Does S&P 500 Inclusion And AI NAND Demand Shift The Bull Case For Sandisk (SNDK)?

- In late November 2025, Sandisk Corporation was added to multiple large-cap indices including the S&P 500, S&P 500 Information Technology, S&P 500 Equal Weighted and S&P Global 1200, while being removed from several small- and mid-cap benchmarks.

- This rapid index migration reflects Sandisk’s shift into the large-cap mainstream, underpinned by strong AI-driven demand for its NAND flash storage and a recent return to profitability.

- Next, we’ll examine how Sandisk’s S&P 500 inclusion and AI-fueled NAND flash demand reshape its investment narrative despite the recent share pullback.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Sandisk's Investment Narrative?

To own Sandisk today, you have to believe that AI-driven demand for high-capacity NAND and next-generation flash like UltraQLC and High Bandwidth Flash can support years of healthy revenue growth, while a young management team matures quickly. The recent leap into the S&P 500 and other large-cap indices matters less for fundamentals than for near-term trading: it tends to pull in index funds and improve liquidity, but the sharp rally this year and the post-inclusion pullback underline how sentiment can swing around memory cycles. Short term, the key catalysts still look tied to pricing power in NAND, execution on new fabs with Kioxia and early proof points on HBF, but index status and a higher profile could amplify both upside and downside if earnings or AI demand disappoint.

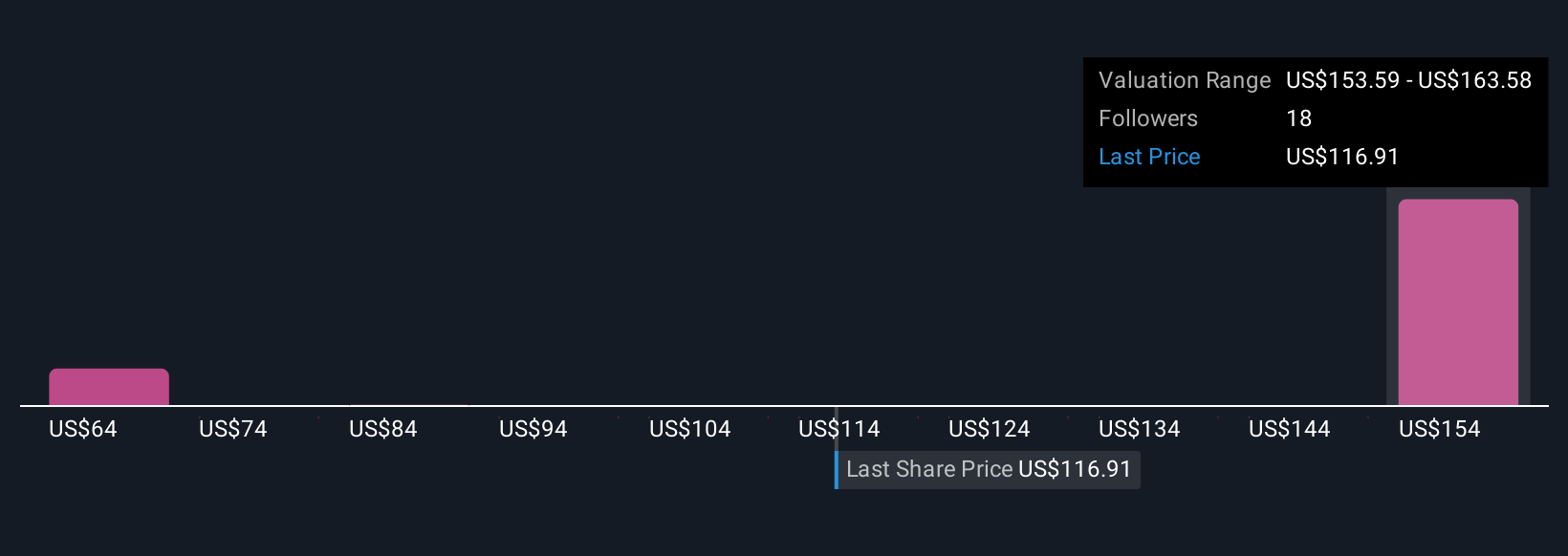

However, new large-cap status also magnifies any stumble in AI storage demand or pricing. Despite retreating, Sandisk's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Four Simply Wall St Community fair value views span roughly US$69 to US$645, showing very different expectations for Sandisk’s upside. Set those against the recent index inclusion and AI-driven NAND story, and it becomes clear why many readers may want to compare multiple viewpoints before deciding how much volatility they can accept.

Explore 4 other fair value estimates on Sandisk - why the stock might be worth over 3x more than the current price!

Build Your Own Sandisk Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sandisk research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sandisk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sandisk's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报