Is NANO Nuclear Energy (NNE) Turning Micro Reactors Into the Next Data-Center Power Advantage?

- NANO Nuclear Energy Inc. recently announced a Feasibility Study Agreement with BaRupOn LLC to assess deploying multiple KRONOS MMR™ units delivering up to 1 GW of nuclear power at the planned 7,701-acre LAMP and Innovation Hub in Liberty, Texas.

- This agreement positions NANO Nuclear at the intersection of advanced nuclear technology and rising power needs for high-performance computing and digital infrastructure in the U.S.

- Against this backdrop, we’ll explore how the BaRupOn feasibility study shapes NANO Nuclear’s investment narrative around micro reactors and data-center power.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is NANO Nuclear Energy's Investment Narrative?

To own NANO Nuclear, you really have to believe that micro reactors can move from concept to commercial deployment and that the company’s technology, fuel initiatives and partnerships will matter when that happens. The BaRupOn feasibility study fits that story neatly, tying the KRONOS MMR concept to real-world power needs from high-performance computing and data infrastructure, but it is still an early-stage, non-binding assessment and not a revenue contract. In the near term, the more material catalysts remain progress on KRONOS licensing, the Illinois and Idaho collaborations, and validation of NANO’s ALIP pump as an enabling component for advanced reactors. Against a backdrop of zero revenue, continued losses and recent volatility, the biggest risks are execution, regulatory timelines and future dilution after significant capital raises. However, investors also need to weigh how much ongoing dilution risk they are really comfortable with.

Our valuation report unveils the possibility NANO Nuclear Energy's shares may be trading at a premium.Exploring Other Perspectives

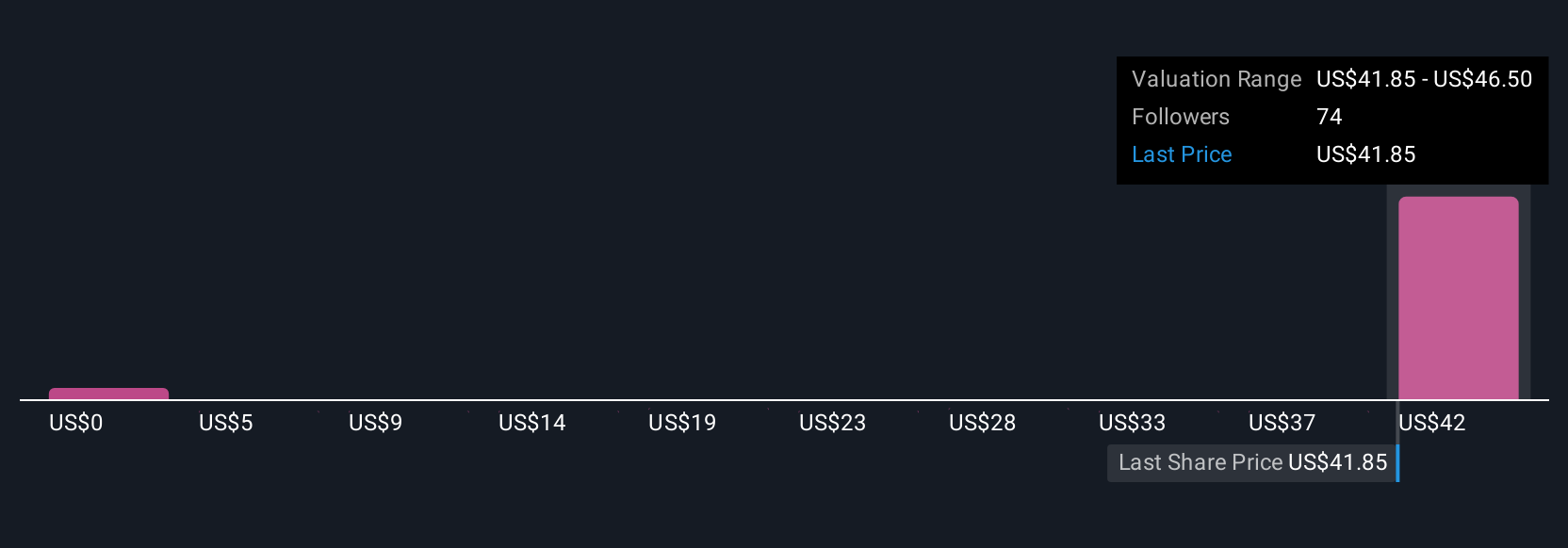

Sixteen fair value estimates from the Simply Wall St Community range widely, from about US$4.67 to US$46.67 per share. That spread reflects how differently people are thinking about early-stage nuclear, especially with fresh headlines like the BaRupOn study sitting alongside ongoing losses and no clear profitability horizon. You are seeing in real time how varied expectations on execution risk, capital needs and project conversion can shape very different views of NANO Nuclear’s potential performance.

Explore 16 other fair value estimates on NANO Nuclear Energy - why the stock might be worth as much as 42% more than the current price!

Build Your Own NANO Nuclear Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NANO Nuclear Energy research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free NANO Nuclear Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NANO Nuclear Energy's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报