Datadog (DDOG): Assessing Valuation After New Security and Cloud Marketplace Partnerships

Datadog (DDOG) just rolled out two client focused partnerships: one with Contrast Security to sharpen application threat detection inside Cloud SIEM and another with Flywl to simplify how enterprises buy and manage Datadog across cloud marketplaces.

See our latest analysis for Datadog.

Those partnerships land at an interesting moment for the stock, with a 30 day share price return of minus 20.83 percent but a 90 day share price return still up 10.97 percent, and a three year total shareholder return of 103.07 percent, which suggests that long term momentum is intact even as short term sentiment cools.

If these moves have you rethinking your exposure to software infrastructure, it could be worth exploring other high growth tech and AI names. You can use our high growth tech and AI stocks as a starting list of ideas.

With shares still more than 25 percent below estimated intrinsic value and trading at a roughly 40 percent discount to analyst targets, investors now face a pivotal question: is this a genuine buying window, or is future growth already priced in?

Most Popular Narrative Narrative: 28.6% Undervalued

Datadog's most popular narrative pegs fair value at roughly $211.97 per share versus a last close of $151.41, framing the stock as materially mispriced and setting up an aggressive long term growth story.

Ongoing product innovation (e.g., autonomous AI agents, enhanced security modules, expanded log and data observability) is increasing platform breadth and relevance, providing cross-selling opportunities and driving higher average revenue per user and net retention rate, which in turn improves recurring revenue predictability and gross margins.

Want to see the math behind this punchy upside case? The narrative leans on rapid scaling revenues, expanding margins, and a future earnings multiple that only elite software names usually command. Curious which specific growth and profitability assumptions justify that premium valuation path? Read on to uncover the projections driving this fair value call.

Result: Fair Value of $211.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat path depends on Datadog dodging key risks, including hyperscaler competition and large AI customers aggressively optimizing, or even insourcing, observability spend.

Find out about the key risks to this Datadog narrative.

Another Angle on Valuation

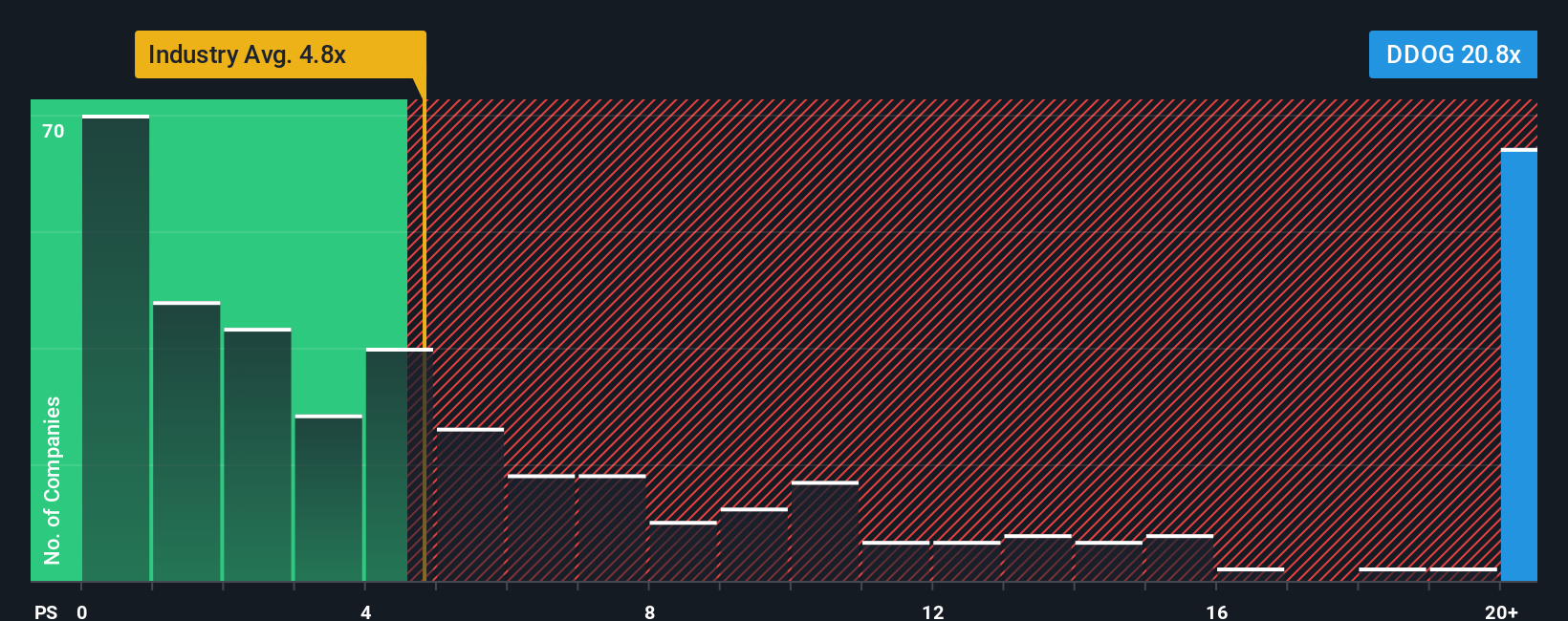

There is a catch, though. On a price to sales basis, Datadog looks expensive, trading at 16.5 times sales versus 7.4 times for peers and 4.9 times for the broader US software group, and even above its own 13.3 times fair ratio estimate. This points to meaningful multiple compression risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datadog Narrative

If you are not convinced by this view, or simply prefer to dig into the numbers yourself, you can build a custom Datadog thesis in just a few minutes, Do it your way.

A great starting point for your Datadog research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next set of opportunities by putting the Simply Wall St Screener to work across different themes and risk profiles.

- Capture early stage growth stories with these 3575 penny stocks with strong financials that already show solid financial underpinnings instead of betting blindly on hype.

- Position your portfolio for the next wave of automation and intelligence by targeting these 26 AI penny stocks shaping everything from infrastructure to real world applications.

- Strengthen your income stream and potential total return by focusing on these 15 dividend stocks with yields > 3% that can reward patience year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal