Qualys (QLYS) Valuation Check After Strong Q3 Beat and Raised Full-Year Guidance

Qualys (QLYS) just delivered a stronger than expected third quarter, lifting revenue, widening margins, and raising full year guidance. That upgraded outlook is what has investors reassessing the stock.

See our latest analysis for Qualys.

Even with today’s earnings bump, Qualys’ share price at about $146 still reflects a mixed picture, with a modest year to date share price return but a slightly negative 1 year total shareholder return. This suggests that near term momentum is rebuilding while longer term holders remain only moderately ahead.

If this kind of earnings led re rating has you looking wider in cybersecurity and software, it could be a good moment to explore high growth tech and AI stocks as potential next opportunities.

On the surface, solid growth, rich margins, and a slight intrinsic value discount hint at upside. Yet a lofty history and cautious analyst targets complicate the picture. Is this a fresh buying window or is future growth already priced in?

Most Popular Narrative Narrative: 2.5% Overvalued

With Qualys last closing at $146.08 against a narrative fair value of $142.56, the story leans only slightly rich and largely balanced.

Adoption of Qualys' new cloud-native risk operations center (ROC) and Agentic AI platform positions the company as a leading pre-breach risk management provider, offering unified orchestration, automation, and remediation across both Qualys and non-Qualys data; this opens incremental greenfield opportunities and should support higher ARPU and expanded TAM, leading to durable revenue and earnings growth.

Want to see why modest growth assumptions, stable but easing margins, and a richer future earnings multiple still support this valuation path? The full narrative spells out the revenue build, profit trajectory, and long term multiple the market may be willing to pay, but keeps one core assumption surprisingly bold.

Result: Fair Value of $142.56 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid AI competition and potential misfires in Flex pricing or QLU usage could crimp revenue visibility and undermine the current growth narrative.

Find out about the key risks to this Qualys narrative.

Another Take: Market Multiples Point to Upside

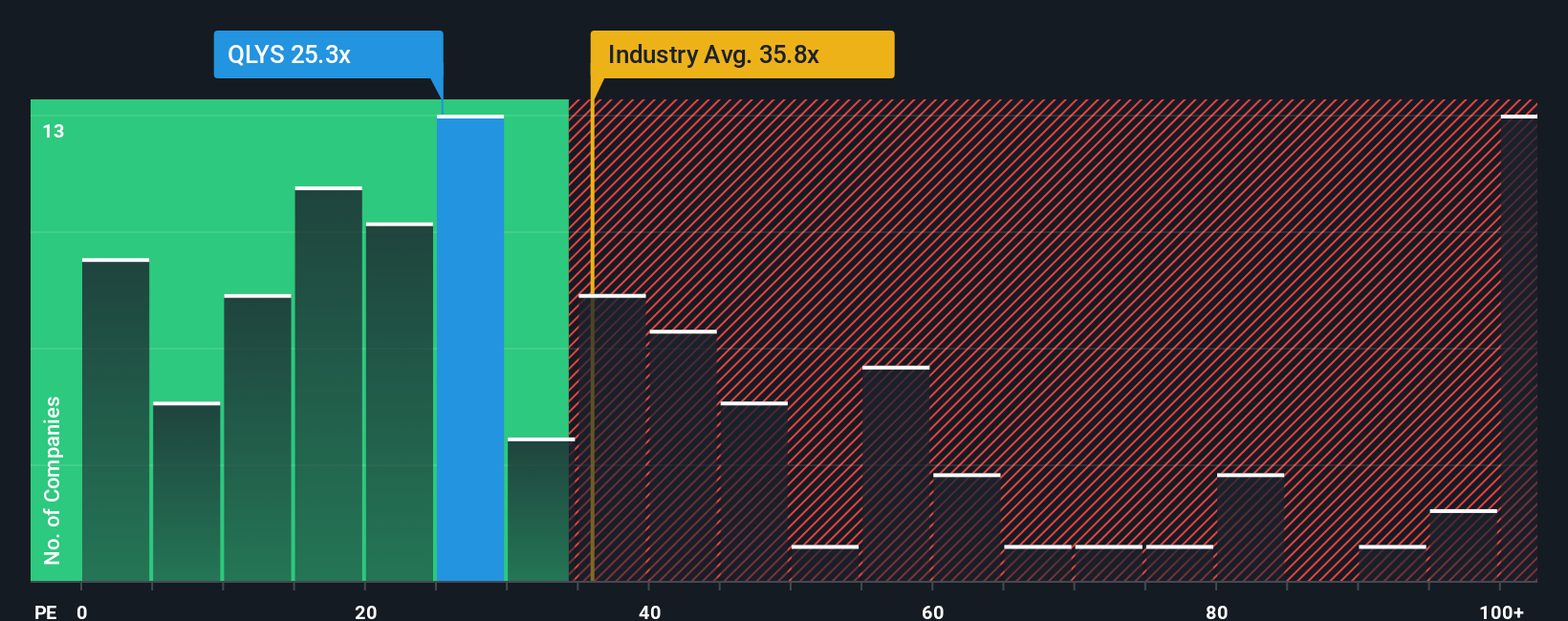

While the narrative model pegs Qualys as about 2.5% overvalued, simple earnings multiples tell a looser story. At roughly 27.7 times earnings, the stock trades well below peers on 64.8 times and the US software average on 31.5 times, yet above its fair ratio of 25 times. That gap hints at some valuation risk, but also room for the market to re rate closer to peers if execution holds, leaving investors to decide which signal to trust.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Qualys Narrative

If you see the story differently or prefer to test your own assumptions against the numbers, you can craft a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Qualys.

Looking for more investment ideas?

Do not stop with one stock when you can upgrade your whole watchlist. Use the Simply Wall Street Screener to explore a wider range of opportunities.

- Consider potential high growth at lower price points by scanning these 3573 penny stocks with strong financials that already show financial strength instead of relying on pure speculation.

- Explore the next technology wave by targeting these 26 AI penny stocks that combine scalable business models with demonstrated traction in artificial intelligence.

- Look for quality at a discount by focusing on these 908 undervalued stocks based on cash flows where current prices appear to lag behind long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal