Adaptive Biotechnologies (ADPT): Valuation Check After ASH clonoSEQ Data Spotlight and Q3 Earnings Beat

Adaptive Biotechnologies (ADPT) is back in the spotlight as new clonoSEQ data dominates the American Society of Hematology meeting, just weeks after the company surprised Wall Street with stronger than expected third quarter profitability and revenue growth.

See our latest analysis for Adaptive Biotechnologies.

Despite a sharp 1 day share price pullback of 15.52 percent to 14.75, Adaptive Biotechnologies still boasts a powerful year to date share price return of 138.29 percent and a 1 year total shareholder return of 135.25 percent. This suggests momentum remains broadly constructive even after recent insider selling and profit taking.

If this kind of clinical driven rerating has your attention, it may be worth exploring other specialist names in healthcare stocks to see where the market is spotting the next wave of opportunity.

With clonoSEQ data surging at ASH and earnings surprising to the upside, investors now face a tougher question: is Adaptive Biotechnologies still trading at a discount, or has the market already priced in its future growth?

Most Popular Narrative Narrative: 24.6% Undervalued

Adaptive Biotechnologies last closed at 14.75 per share, while the most followed narrative pegs fair value meaningfully higher, implying further upside if its growth story holds.

Substantial expansion in the MRD clinical pharma pipeline, evidenced by a growing clinical trial backlog (now at $218 million, up 21% over prior year) and increased use of clonoSEQ as a primary endpoint, forecasts future milestone payments and a high-quality revenue stream as regulatory momentum globally accelerates MRD adoption in drug development.

Curious how sustained double digit revenue growth, rising margins and a punchy future earnings multiple can all coexist in one story? See what is baked into that fair value call.

Result: Fair Value of $19.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained losses and potential pricing pressure on clonoSEQ reimbursement could quickly challenge the bullish growth assumptions that underpin that undervaluation case.

Find out about the key risks to this Adaptive Biotechnologies narrative.

Another Lens on Valuation

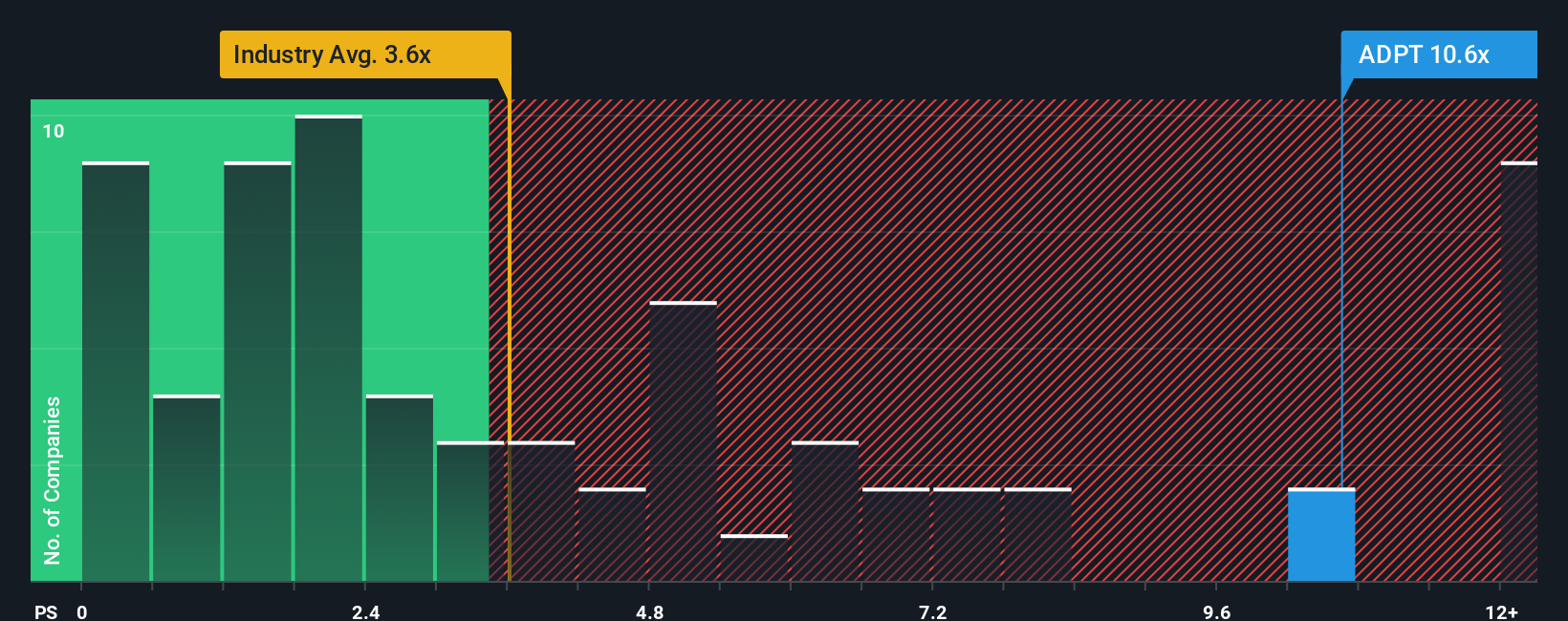

While narrative fair value points to upside, a simple price-to-sales check tells a different story. Adaptive trades at about 8.9 times sales versus 3.4 times for the US Life Sciences industry and 3.7 times peers, far above a 4.8 times fair ratio the market could drift back toward.

That kind of gap can close in two ways: either earnings race to catch up, or the share price does the adjusting. Which risk do you think is more likely from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adaptive Biotechnologies Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a tailored view in just a few minutes: Do it your way.

A great starting point for your Adaptive Biotechnologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Turn this momentum into a smarter watchlist by using the Simply Wall Street Screener to uncover focused opportunities, instead of waiting for the next headline move.

- Capture early stage growth potential by scanning these 3575 penny stocks with strong financials that combine small market caps with surprisingly solid fundamentals and upside that broader markets may be overlooking.

- Ride powerful structural trends by targeting these 15 dividend stocks with yields > 3% that can boost your income stream while still offering room for capital appreciation over time.

- Strengthen your opportunity set with these 908 undervalued stocks based on cash flows that trade below what their cash flows imply, before the rest of the market closes the gap.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal