How Investors May Respond To Nebius Group (NBIS) Doubling AI Capacity After Meta Deal And New Financing

- In late November 2025, Nebius Group reported sold-out AI data center capacity, secured a five-year US$3.00 billion contract with Meta Platforms, and highlighted accelerating expansion supported by substantial new equity and debt financing.

- This combination of very strong demand, high-profile hyperscale customers, and rising leverage has sharpened investor focus on how Nebius balances rapid growth with financial risk.

- Next, we’ll examine how Nebius’s move to more than double its AI power capacity target reshapes the company’s existing investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Nebius Group Investment Narrative Recap

To own Nebius, you need to believe that surging AI infrastructure demand and hyperscaler relationships can eventually outweigh current losses, dilution, and rising leverage. The Meta contract and sold out capacity reinforce the near term revenue catalyst, but they also amplify the key risk around execution and balance sheet strain as Nebius races to deliver on its enlarged 2.5 GW AI power target.

The five year, roughly US$3.0 billion GPU infrastructure agreement with Meta feels most relevant here, since it both validates Nebius as a major AI supplier and ties directly into its capacity build out plans and financing needs. With Nebius already raising more than US$4.0 billion through equity and convertible debt, this contract could influence how investors weigh future cash inflows against the compounding effects of dilution, higher interest expense, and execution risk on large, multi site deployments.

Yet even with sold out capacity and high profile AI contracts, investors still need to consider how increased debt and share issuance could affect...

Read the full narrative on Nebius Group (it's free!)

Nebius Group's narrative projects $3.2 billion revenue and $428.7 million earnings by 2028.

Uncover how Nebius Group's forecasts yield a $159.29 fair value, a 62% upside to its current price.

Exploring Other Perspectives

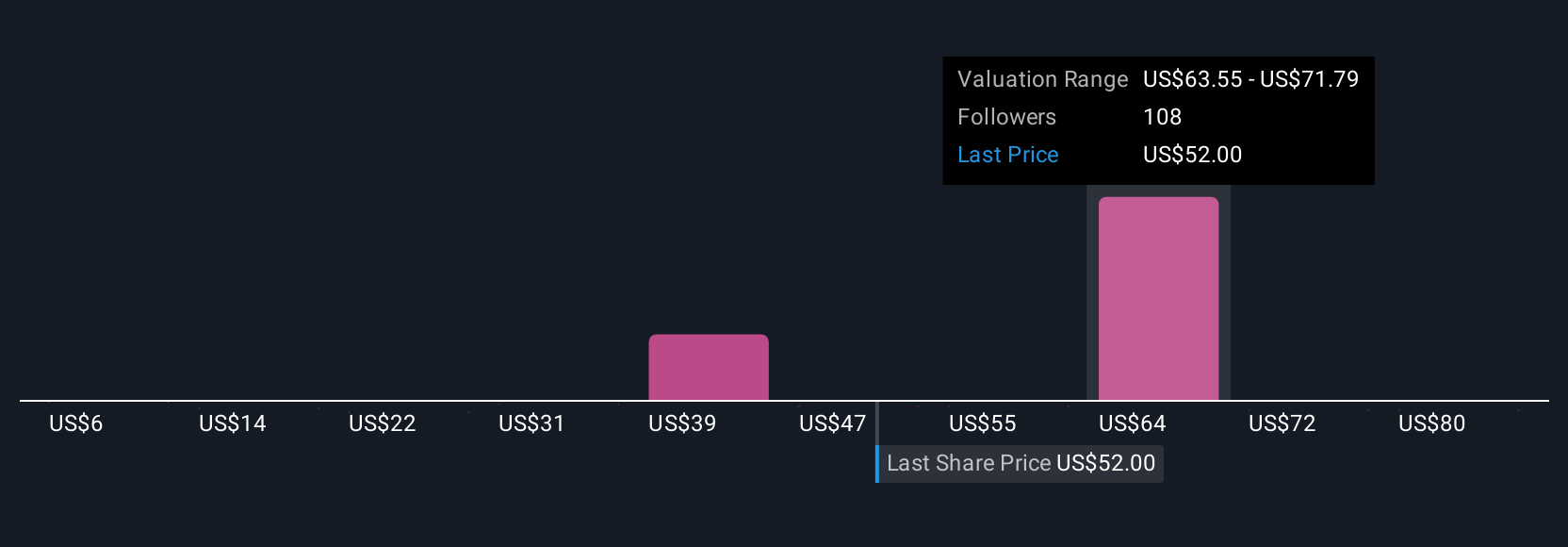

Simply Wall St Community members place Nebius’s fair value anywhere from US$10.97 to US$165.80 across 33 separate views, underlining how far apart opinions can be. When you set those against the company’s plan to more than double AI power capacity, it highlights why some may focus on long term demand potential while others worry more about financing risk and execution.

Explore 33 other fair value estimates on Nebius Group - why the stock might be worth less than half the current price!

Build Your Own Nebius Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nebius Group's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal