Bausch + Lomb (BLCO) Is Up 7.3% After Morgan Stanley Highlights Disruptive Ophthalmology Pipeline

- Morgan Stanley recently upgraded Bausch + Lomb to Overweight from Equal Weight, pointing to what it views as the strongest product pipeline in ophthalmology and highlighting new disruptive treatments in development.

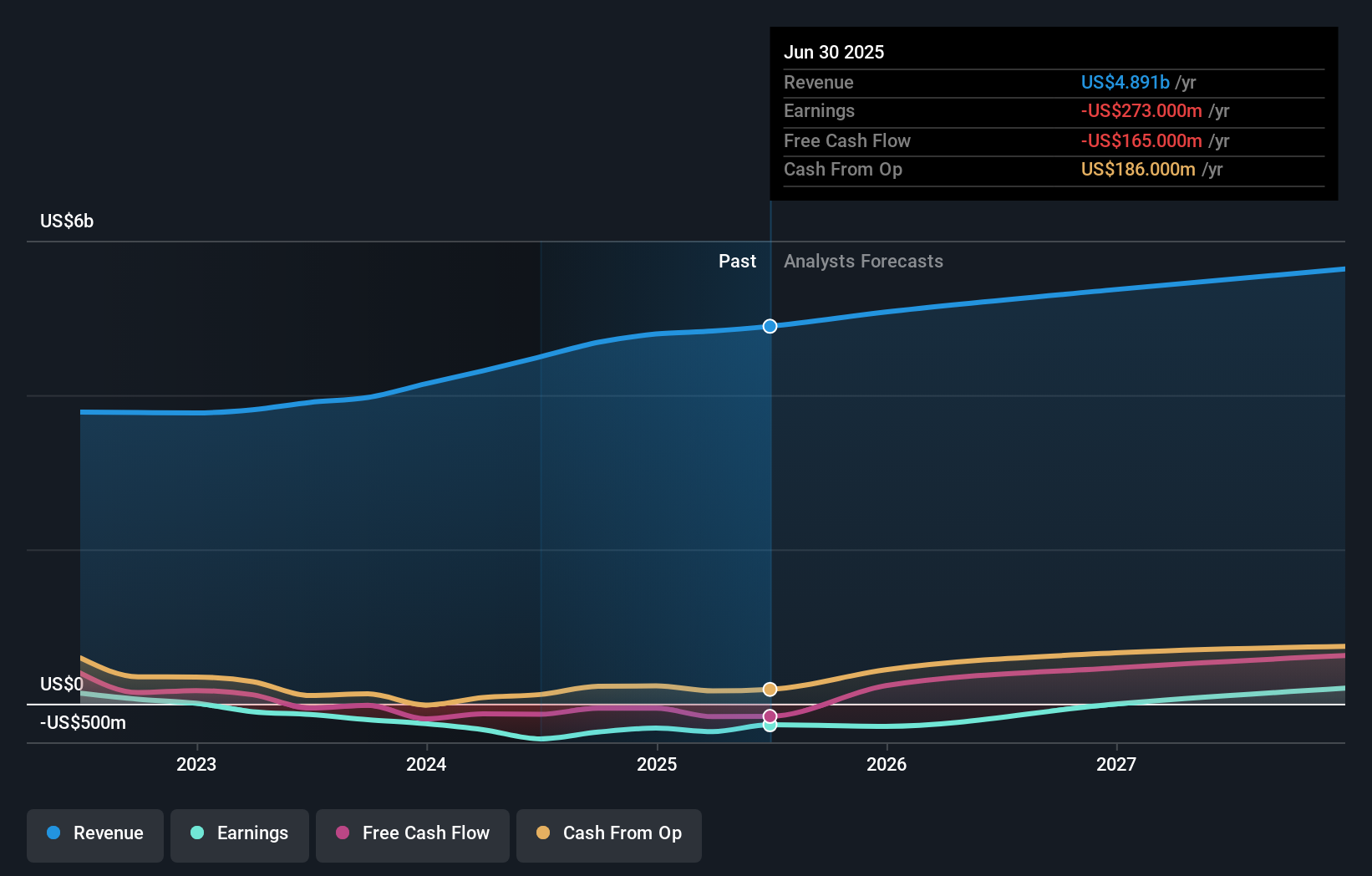

- The bank also emphasized efficiency initiatives that are helping lift profit margins, suggesting the company may be entering a more productive phase for converting innovation into earnings.

- Next, we’ll examine how Morgan Stanley’s upbeat view on Bausch + Lomb’s disruptive ophthalmology pipeline shapes the company’s broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Bausch + Lomb's Investment Narrative?

To own Bausch + Lomb, you have to believe that its broad eyecare platform and ophthalmology pipeline can eventually translate steady revenue gains into consistent profits, despite a history of losses. Recent results show revenue ticking higher while net income remains in the red, so the near term story is still about executing on cost controls and improving margins. Morgan Stanley’s upgrade, tied to what it sees as the strongest pipeline in the field and early benefits from efficiency efforts, reinforces those existing short term catalysts rather than creating new ones, although the share price jump suggests the market is starting to give more credit to that story. The main risk is that execution, pricing pressure, or product setbacks keep profitability further away than current expectations assume.

However, one key profitability risk may not be fully appreciated by all investors yet. Bausch + Lomb's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

The Simply Wall St Community’s two fair value estimates for Bausch + Lomb span from US$17.10 to about US$35.78, showing how far apart individual views can be. Set that against the recent upgrade-driven optimism around the company’s ophthalmology pipeline, and it becomes clear why aligning any valuation with the execution risks on the path to profitability really matters.

Explore 2 other fair value estimates on Bausch + Lomb - why the stock might be worth over 2x more than the current price!

Build Your Own Bausch + Lomb Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch + Lomb research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Bausch + Lomb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch + Lomb's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报