Is It Too Late To Consider USA Compression Partners After Its Strong Multi Year Run?

- If you are wondering whether USA Compression Partners still represents good value after its big run, or if most of the upside is already priced in, this article will walk through what the numbers are really saying about the units today.

- The price has cooled slightly in the last week, down about 4.0%. That comes after a solid 1.5% gain year to date and a 15.9% return over the last year, with the longer term still showing a 63.2% gain over 3 years and 222.8% over 5 years.

- Recent moves in the unit price have been shaped by ongoing interest in midstream energy infrastructure, with investors favoring assets that offer contracted cash flows and attractive yield in a higher for longer rate environment. At the same time, sector wide debates around long term natural gas demand and capital discipline have kept volatility elevated for compression providers such as USA Compression Partners.

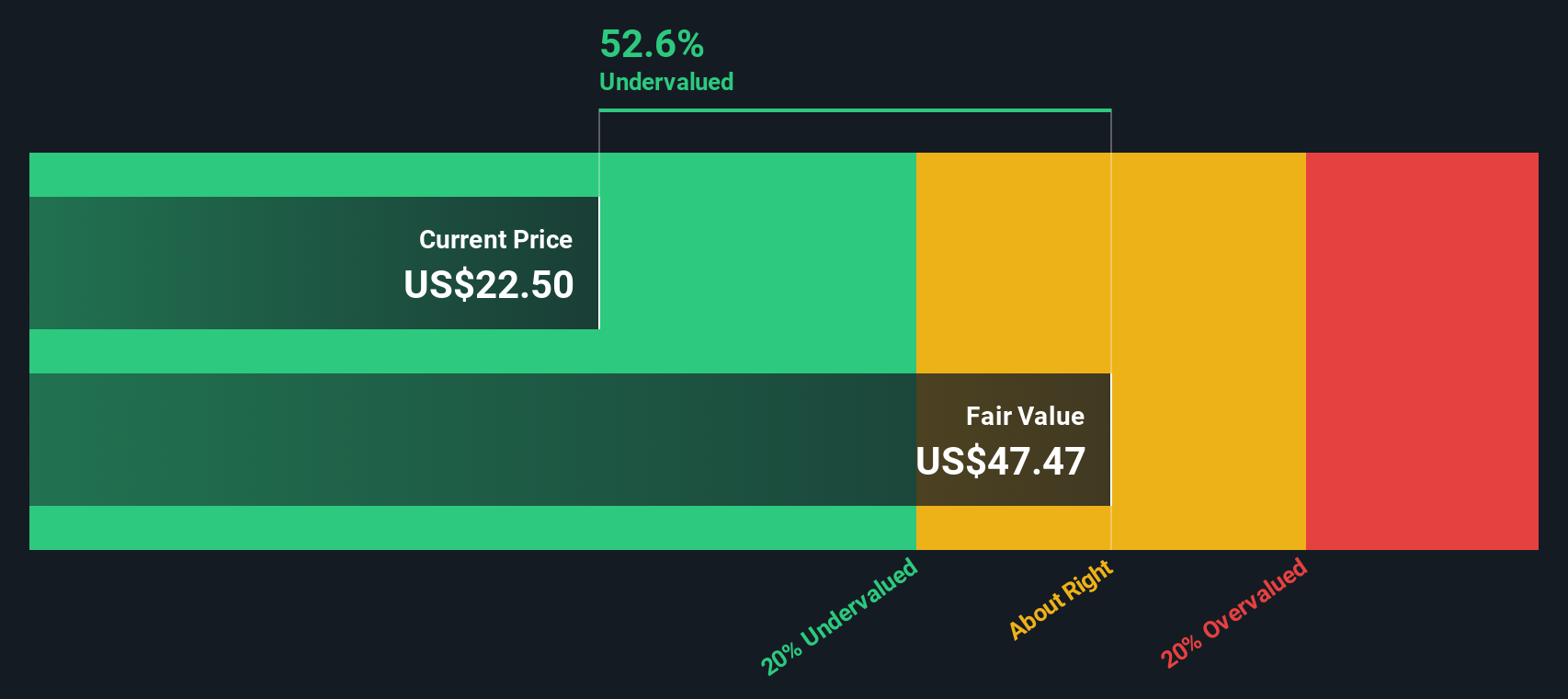

- Despite that backdrop, USA Compression Partners only scores 1 out of 6 on our undervaluation checks. We will break down what each valuation lens is seeing and then finish by looking at a more complete way to think about fair value beyond the usual models.

USA Compression Partners scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: USA Compression Partners Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting those cash flows back to today, using a required rate of return. For USA Compression Partners, the latest twelve month Free Cash Flow is about $183.5 Million, and analysts expect cash flows to soften from $160.5 Million in 2026 to $115 Million in 2027, before gradually drifting lower and then stabilizing over the following years based on Simply Wall St extrapolations.

Aggregating these projections using a 2 Stage Free Cash Flow to Equity approach results in an estimated intrinsic value of roughly $11.78 per unit. That compares to a current market price that implies the units are 106.1% above this DCF fair value, which indicates the market is pricing in significantly stronger or more durable cash flows than the model assumes.

The takeaway from this perspective is that, on a pure cash flow basis, USA Compression Partners appears richly valued rather than cheap.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests USA Compression Partners may be overvalued by 106.1%. Discover 905 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: USA Compression Partners Price vs Earnings

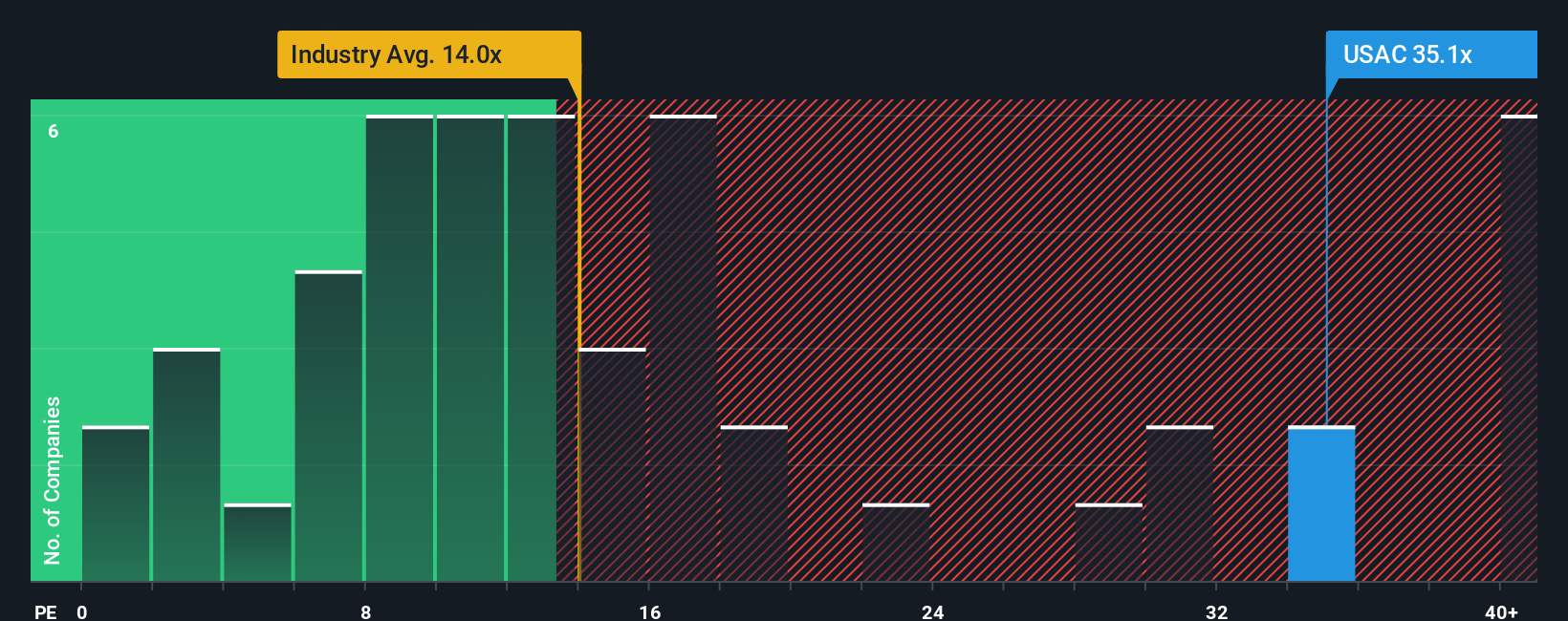

For profitable businesses like USA Compression Partners, the price to earnings ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. In general, companies with stronger, more reliable growth and lower perceived risk can justify a higher PE multiple, while slower growth or higher risk usually calls for a lower, more conservative PE.

USA Compression Partners currently trades on a PE of about 30.9x. That sits above the broader Energy Services industry average of around 18.3x, but actually below the peer group average of roughly 36.6x. This suggests the market is pricing the business at a premium to the sector overall, but not to the most optimistic comparables.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what a “normal” PE should be for USA Compression Partners, given its specific mix of earnings growth, profit margins, risk profile, industry, and market cap. On that basis, the Fair Ratio is 21.7x. The current 30.9x multiple is materially higher than what these fundamentals alone would justify, which points to a stretched valuation rather than a bargain.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1449 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your USA Compression Partners Narrative

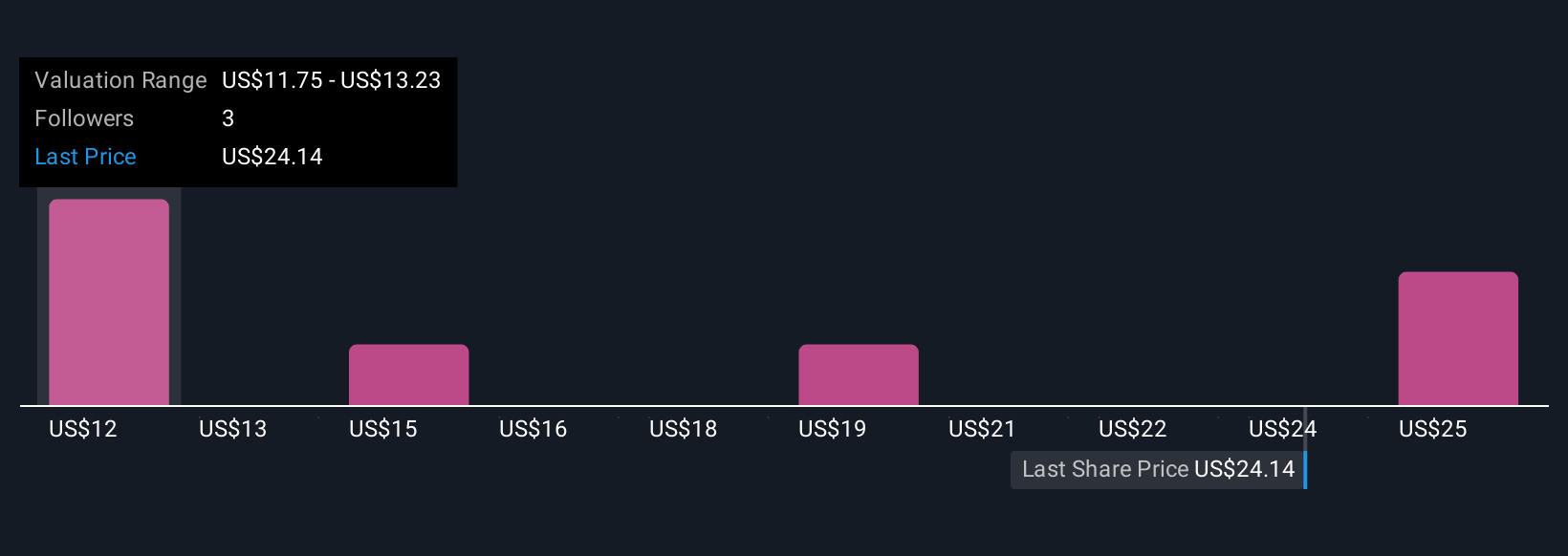

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of USA Compression Partners’ future with the numbers that sit behind a fair value estimate.

A Narrative is your story for the company, where you spell out what you think will happen to its revenue, earnings and profit margins, then link that story to a financial forecast and a fair value that can be compared directly to today’s price.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy, guided tool that helps you assess your own view on buying or selling by showing whether your fair value estimate is above or below the current market price, and they are automatically refreshed when new earnings, news or other key data points arrive.

For example, one USA Compression Partners Narrative might assume revenue keeps compounding, margins expand toward the mid teens and justify a fair value near the bullish 30.0 dollar target, while a more cautious Narrative could focus on customer concentration, capital intensity and energy transition risks and land closer to the bearish 23.0 dollar view.

Do you think there's more to the story for USA Compression Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal