Sports Entertainment Group Limited (ASX:SEG) Screens Well But There Might Be A Catch

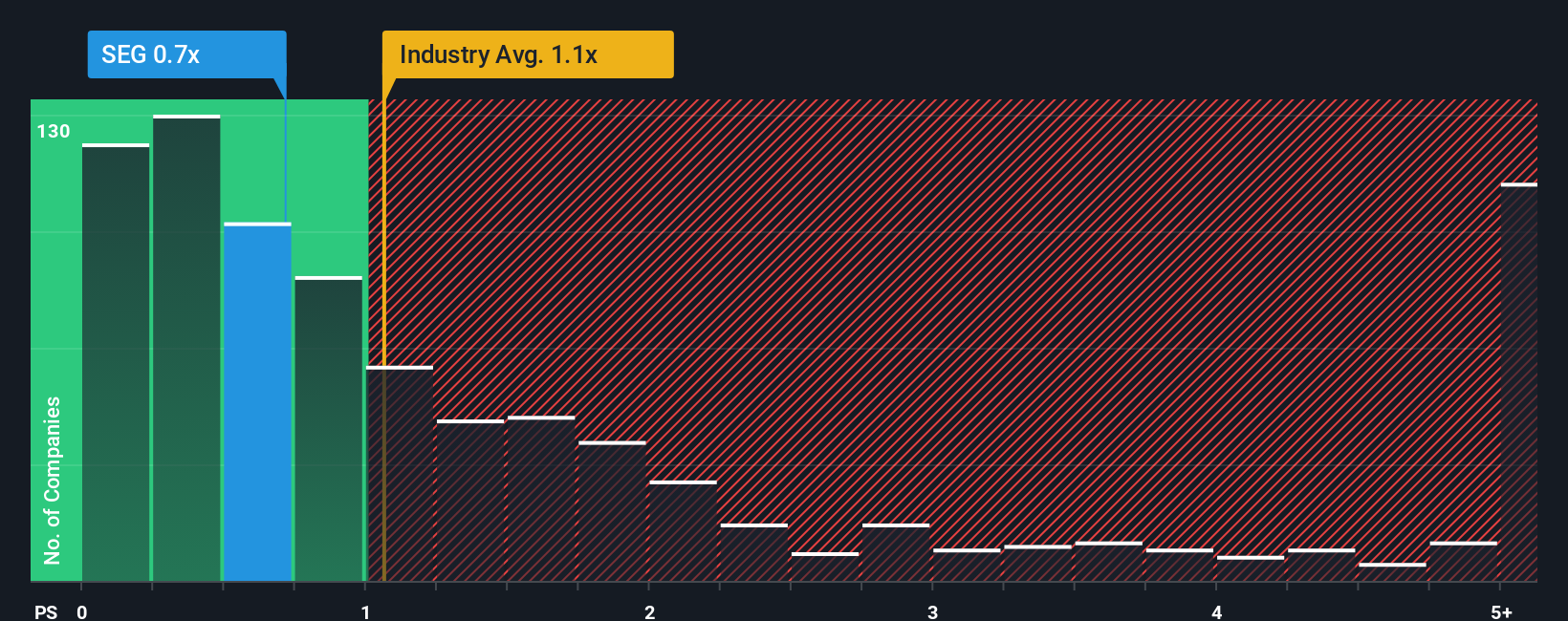

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Media industry in Australia, you could be forgiven for feeling indifferent about Sports Entertainment Group Limited's (ASX:SEG) P/S ratio, which comes in at about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Sports Entertainment Group

What Does Sports Entertainment Group's P/S Mean For Shareholders?

Sports Entertainment Group's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Sports Entertainment Group will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Sports Entertainment Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Sports Entertainment Group?

The only time you'd be comfortable seeing a P/S like Sports Entertainment Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

Turning to the outlook, the next three years should demonstrate the company's robustness, generating growth of 8.0% each year as estimated by the lone analyst watching the company. That would be an excellent outcome when the industry is expected to decline by 0.9% per annum.

With this information, we find it odd that Sports Entertainment Group is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sports Entertainment Group currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Sports Entertainment Group, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报