Does DENTSPLY SIRONA’s 40% 2025 Share Price Slump Signal a Deep Value Opportunity?

- If you are wondering whether DENTSPLY SIRONA is a bargain or a value trap at today’s price, you are not alone. This breakdown is intended to help you decide with a clear, valuation-first lens.

- The stock has been under heavy pressure, down 1.6% over the last week, 11.5% over the last month, and roughly 40% year to date. Moves of this size often signal shifting market sentiment and a possible disconnect between price and underlying value.

- Recent coverage has focused on the company’s ongoing portfolio simplification, restructuring of certain product lines, and continued investment in digital dentistry tools. These moves aim to streamline operations and refocus on higher margin opportunities. At the same time, commentary around competitive pressures in dental equipment and consumables has added to near term uncertainty, which helps explain why the share price has struggled despite a long term need for dental care.

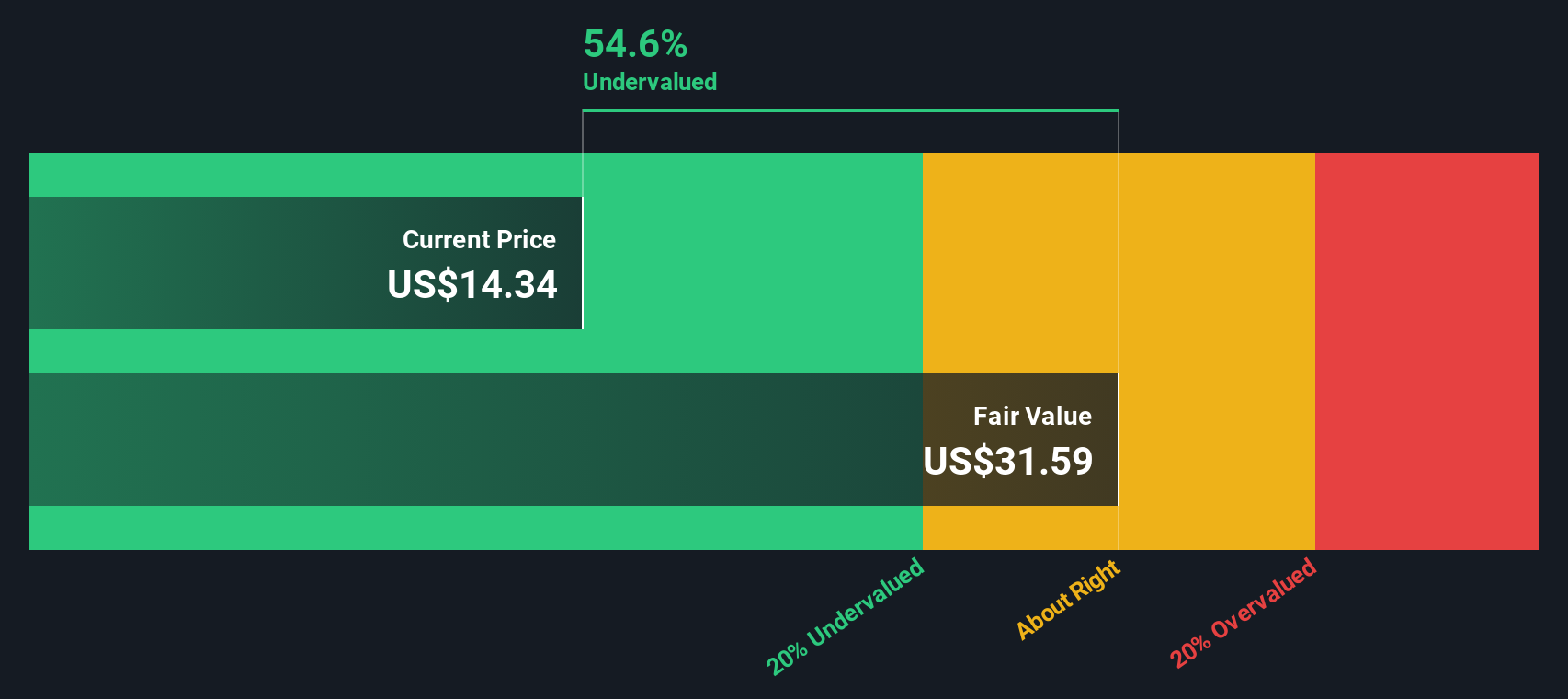

- Even so, our valuation checks suggest DENTSPLY SIRONA scores a solid 5/6 on undervaluation. This is a strong starting point before we dig into multiples, cash flow models, and later in the article, a more nuanced way to judge what the market is really pricing in.

Find out why DENTSPLY SIRONA's -40.5% return over the last year is lagging behind its peers.

Approach 1: DENTSPLY SIRONA Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today’s value. For DENTSPLY SIRONA, the model uses a 2 Stage Free Cash Flow to Equity approach, based on analyst estimates and longer term extrapolations.

The company generated about $78 million in free cash flow over the last twelve months, and analysts see this rising to roughly $407 million by 2029. Beyond that, Simply Wall St extends the forecast, with free cash flow expected to climb into the mid $500 million range over the following years as growth gradually slows.

After discounting these projected cash flows back to today, the model arrives at an intrinsic value of about $29.16 per share. Relative to the current market price, this implies the stock is trading at roughly a 61.9% discount, suggesting the market is pricing in a far weaker future than the cash flow outlook indicates.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DENTSPLY SIRONA is undervalued by 61.9%. Track this in your watchlist or portfolio, or discover 933 more undervalued stocks based on cash flows.

Approach 2: DENTSPLY SIRONA Price vs Sales

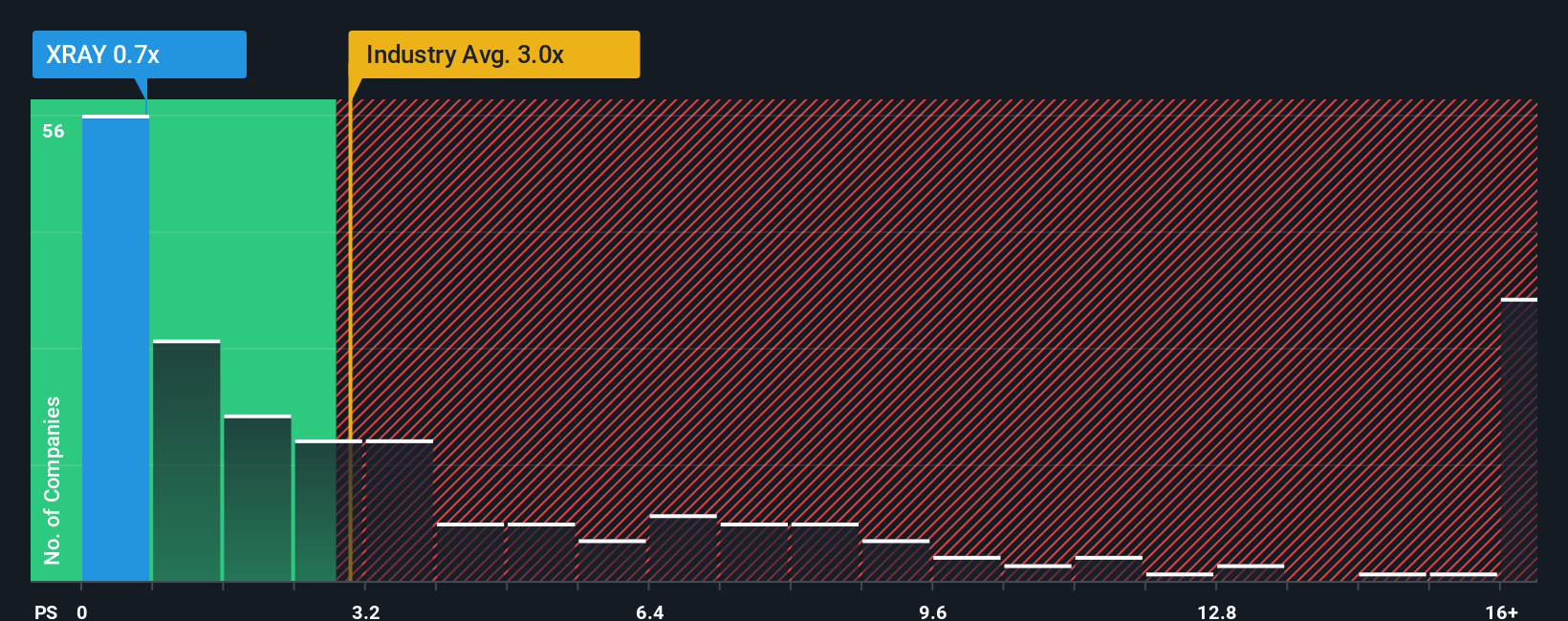

For a company like DENTSPLY SIRONA, where earnings are currently depressed, the Price to Sales ratio is a useful way to gauge value because sales are typically more stable than profits and less affected by short term restructuring or one off charges.

In general, higher growth and lower risk justify a higher sales multiple, while slower growth, thinner margins, or elevated uncertainty should pull a “normal” Price to Sales ratio lower. Today, DENTSPLY SIRONA trades at about 0.61x sales, well below both the Medical Equipment industry average of roughly 3.39x and the peer group average of around 5.07x.

Simply Wall St’s Fair Ratio framework estimates what a reasonable multiple should be for this specific business, in this case about 1.32x sales. Unlike simple peer or industry comparisons, the Fair Ratio adjusts for factors like expected growth, profitability, risk profile, industry characteristics, and company size. This makes it a more tailored benchmark. With the actual Price to Sales ratio at 0.61x versus a Fair Ratio of 1.32x, the shares screen as meaningfully undervalued on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DENTSPLY SIRONA Narrative

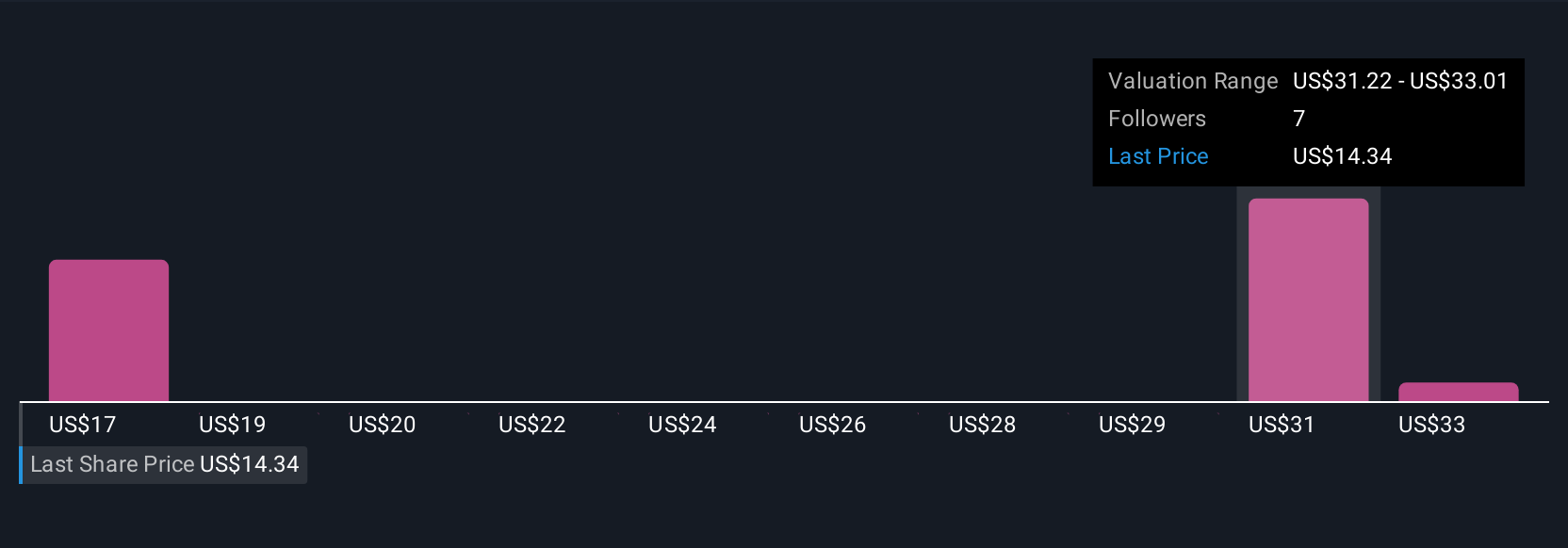

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, a simple way to connect your view of DENTSPLY SIRONA’s story with a set of numbers like future revenue, earnings, margins, and the fair value you think is reasonable.

A Narrative on Simply Wall St links three things together: the qualitative story you believe about the business, the financial forecast that follows from that story, and the resulting estimate of fair value that you can then compare to today’s price.

These Narratives are easy to use and live within the Community page on Simply Wall St’s platform, where millions of investors can see how different perspectives translate into different fair values and potential upside or downside.

Because each Narrative continuously compares its fair value to the current share price and is updated when new information like earnings, guidance changes, or major news is released, it becomes a dynamic signal grounded in your own assumptions.

For example, some DENTSPLY SIRONA investors on the platform see a recovery story that supports a fair value near the high end of analyst targets around 24 dollars, while more cautious investors use weaker growth and margin assumptions to arrive closer to 14 dollars, and Narratives make those differences explicit and trackable over time.

Do you think there's more to the story for DENTSPLY SIRONA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报