Undiscovered Gems in Europe for December 2025

As the European market continues to show resilience with the STOXX Europe 600 Index rising by 2.35%, investors are keeping a close eye on economic indicators, such as subdued inflation rates that suggest stability around the ECB's target. In this environment, identifying promising small-cap stocks becomes crucial, as these companies often offer unique growth opportunities that align well with current market dynamics and economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Clínica Baviera (BME:CBAV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics across Spain and Europe, with a market cap of €754.17 million.

Operations: Clínica Baviera generates revenue through its network of ophthalmology clinics across Spain and Europe. The company's financial performance can be assessed by examining its net profit margin, which provides insight into profitability after accounting for all expenses.

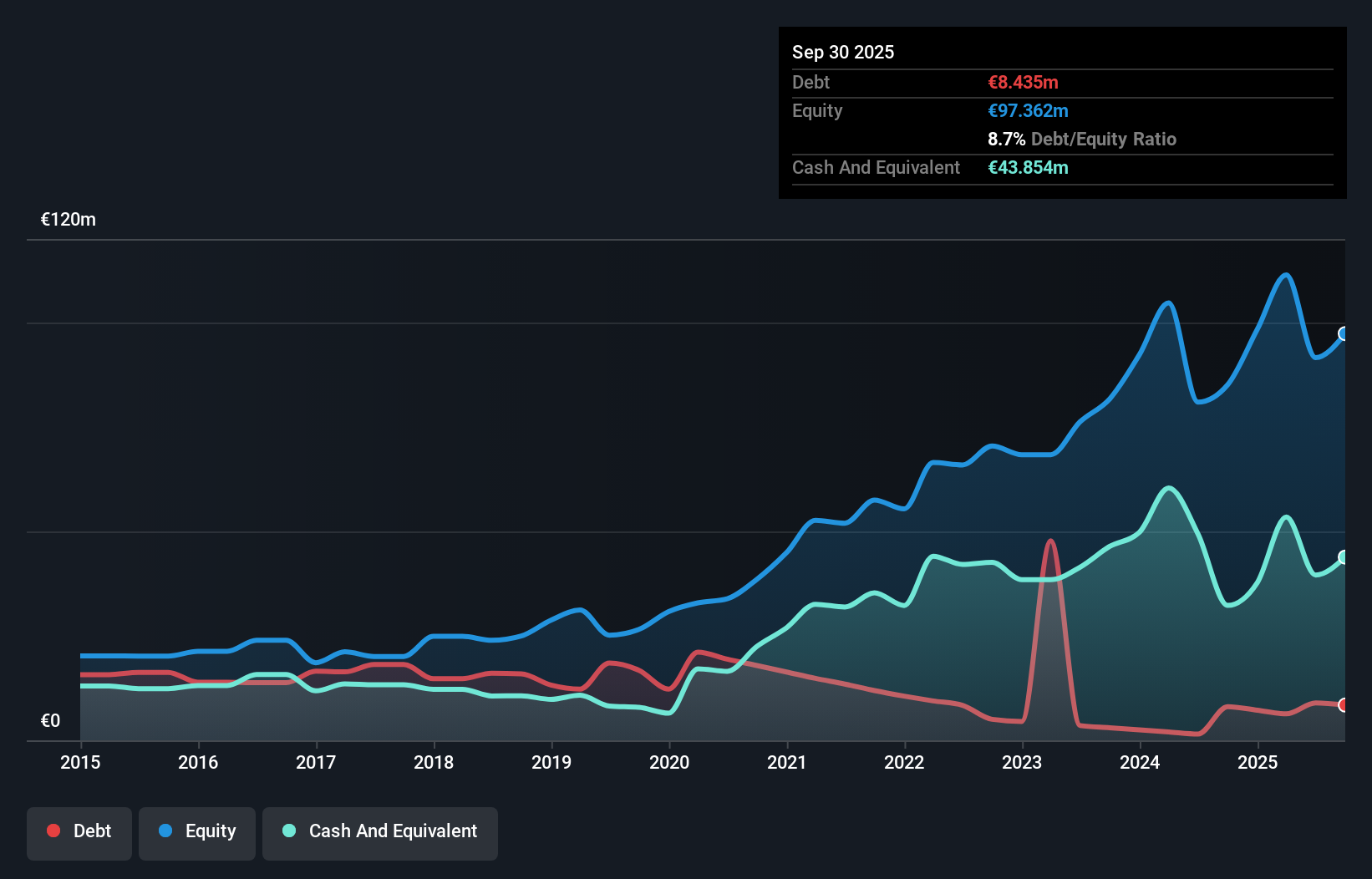

Clínica Baviera, a promising name in the European healthcare sector, shows significant potential with its robust financial health. Trading at 22% below estimated fair value, it has reduced its debt to equity ratio from 46.4% to 8.7% over five years, indicating prudent financial management. The company boasts a solid earnings growth of 9.2%, outpacing the broader healthcare industry’s growth rate of 9%. With interest payments well-covered by EBIT at a multiple of 21 times and more cash than total debt on hand, Clínica Baviera appears well-positioned for sustained performance in the coming years.

Pexip Holding (OB:PEXIP)

Simply Wall St Value Rating: ★★★★★★

Overview: Pexip Holding ASA is a video technology company that offers an end-to-end video conferencing platform and digital infrastructure across various regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of NOK 6.01 billion.

Operations: Pexip generates revenue primarily from the sale of collaboration services, amounting to NOK 1.23 billion.

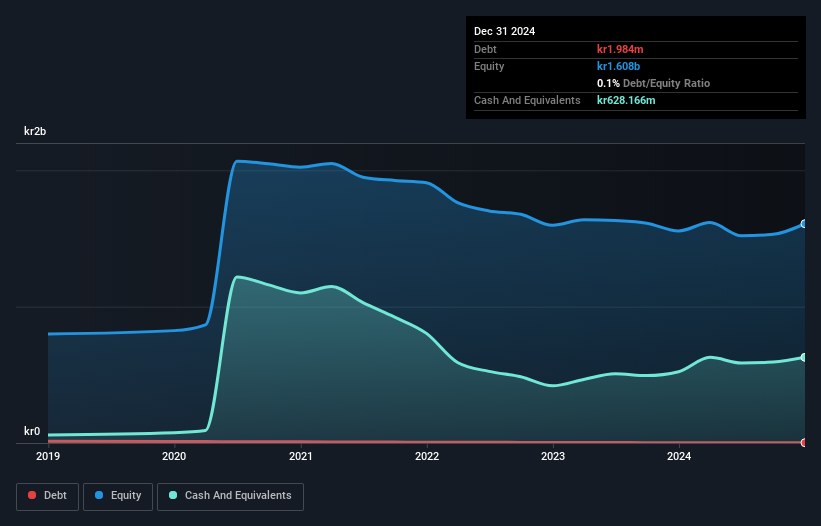

Pexip Holding, a nimble player in the video technology space, has recently turned profitable, showcasing high-quality earnings. The company reported net income of NOK 25.64 million for Q3 2025, up from NOK 5.8 million the previous year, with sales reaching NOK 265.63 million compared to NOK 228.48 million a year ago. Pexip's debt-equity ratio improved significantly over five years from 0.4 to 0.1 and it trades at a discount of about 27% below its estimated fair value, suggesting potential upside for investors despite competitive pressures in the market and reliance on product differentiation for sustained growth.

Uzin Utz (XTRA:UZU)

Simply Wall St Value Rating: ★★★★★★

Overview: Uzin Utz SE is engaged in the development, manufacturing, and sale of construction chemical system products across Germany, the United States, Netherlands, and other international markets, with a market capitalization of €363.19 million.

Operations: Uzin Utz generates revenue primarily through its Germany - Laying Systems segment, contributing €213.88 million, followed by Western Europe at €77.63 million and USA - Laying Systems at €73.12 million. The Netherlands - Laying Systems also adds significantly with €88.65 million in revenue.

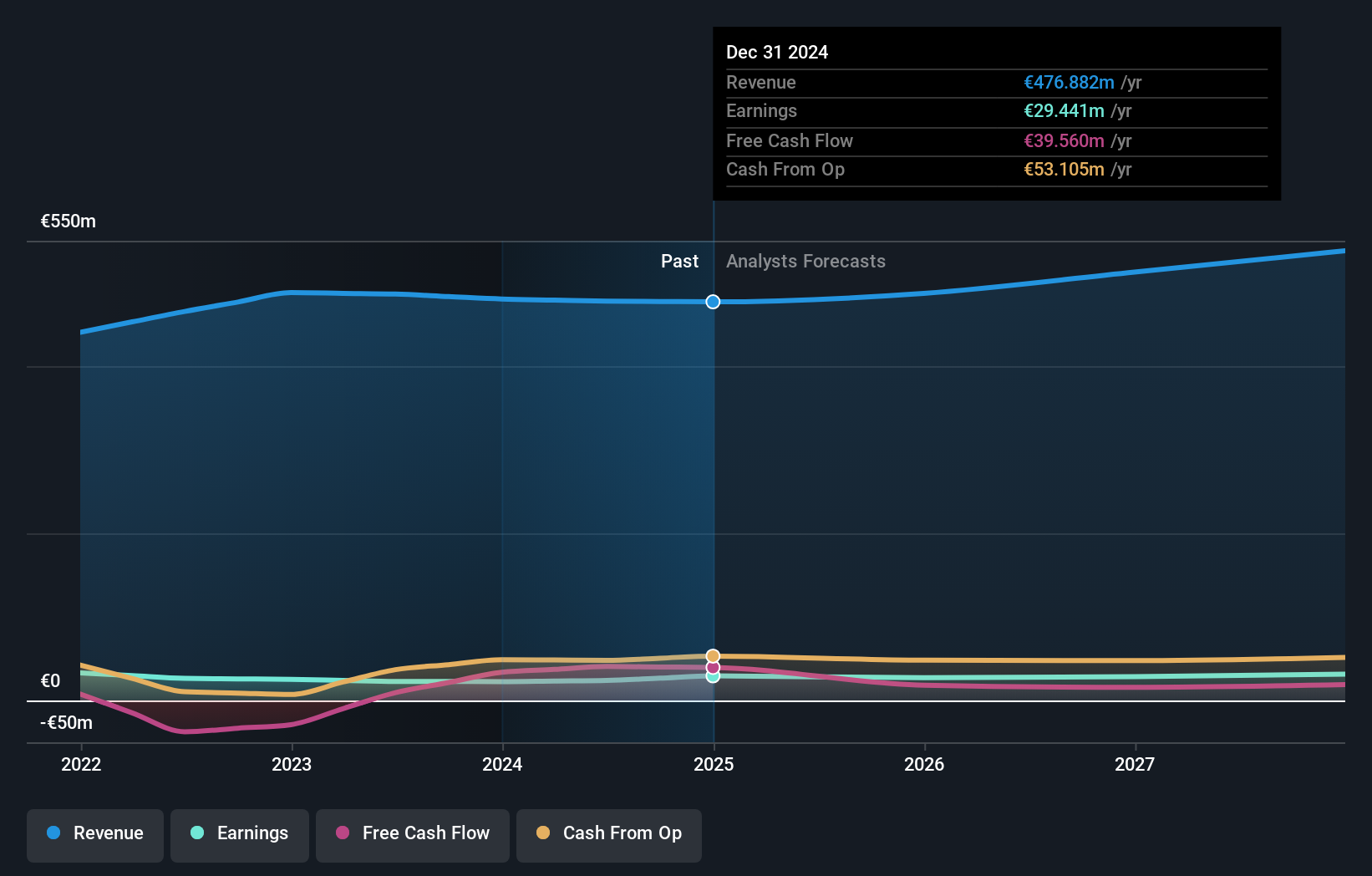

Uzin Utz, a nimble player in the chemicals sector, is making waves with its impressive earnings growth of 29.5% over the past year, outpacing the industry average of -9.3%. Its net debt to equity ratio at 15.4% is comfortably below satisfactory levels, indicating prudent financial management. The company's price-to-earnings ratio stands at 11.7x, which is attractively lower than the German market average of 18x. With interest payments well covered by EBIT (16.2x), Uzin Utz seems financially robust and poised for continued success in its niche market segment as it presented recently at the German Equity Forum 2025 in Frankfurt.

- Click to explore a detailed breakdown of our findings in Uzin Utz's health report.

Assess Uzin Utz's past performance with our detailed historical performance reports.

Key Takeaways

- Navigate through the entire inventory of 314 European Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报