PDF Solutions (PDFS): Assessing Valuation After 2025 Growth Guidance Confirmation and Upcoming Analyst Day

PDF Solutions (PDFS) is putting its growth story front and center, confirming 21-23% revenue growth guidance for 2025 as it prepares for a webcast Analyst Day featuring its CEO and CFO.

See our latest analysis for PDF Solutions.

The guidance confirmation seems to be resonating, with a 4.12% 1 day share price return and a strong 90 day share price return of 42.31%, even though the 1 year total shareholder return remains negative.

If this kind of growth narrative has your attention, it might be worth exploring other high growth tech and AI names using our high growth tech and AI stocks to spot similar opportunities.

With shares still down over the past year but now rallying ahead of Analyst Day, the key question is whether PDF Solutions is quietly undervalued or if the market is already pricing in that 21-23% growth.

Most Popular Narrative Narrative: 18.2% Undervalued

With the narrative fair value at $34.25 versus the last close of $28.02, this framework leans toward upside as revenue visibility and profitability improve.

The company's disciplined operating expense growth relative to revenue, combined with high margin analytics software sales, is driving operating margin expansion setting the stage for improved net margins and long term EPS growth.

Curious how this story backs into that higher valuation? The narrative focuses on aggressive growth, rising margins, and a future earnings multiple that might surprise you. Want to see the full financial roadmap behind that target? Read on to uncover the assumptions powering this fair value estimate.

Result: Fair Value of $34.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on smooth execution, as geopolitical tensions and heavy R&D spending could pressure margins and derail the growth trajectory.

Find out about the key risks to this PDF Solutions narrative.

Another Angle on Valuation

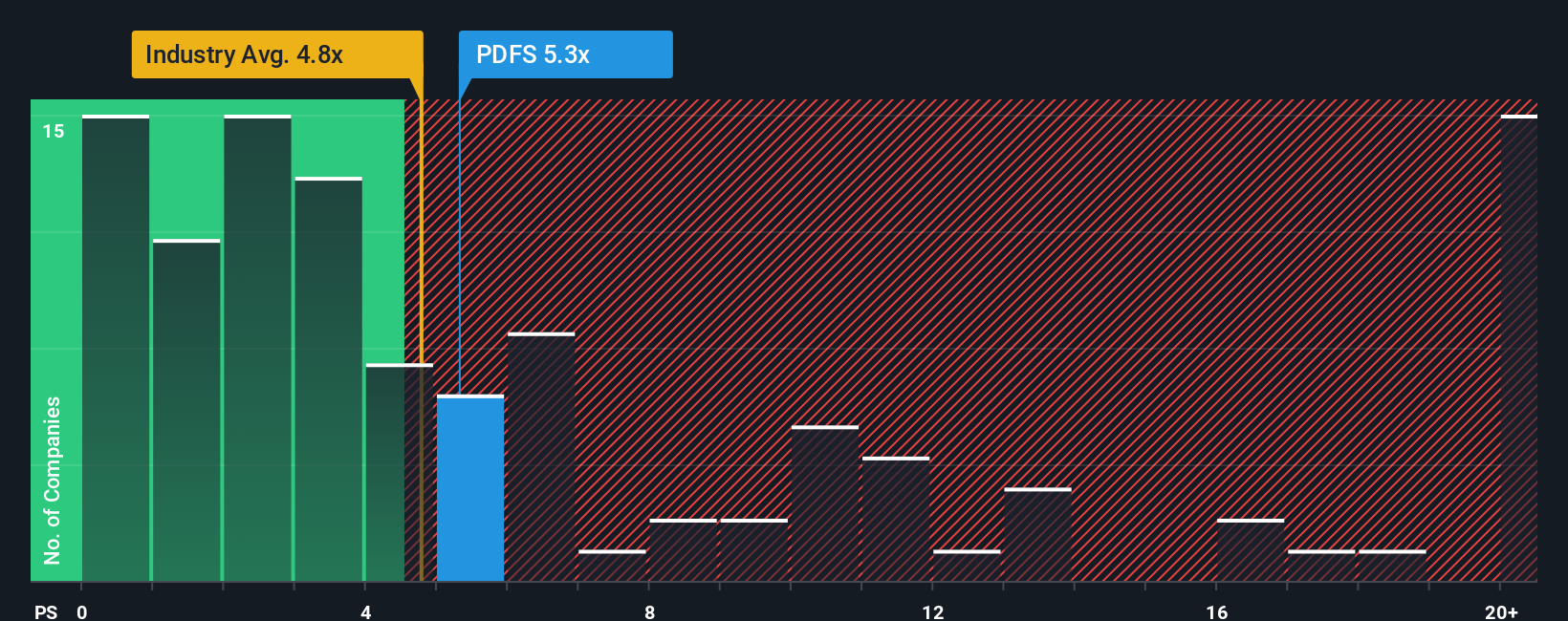

On sales based metrics, PDF Solutions looks anything but cheap, trading at a 5.4x price to sales ratio versus 4.7x for the US semiconductor industry and 4.2x for peers, and only slightly below its 5.8x fair ratio. That premium highlights potential execution risk if growth slows, and also indicates room for a rerating if margins improve. Which outcome aligns better with your view of the company?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PDF Solutions Narrative

If you see the story differently, or just want to dig into the numbers yourself, you can shape a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding PDF Solutions.

Looking for more investment ideas?

Do not stop at one opportunity when an entire universe of data backed ideas is waiting. Use the Simply Wall St Screener to uncover your next move.

- Capitalize on potential mispricings by targeting companies trading below their intrinsic worth through these 935 undervalued stocks based on cash flows that highlight compelling value setups.

- Ride cutting edge innovation by focusing on early stage innovators using these 25 AI penny stocks that group ambitious businesses shaping the next wave of intelligent technology.

- Strengthen your portfolio income stream by zeroing in on dependable payouts with these 14 dividend stocks with yields > 3% that surface companies offering attractive, sustainable yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报