New Fortress Energy (NFE): Reassessing Valuation After a Sharp Short-Term Share Price Rebound

New Fortress Energy (NFE) has quietly bounced, with shares up around 12% in a day and almost 20% over the past week, despite a steep slide this year. Let us unpack what might be changing.

See our latest analysis for New Fortress Energy.

That bounce comes after a brutal stretch, with the latest 1 year total shareholder return still deep in the red. As a result, this sharp 7 day share price move looks more like early momentum than a full trend change.

If this rebound has you rethinking your energy exposure, it could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With revenues still growing but years of heavy losses behind it, has New Fortress Energy finally fallen to a bargain price that underestimates a turnaround, or are investors correctly pricing in limited future growth from here?

Most Popular Narrative: 53.5% Undervalued

With New Fortress Energy last closing at $1.57 versus a narrative fair value of $3.38, followers see a sharp disconnect that hinges on future cash generation.

The FLNG asset coming online is expected to significantly contribute to future earnings as it allows optimization of the portfolio, leading to increased future returns, positively impacting revenue and earnings. The initiative to reduce debt and simplify the capital structure will decrease debt costs, improving net margins and overall financial health.

Curious how faster revenue growth, a swing to profitability, and a low future earnings multiple can still point to such a large upside gap? The most widely followed narrative lays out a detailed roadmap of projected margins, earnings power and valuation assumptions that challenge today’s beaten down price. Want to see exactly which growth and profitability targets have to click for $3.38 to make sense?

Result: Fair Value of $3.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on smooth execution in Puerto Rico and Brazil, and on global gas prices not eroding already pressured margins.

Find out about the key risks to this New Fortress Energy narrative.

Another Angle: Cash Flows Paint a Harsher Picture

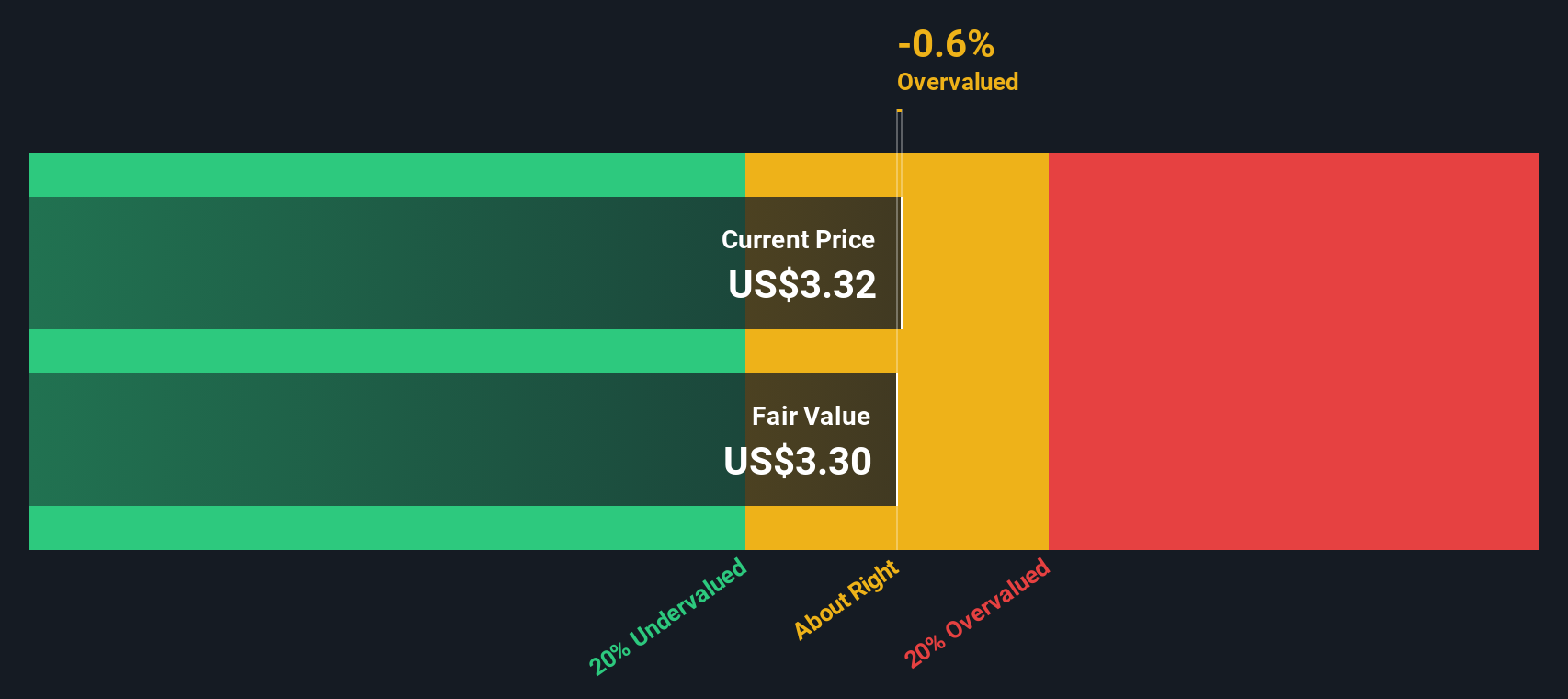

While narratives and analyst targets point to big upside, our SWS DCF model is far more cautious. It suggests fair value sits near $0.09, which makes the current $1.57 look significantly overvalued. Is the market right to bet on a turnaround, or is this optimism running ahead of cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out New Fortress Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own New Fortress Energy Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a custom view in just a few minutes: Do it your way.

A great starting point for your New Fortress Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in a few high conviction ideas using the Simply Wall Street Screener so you are not leaving potential returns on the table.

- Target powerful growth stories by scanning these 26 AI penny stocks shaping tomorrow’s software, automation, and intelligent infrastructure.

- Secure steadier income potential with these 15 dividend stocks with yields > 3% offering attractive yields backed by real cash generation.

- Position ahead of the next market narrative by reviewing these 81 cryptocurrency and blockchain stocks building real businesses on blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal