Assessing Vornado Realty Trust After Recent Share Price Weakness and DCF Upside Potential

- If you are looking at Vornado Realty Trust and wondering whether this beaten up New York office landlord is quietly turning into a value opportunity, you are not alone.

- The stock closed at $36.49 and is down 0.9% over the last week, 3.3% over the past month, and 14.4% year to date, but it is still up a hefty 79.1% over three years and 8.3% over five years, a reminder of how quickly sentiment around this name can swing.

- Those mixed returns sit against a backdrop of ongoing uncertainty around office demand in gateway cities and headlines about higher for longer interest rates pressuring REIT valuations. At the same time, investors have been watching closely as New York office fundamentals slowly stabilize and capital markets thaw for high quality assets, which helps explain why Vornado has not simply traded in a straight line lower.

- On our framework, Vornado scores a 4/6 valuation check score, suggesting it looks undervalued on several important metrics. In the next sections we will break down what that means across different valuation approaches and hint at an even richer way to think about fair value by the end of the article.

Approach 1: Vornado Realty Trust Discounted Cash Flow (DCF) Analysis

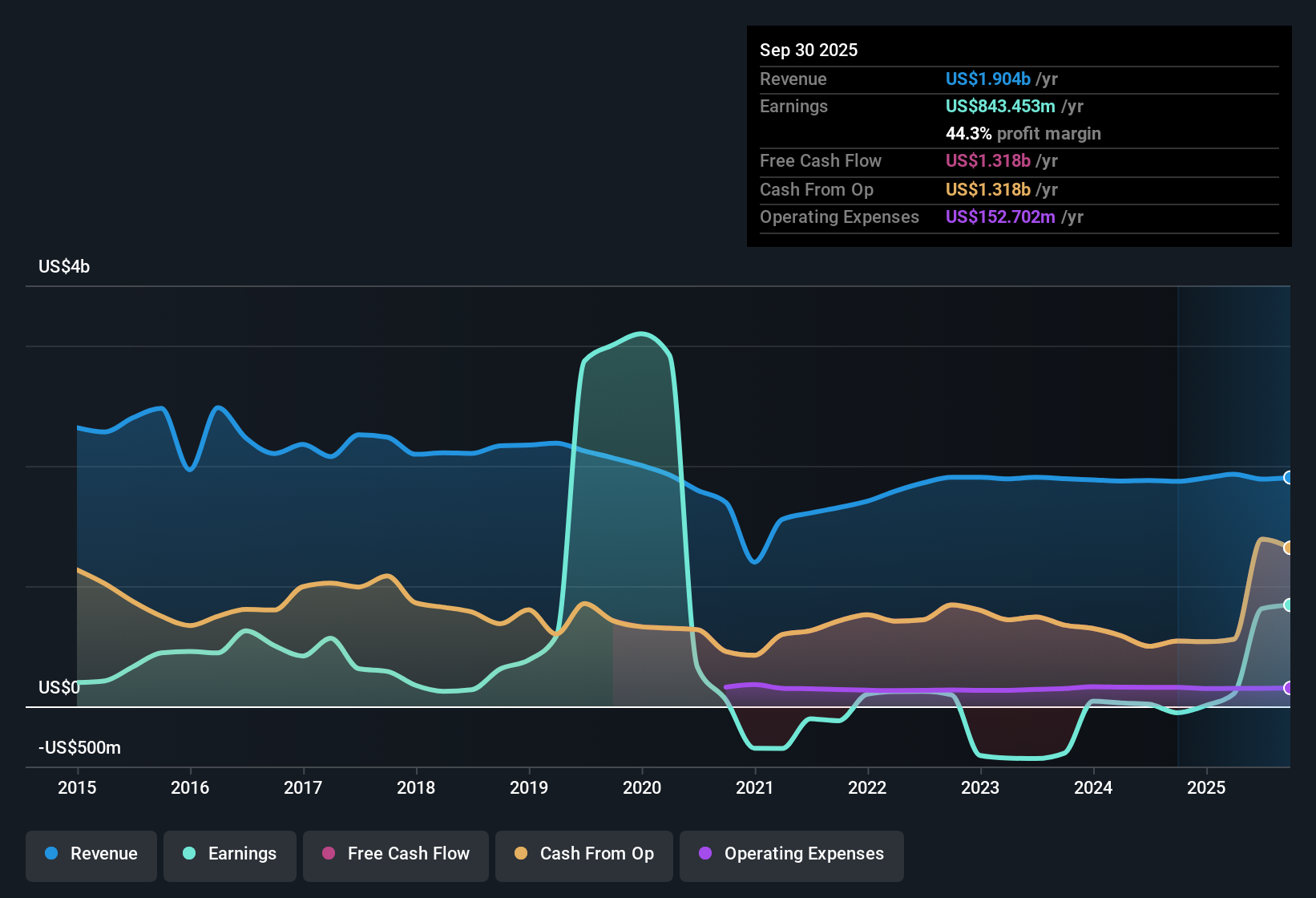

The Discounted Cash Flow model estimates what Vornado is worth today by projecting its adjusted funds from operations into the future and discounting those cash flows back to the present. For Vornado, we start with last twelve months free cash flow of about $468.5 Million and use analyst forecasts for the next few years, then extend those estimates further out using Simply Wall St projections.

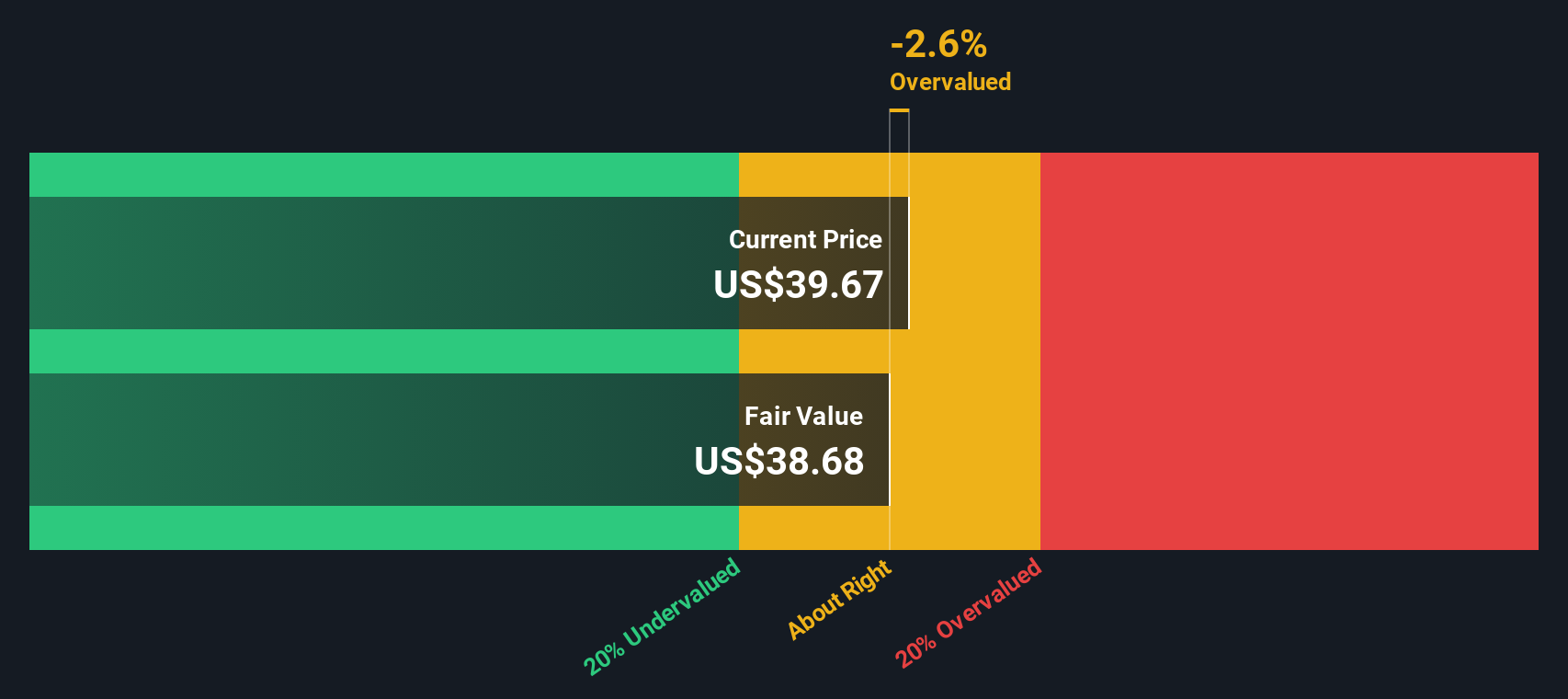

Under this two stage model, Vornado’s free cash flow is expected to rise gradually toward roughly $625.5 Million by 2035, as the business normalizes and grows at moderating rates. When all of those future $ cash flows are discounted back and added together, the model arrives at an intrinsic value of about $44.63 per share.

