Is It Too Late to Buy The Metals Company Stock?

Key Points

It's aiming to harvest rocks undersea, such as copper, cobalt, nickel, and manganese.

The company does not yet have regulatory approval to mine these nodules commercially.

But strong demand and the metals' scarcity has made some investors bullish on the stock.

Investors who bought The Metals Company (NASDAQ: TMC) stock last December and held on through all the ups and downs of 2025 are now sitting on a gain of roughly 766%. Indeed, in mid-October, the company's stock had grown almost 11-fold year over year.

Let that sink in. Literally: This might be the only company that grew exponentially on the promise of diving for polymetallic rocks about 18,000 feet or so under the ocean.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Few mining companies can replicate that market success. And yet, if you believe the U.S. will need more critical minerals than it currently has, another huge gain is plausible.

TMC's promise beneath the surface

The Metals Company, also called TMC, is a Canadian-based deep-sea miner aiming to harvest polymetallic nodules, that is, potato-sized rocks abundant in nickel, cooper, cobalt, and manganese. If those metals ring a bell, that's because they're critical for electric vehicle (EV) batteries, data centers, clean energy infrastructure, and other tech manufacturing.

TMC hasn't gotten the green light to mine these rocks commercially. Although it's sitting on a treasure chest of nodules worth more than $23 billion by its own estimates, regulatory approval is still a huge uncertainty that could keep that treasure buried for years to come.

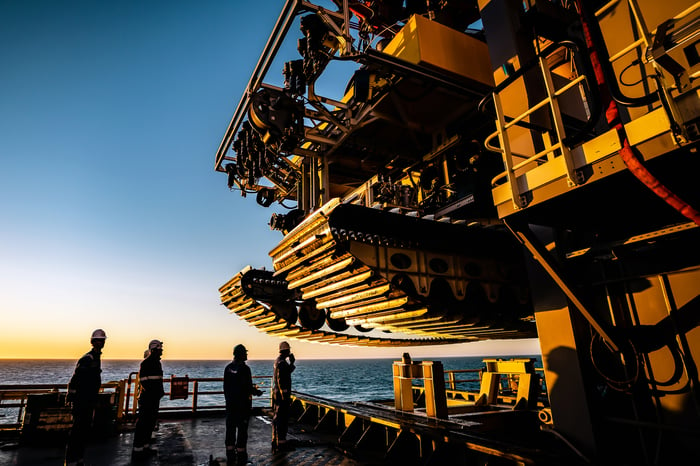

Image source: The Metals Company.

The company's most recent quarterly earnings underscores the risk. It reported a third-quarter net loss of roughly $185 million, about 780% higher than last year. It also boasts a roughly $3 billion market valuation without a single dollar of revenue.

As such, this stock is still for aggressive investors only. For those who understand the risks, a small stake could be a calculated bet on future metal scarcity.

Steven Porrello has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal