What Moog (MOG.A)'s Strong 2025 Results, 2026 Outlook and M&A Push Mean For Shareholders

- Moog Inc. recently reported fourth-quarter 2025 sales of US$1,049.14 million and full-year sales of US$3.86 billion, alongside higher net income and earnings per share, while also declaring a US$0.29 quarterly dividend and confirming 2026 guidance for US$4.2 billion in net sales and US$10 in diluted EPS.

- The company also completed its 2025 audit with EY, appointed KPMG as its new auditor, and signaled an active acquisition pipeline, particularly to expand its defense and international missiles businesses.

- We’ll now examine how Moog’s stronger earnings outlook and acquisition focus could influence the previously discussed investment narrative for the company.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Moog Investment Narrative Recap

To own Moog, you need to believe in its role as a specialist supplier to long‑cycle aerospace, defense and industrial programs, with defense modernization and automation demand underpinning long term orders. The latest results and 2026 guidance reinforce that the near term earnings trajectory remains aligned with this view, while the most immediate risk still looks tied to Moog’s ability to convert growth into stronger free cash flow rather than any single quarterly headline.

The confirmation of 2026 guidance for US$4.2 billion in net sales and US$10 in diluted EPS is the most relevant update here, because it frames how management sees the earnings power that could support Moog’s defense and automation catalysts against ongoing working capital and cash flow pressures highlighted earlier in the narrative.

But investors should also be aware that Moog’s heavier working capital needs and softer free cash flow conversion could still...

Read the full narrative on Moog (it's free!)

Moog's narrative projects $4.4 billion revenue and $401.7 million earnings by 2028. This requires 5.7% yearly revenue growth and about a $190 million earnings increase from $211.6 million today.

Uncover how Moog's forecasts yield a $228.75 fair value, in line with its current price.

Exploring Other Perspectives

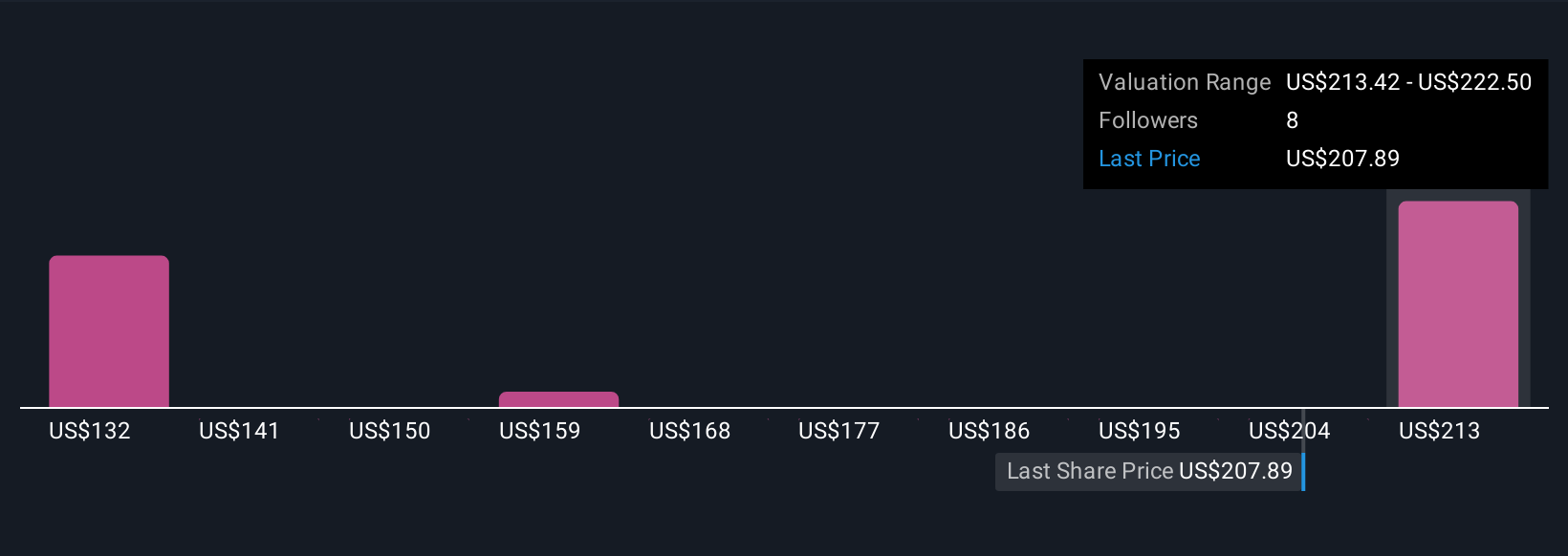

Three fair value estimates from the Simply Wall St Community range widely, from US$162.12 to about US$350.87 per share, underscoring how differently investors can view Moog’s prospects. Against that backdrop, the company’s continued focus on defense oriented growth and its guidance for higher earnings place extra attention on whether those gains translate into stronger and more consistent free cash flow over time.

Explore 3 other fair value estimates on Moog - why the stock might be worth as much as 54% more than the current price!

Build Your Own Moog Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moog research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Moog research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moog's overall financial health at a glance.

No Opportunity In Moog?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报