gen 2 platform could reshape the company’s existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Rivian Automotive Investment Narrative Recap

To own Rivian today, you have to believe it can turn rapid revenue growth into a viable, scaled EV business before its cash needs become too heavy. The new 45% Gen 2 material cost-cut goal and 2027 adjusted EBITDA target are directly tied to that belief, but do not remove the near term risk that continued high cash burn and fresh capital needs could dilute existing shareholders.

The Georgia plant plan, backed by a planned US$6.6 billion DOE loan and aimed at adding 400,000 units of capacity, sits at the heart of Rivian’s volume and cost-scaling story. It reinforces the same catalysts as the Gen 2 initiative, but also concentrates execution risk around delivering the R2 launch and filling that capacity efficiently in a competitive EV market.

Yet while cost cuts and capacity expansion look promising on paper, investors also need to be aware of how future capital raises could...

Read the full narrative on Rivian Automotive (it's free!)

Rivian Automotive's narrative projects $15.7 billion revenue and $788.9 million earnings by 2028.

Uncover how Rivian Automotive's forecasts yield a $14.83 fair value, a 14% downside to its current price.

Exploring Other Perspectives

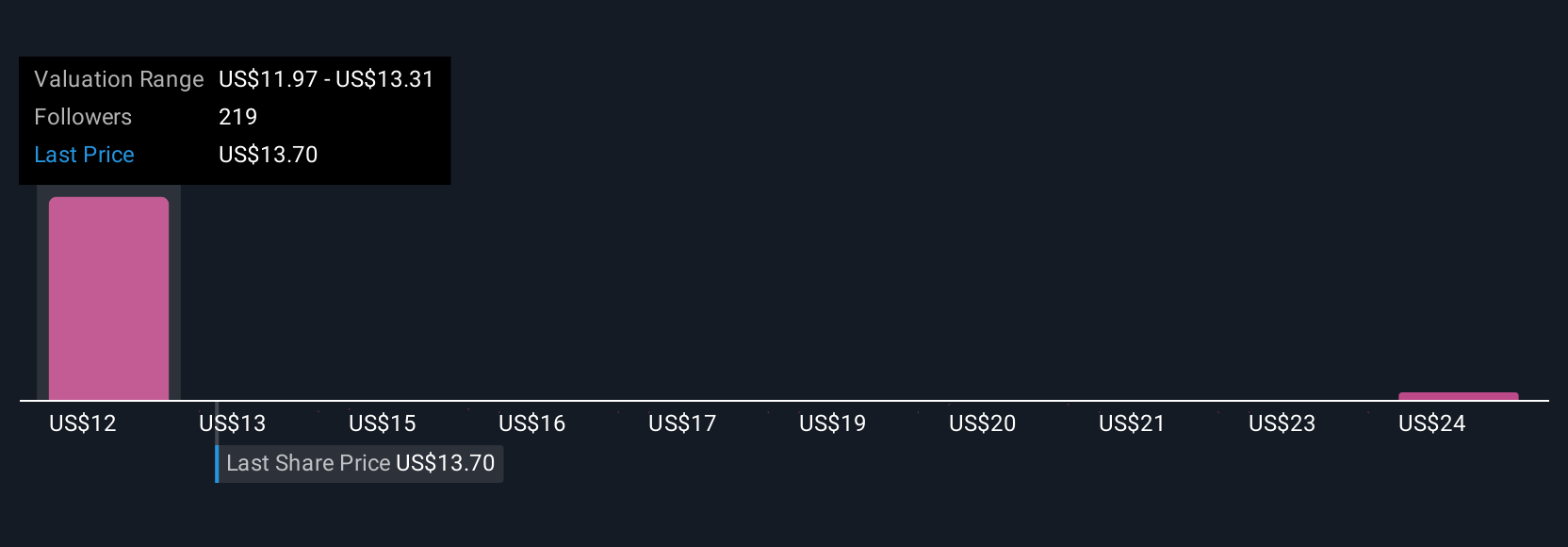

Twenty one fair value estimates from the Simply Wall St Community span roughly US$2.66 to US$25.41 per share, showing how far apart individual views can be. When you set those side by side with Rivian’s heavy cash burn and potential for further dilution, it underlines why many readers may want to compare several different scenarios for the company’s long road to profitability.

Explore 21 other fair value estimates on Rivian Automotive - why the stock might be worth as much as 47% more than the current price!

Build Your Own Rivian Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Rivian Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rivian Automotive's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报