Reassessing Crocs (CROX) Valuation After Strong Adjusted Profits and Expanding International Growth

Why Crocs Stock Is Back in Focus

Crocs (CROX) is back on investors radar after posting solid adjusted profits that cut through headline noise from HEYDUDE related non cash charges, highlighting how its core business is really performing.

The story behind that strength centers on international momentum in markets like China and India, a growing direct to consumer footprint, and steady balance sheet cleanup through buybacks and debt reduction.

See our latest analysis for Crocs.

Despite a weak 1 day share price return and a choppy year to date, Crocs’ roughly 9 percent 1 month share price return and positive 3 month move suggest momentum is tentatively rebuilding after earlier pessimism around HEYDUDE noise.

If Crocs’ story has you watching consumer names more closely, it could be worth exploring auto manufacturers as another way to spot shifting demand and brand power across the market.

With the stock still trading below many estimates of intrinsic value even after its recent rebound, the key debate now is simple: is Crocs quietly undervalued, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 1.9% Undervalued

With Crocs’ fair value estimate sitting just above the latest close at $87.83 versus $86.19, the most followed narrative sees modest upside built on powerful earnings math.

The company's accelerating direct-to-consumer (DTC) strategy, expanding owned retail and digital channels, experimenting with new retail concepts, and scaling global social commerce is enabling Crocs to maintain higher pricing, reduce reliance on promotional activity, and capture higher-margin sales. Over time, this is expected to structurally increase net margins and improve the overall quality and predictability of earnings.

Curious how shrinking top line assumptions can still support a rising earnings engine, richer margins, and a surprisingly low future earnings multiple, all discounted at 9.53 percent? Dive into the full narrative to see which moving parts really drive that fair value call.

Result: Fair Value of $87.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent North American softness and ongoing HEYDUDE brand challenges could derail the margin and earnings progress that underpins the case for modest undervaluation.

Find out about the key risks to this Crocs narrative.

Another Angle on Valuation

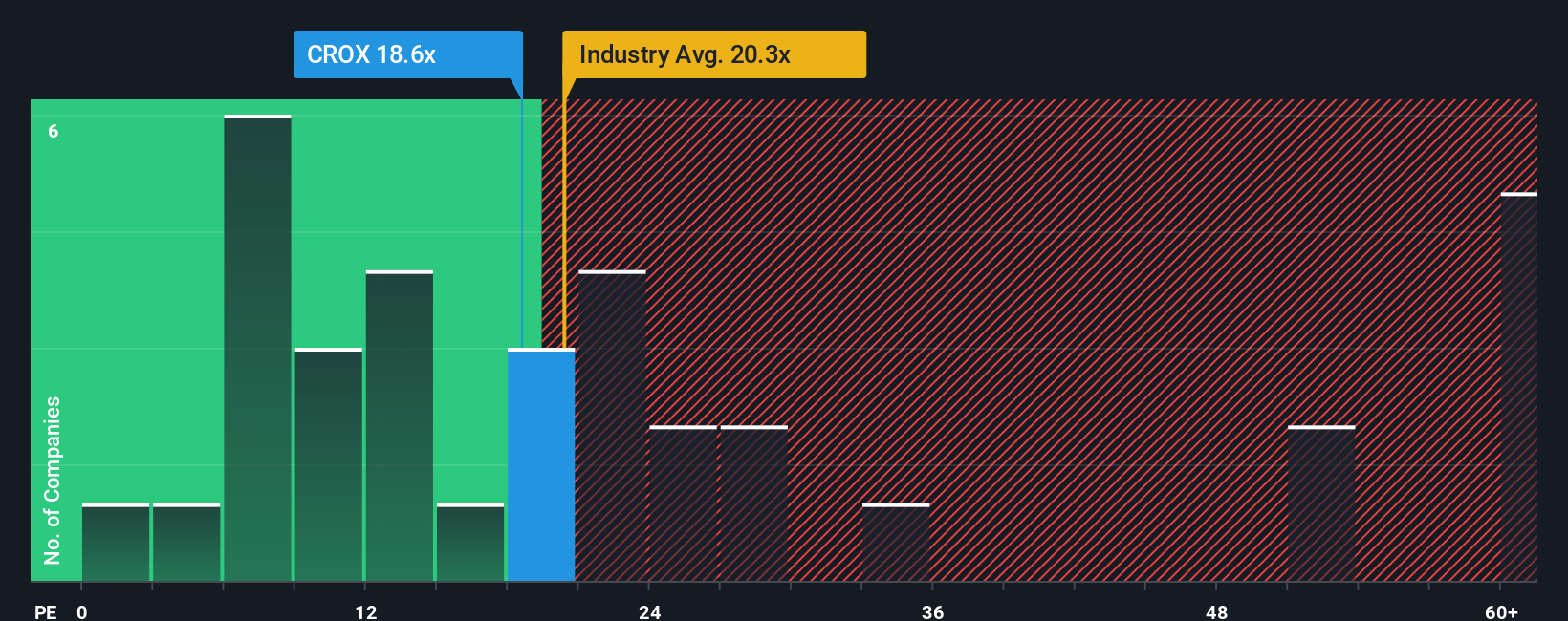

Step away from earnings forecasts for a moment, and Crocs suddenly looks much richer. At about 24.5 times earnings, it trades above both the US luxury average of 21.5 times and the peer average of 23.7 times, even though its one-year share performance has badly lagged.

Yet our fair ratio work suggests the market could one day justify a far higher 59.7 times earnings multiple if margins and growth really come through. That would leave a wide gap between cautious sentiment today and what investors might be willing to pay later. Is that a margin of safety, or a value trap waiting to be exposed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crocs Narrative

If this perspective does not fully resonate, or you would rather dig into the numbers yourself, you can craft a personalized view in just minutes: Do it your way.

A great starting point for your Crocs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to use the Simply Wall Street Screener to uncover focused ideas that could reshape your portfolio.

- Review these 903 undervalued stocks based on cash flows to explore potential bargains with strong cash generation that may be trading below what their future cash flows justify.

- Use these 27 AI penny stocks to research companies involved in automation and machine learning that may be positioned to benefit from AI adoption.

- Screen these 81 cryptocurrency and blockchain stocks to explore opportunities tied to blockchain innovation and developments in payment infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal