How Advent’s Major Stake Cut At First Watch (FWRG) Has Changed Its Investment Story

- Advent International has already sold 9,400,000 shares of First Watch Restaurant Group, sharply reducing its stake to 5,289,784 shares worth about US$82.73 million as of September 30, 2025.

- This large secondary sale by a key shareholder comes as analysts continue to highlight First Watch’s growth potential and the company prepares to present at Barclays’ 11th Annual Eat, Sleep, Play, Shop Conference in New York on December 2, 2025.

- Next, we’ll examine how Advent International’s sizable share sale may influence First Watch’s growth-focused investment narrative and longer-term outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

First Watch Restaurant Group Investment Narrative Recap

To own First Watch, you have to believe its daytime-only, growth-focused model can translate strong sales momentum into healthier profitability over time. Advent International’s 9,400,000-share sell-down looks more like shareholder reshuffling than a change in the operating story, and it does not appear to alter the near term growth catalyst of new-unit openings or the key risk that rising commodity and labor costs could keep margins under pressure.

The most relevant recent update here is the November follow-on equity offering, in which 5,289,784 shares were sold for about US$93.7 million. While this expanded First Watch’s public float around the time Advent cut its stake, the company’s guidance for about 20% to 21% revenue growth in 2025 and 60 to 61 new system-wide restaurants keeps the focus squarely on execution and unit economics as the real drivers of future returns.

But investors should also be aware that persistent food and wage inflation could still squeeze margins and...

Read the full narrative on First Watch Restaurant Group (it's free!)

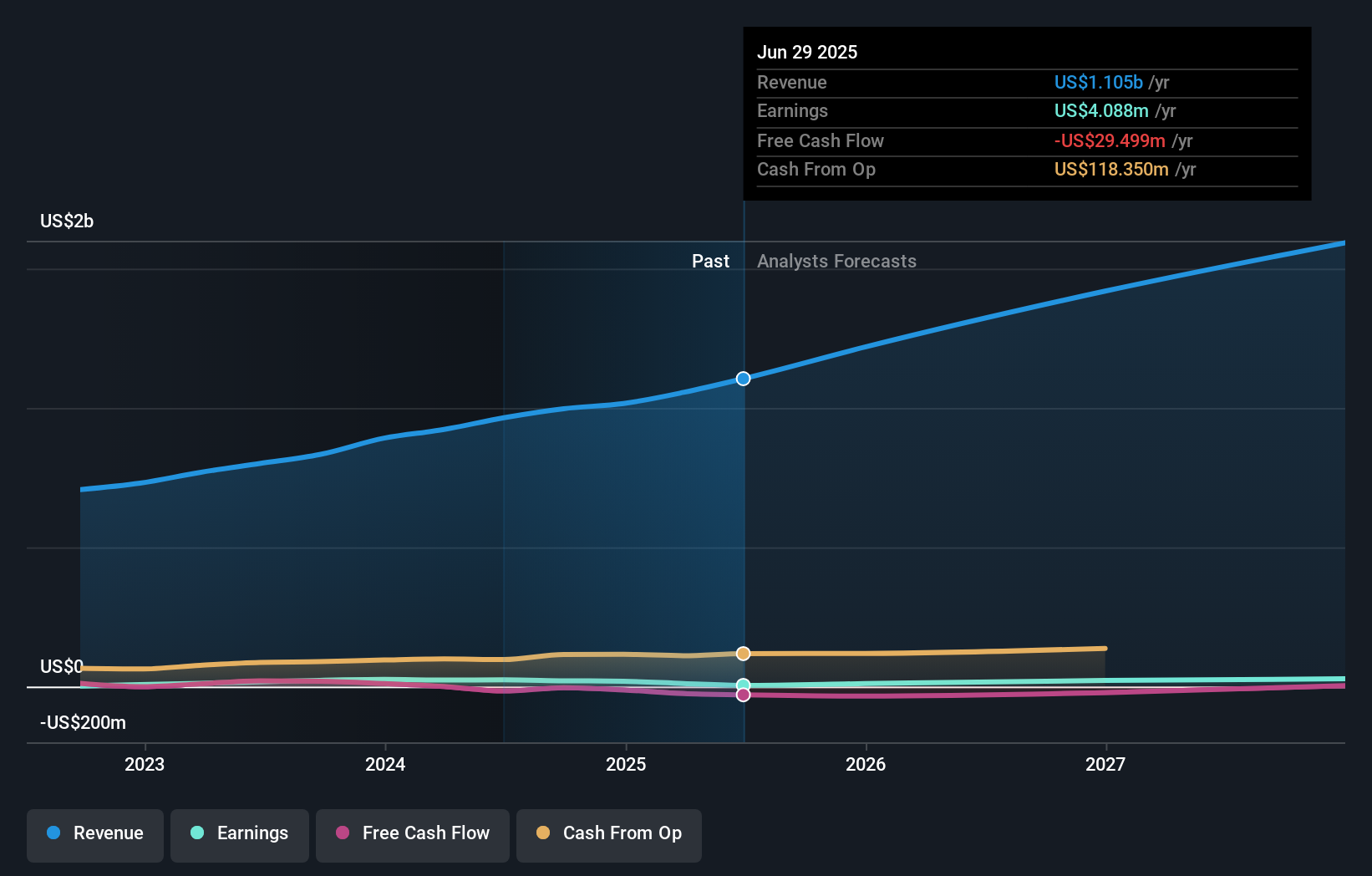

First Watch Restaurant Group's narrative projects $1.7 billion revenue and $33.8 million earnings by 2028. This requires 15.1% yearly revenue growth and about a $29.7 million earnings increase from $4.1 million today.

Uncover how First Watch Restaurant Group's forecasts yield a $22.00 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$8.19 to US$22, underscoring how far apart individual views can be. Against that wide range, ongoing cost inflation and margin pressure give you another reason to compare several different perspectives before deciding how First Watch fits into your portfolio.

Explore 2 other fair value estimates on First Watch Restaurant Group - why the stock might be worth as much as 24% more than the current price!

Build Your Own First Watch Restaurant Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free First Watch Restaurant Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Watch Restaurant Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal