Can Thor’s Weak Q1 Outlook Reframe the Long-Term Profit Story for THOR Industries (THO)?

- Thor Industries reported its first-quarter 2026 results pre-market on December 3, 2025, following a prior quarter in which revenue exceeded expectations but full-year guidance fell well short.

- This time, investor focus centered on whether Thor would counter forecasts for a year-on-year revenue decline and an adjusted loss, making its outlook commentary especially important.

- We’ll now examine how these earnings expectations and the prospect of an adjusted loss shape Thor Industries’ broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is THOR Industries' Investment Narrative?

To own Thor Industries, you have to believe in the long-term appeal of RV travel and the company’s ability to convert that demand into steady, if unspectacular, growth despite its low 6% return on equity and modest 2.7% margins. The recent focus on a possible adjusted loss in Q1 2026 does not by itself rewrite that story, but it sharpens the near term catalysts: how quickly orders stabilize, whether management reiterates or revises its FY2026 sales and EPS guidance of US$9.0 billion to US$9.5 billion and US$3.75 to US$4.25, and how aggressively it continues buybacks and dividends after the latest increase to US$0.52 per quarter. If guidance weakens again, the key risk shifts from a temporary downturn to a longer period of subdued profitability.

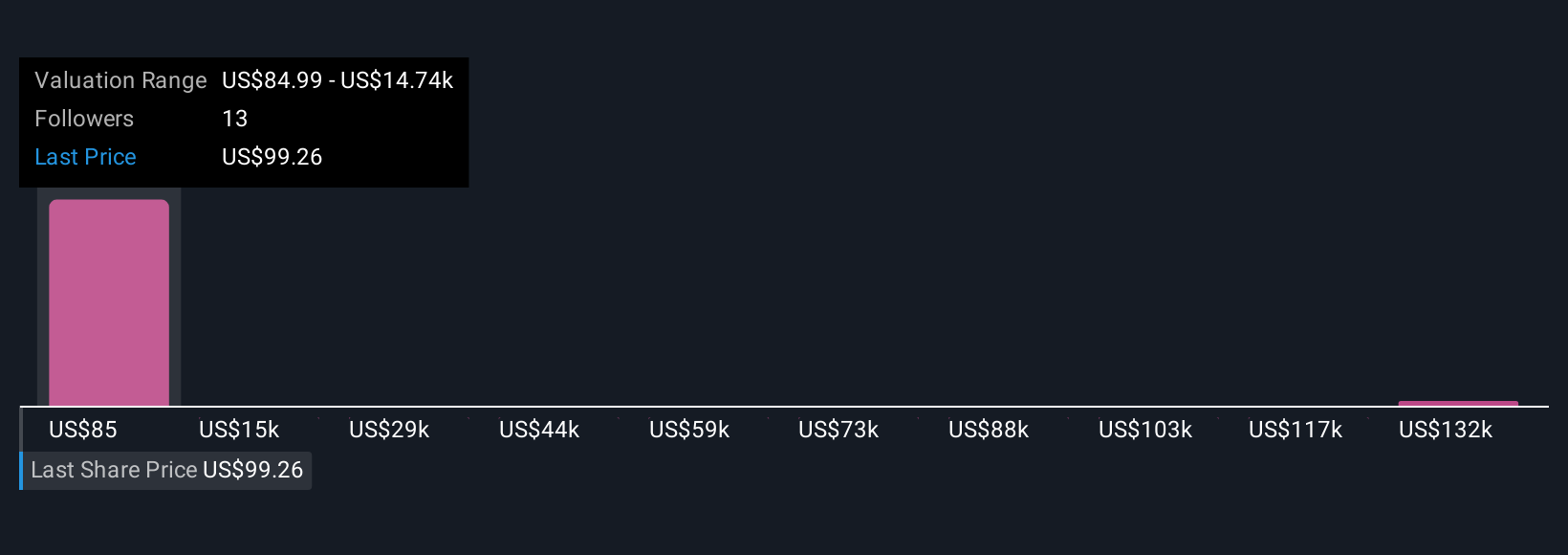

However, one risk tied to profitability trends and rising CEO pay may surprise some investors. THOR Industries' shares are on the way up, but they could be overextended by 17%. Uncover the fair value now.Exploring Other Perspectives

Explore 3 other fair value estimates on THOR Industries - why the stock might be worth 14% less than the current price!

Build Your Own THOR Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your THOR Industries research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free THOR Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate THOR Industries' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报