Is Agilysys’ Global IHG POS Win (InfoGenesis) Altering The Investment Case For AGYS?

- On 2 December 2025, Agilysys, Inc. announced that its cloud-native InfoGenesis POS platform has been approved across all IHG Hotels & Resorts segments globally, positioning it as a core enterprise system for food-and-beverage, retail, and non-traditional service areas.

- This deepened relationship with one of the world's largest hotel groups underscores InfoGenesis’ ability to integrate with complex property systems and scale across diverse brand tiers, enhancing Agilysys’ role in enterprise hospitality technology.

- Next, we’ll explore how becoming a global POS provider for IHG could influence Agilysys’ SaaS-driven growth narrative and margin outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Agilysys Investment Narrative Recap

To own Agilysys, you need to believe in its shift to higher quality, cloud-based recurring revenue and a stickier, integrated hospitality software stack. Becoming a global POS provider for IHG directly supports that SaaS narrative by validating InfoGenesis at scale, but it also concentrates exposure to large hotel partners at a time when travel cyclicality and rising operating expenses remain key near term risks.

Among recent wins, the May 2025 SaaS agreement with Boyd Gaming across 28 properties feels especially relevant, as it likewise highlights InfoGenesis’ role at the center of complex, multi outlet hospitality operations. Taken together with the IHG approval, these deployments point to a growing footprint in enterprise grade venues, which could be an important catalyst for subscription growth and better margins if Agilysys continues to execute well.

Yet while these wins look encouraging, investors should also be aware that rising spend on sales, AI features and marketing could still...

Read the full narrative on Agilysys (it's free!)

Agilysys' narrative projects $425.1 million revenue and $60.4 million earnings by 2028.

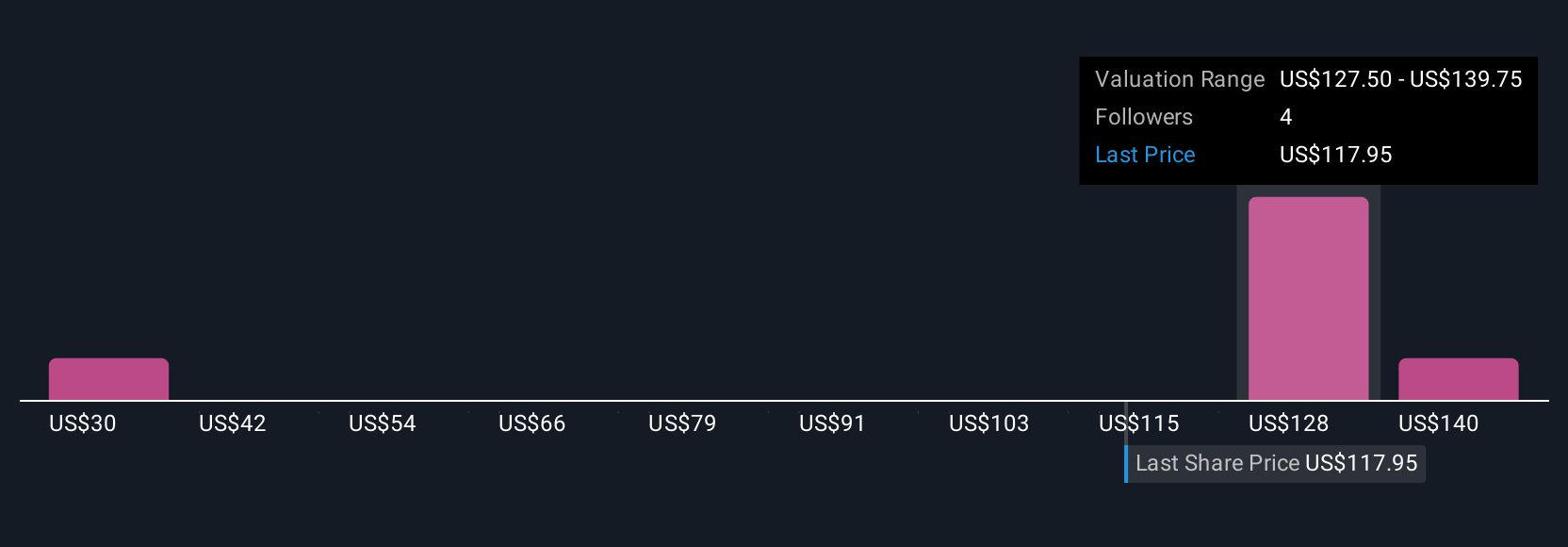

Uncover how Agilysys' forecasts yield a $140.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range widely, from US$29.52 to US$152 per share, showing how differently you might judge Agilysys. Set against the company’s push into large, global clients like IHG, this spread underlines why it can help to weigh several viewpoints before deciding how much of its SaaS growth potential you expect to be realized.

Explore 3 other fair value estimates on Agilysys - why the stock might be worth as much as 23% more than the current price!

Build Your Own Agilysys Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agilysys research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Agilysys research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agilysys' overall financial health at a glance.

No Opportunity In Agilysys?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报