Compared with the recent share price of $36.49, the DCF suggests Vornado is trading at roughly an 18.2% discount to its estimated fair value, pointing to a meaningful margin of safety if the cash flow path plays out as expected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vornado Realty Trust is undervalued by 18.2%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

Approach 2: Vornado Realty Trust Price vs Earnings

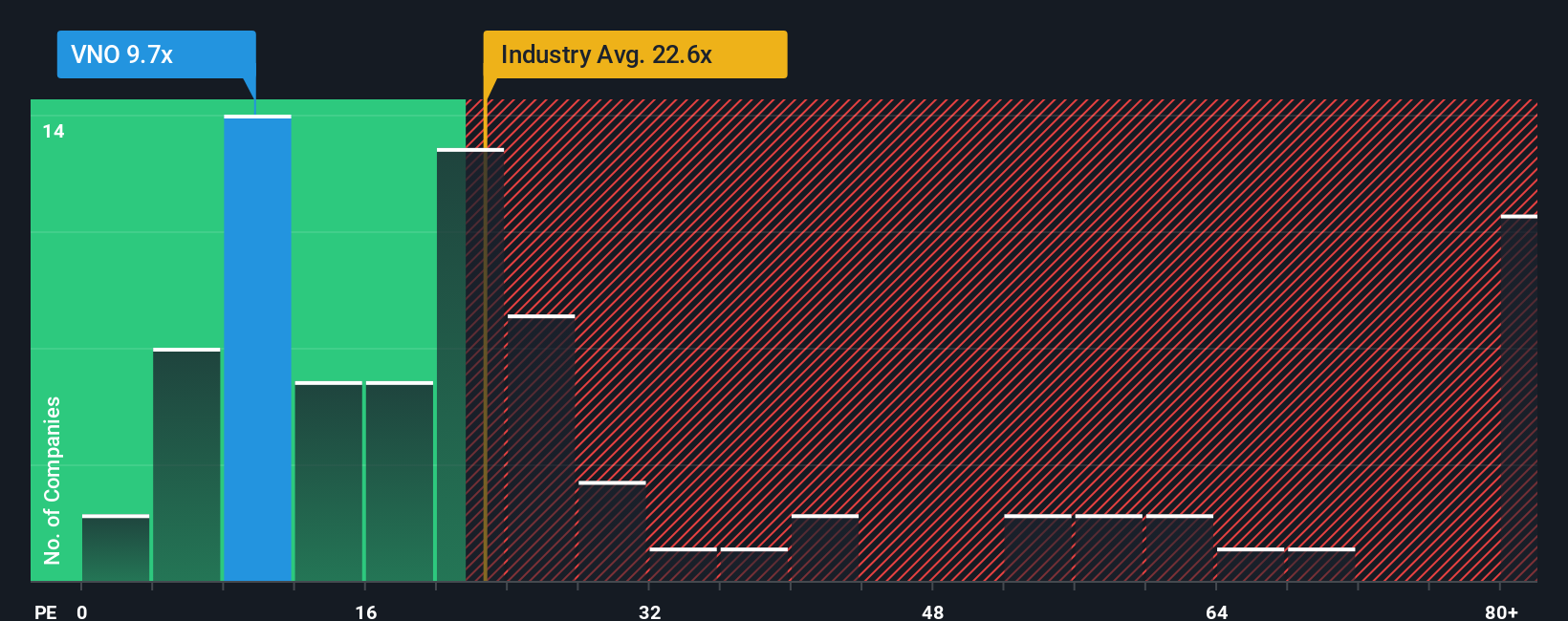

For a profitable REIT like Vornado, the price to earnings (PE) ratio is a practical way to see how much the market is willing to pay for each dollar of current earnings. In general, companies with stronger, more predictable growth and lower perceived risk deserve higher PE multiples, while slower growth or higher uncertainty should translate into lower, discounted PE levels.

Vornado currently trades at about 8.3x earnings, which is well below the Office REITs industry average of roughly 22.6x and the broader peer group average of around 34.3x. To refine that comparison, Simply Wall St uses a proprietary Fair Ratio, which estimates what Vornado’s PE should be after adjusting for its earnings growth outlook, risk profile, margins, market cap and industry characteristics. For Vornado, this Fair Ratio is 15.7x, which indicates that the shares trade at a substantial discount to where they might sit if the market were fully factoring in these fundamentals.

Because the current PE of 8.3x is significantly below the Fair Ratio of 15.7x, this multiple-based view points to Vornado being undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vornado Realty Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Vornado’s story with concrete forecasts and a fair value estimate. A Narrative is your personalized storyline for the company, where you spell out what you think will happen to its revenue, earnings, and margins, then link that story to a financial model that calculates what you believe the shares are truly worth. Narratives on Simply Wall St, available in the Community page used by millions of investors, make it easy to compare that Fair Value with today’s Price so you can decide whether Vornado looks like a buy, a hold, or a sell. They also update dynamically as new information like earnings results, leasing news, or interest rate changes come in, keeping your thesis current instead of static. For Vornado, one investor might build a bullish Narrative around premium Manhattan assets, strong redevelopment and resilient rent growth that supports a Fair Value closer to $46, while another might focus on remote work risks and softer demand that point to a more cautious Fair Value near $30.

Do you think there's more to the story for Vornado Realty Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报