Did New Climb and TERAGO Deals Just Reframe Fortinet's (FTNT) Integrated Security Platform Narrative?

- In late November and early December 2025, Climb and TERAGO each announced new partnerships with Fortinet to bring its enterprise-grade cybersecurity, SD-WAN, and SASE solutions to their respective reseller and managed service ecosystems.

- By plugging Fortinet into these specialized distribution and networking channels, the company is broadening access to its platform in a way that could deepen customer adoption across diverse industries without relying solely on its traditional firewall base.

- Next, we’ll explore how Fortinet’s expanded reach through Climb and TERAGO could influence its investment narrative built around integrated cybersecurity services.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Fortinet Investment Narrative Recap

To own Fortinet, you need to believe its shift from a firewall‑centric vendor to an integrated security and networking platform can offset any slowdown once the current hardware refresh cycle fades. The Climb and TERAGO partnerships modestly support the near term catalyst of broader SASE and cloud adoption, but do not materially change the biggest risk that growth could slow if Fortinet struggles to win more business beyond its existing firewall base.

Among the recent updates, TERAGO’s rollout of Fortinet SD‑WAN and Unified SASE across Canadian managed services slots directly into this story, because it showcases Fortinet’s platform being delivered as a cloud‑centric, recurring service rather than just on‑premise appliances. That matters for the catalyst around higher margin, subscription revenue and for testing whether Fortinet’s SASE value proposition can resonate in greenfield or competitive accounts outside its legacy footprint.

Yet investors should be aware that once the current firewall refresh wave tapers, Fortinet’s growth profile could look very different if...

Read the full narrative on Fortinet (it's free!)

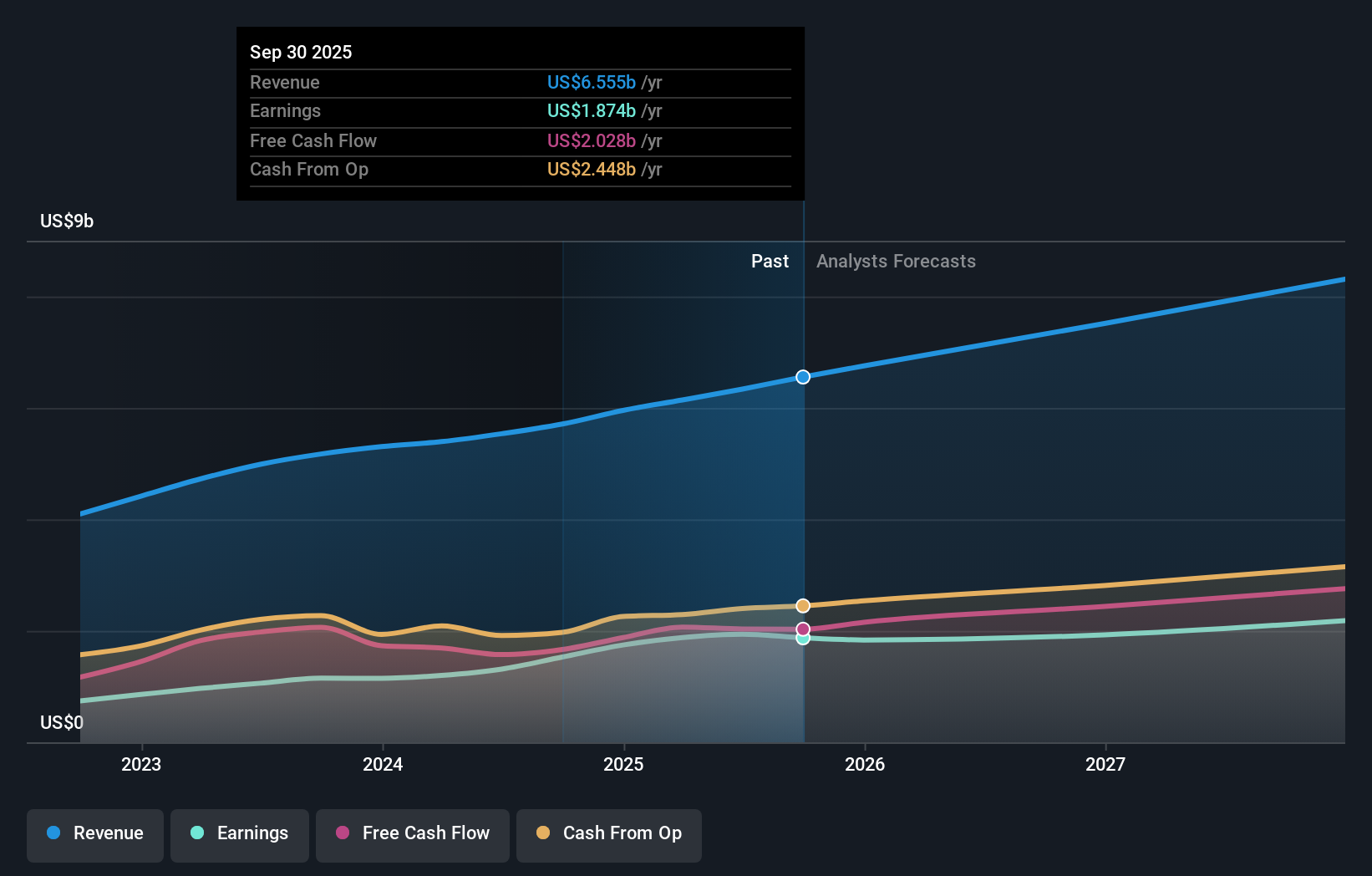

Fortinet's narrative projects $9.2 billion revenue and $2.4 billion earnings by 2028. This requires 13.1% yearly revenue growth and an earnings increase of about $0.5 billion from $1.9 billion today.

Uncover how Fortinet's forecasts yield a $87.45 fair value, a 5% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s 25 fair value estimates for Fortinet range from US$82.99 to US$110.39, showing a wide spread in what members think the shares are worth. Against that backdrop, the key question many are wrestling with is whether Fortinet’s push into SASE and managed service channels can offset the eventual drag from a maturing firewall refresh cycle and support the business over time.

Explore 25 other fair value estimates on Fortinet - why the stock might be worth just $82.99!

Build Your Own Fortinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortinet research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Fortinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortinet's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报