Logory Logistics Technology (HKG:2482) Might Have The Makings Of A Multi-Bagger

If you're looking for a multi-bagger, there's a few things to keep an eye out for. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, we've noticed some promising trends at Logory Logistics Technology (HKG:2482) so let's look a bit deeper.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Logory Logistics Technology, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = CN¥87m ÷ (CN¥2.2b - CN¥1.5b) (Based on the trailing twelve months to June 2025).

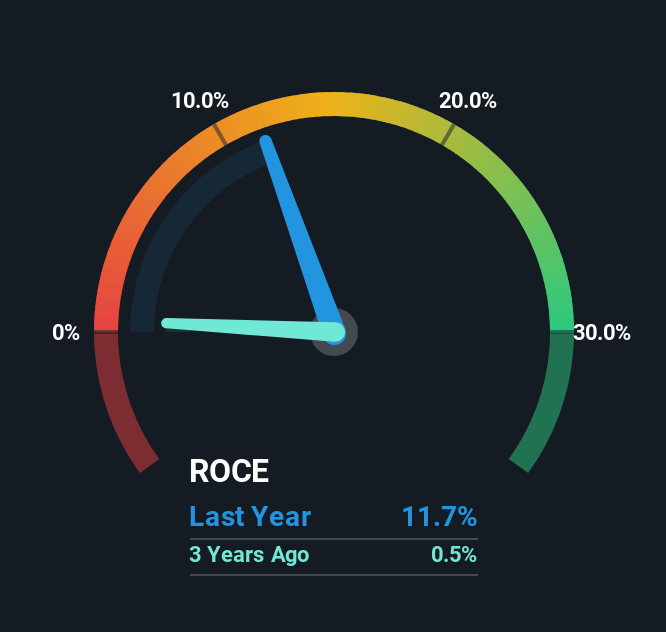

Therefore, Logory Logistics Technology has an ROCE of 12%. On its own, that's a standard return, however it's much better than the 6.5% generated by the Logistics industry.

See our latest analysis for Logory Logistics Technology

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Logory Logistics Technology has performed in the past in other metrics, you can view this free graph of Logory Logistics Technology's past earnings, revenue and cash flow.

The Trend Of ROCE

The trends we've noticed at Logory Logistics Technology are quite reassuring. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 12%. The amount of capital employed has increased too, by 203%. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 66%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. Therefore we can rest assured that the growth in ROCE is a result of the business' fundamental improvements, rather than a cooking class featuring this company's books. Nevertheless, there are some potential risks the company is bearing with current liabilities that high, so just keep that in mind.

The Bottom Line

To sum it up, Logory Logistics Technology has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. Since the total return from the stock has been almost flat over the last year, there might be an opportunity here if the valuation looks good. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

Logory Logistics Technology does have some risks though, and we've spotted 1 warning sign for Logory Logistics Technology that you might be interested in.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal