Should American Tower's (AMT) Bigger Dividend and New Debt Shape How Investors View Its Risk Balance?

- American Tower Corporation recently declared a quarterly cash distribution of US$1.70 per share, payable on February 2, 2026, to shareholders of record as of December 29, 2025.

- At the same time, the company issued US$850.00 million of 4.700% senior unsecured notes due December 15, 2032, highlighting how it is pairing shareholder payouts with long-term funding plans.

- Next, we’ll look at how American Tower’s combination of a higher quarterly dividend and new senior notes shapes its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is American Tower's Investment Narrative?

To own American Tower, you really have to believe in the long-term need for its global tower network and the company’s ability to convert that into growing, high quality earnings, even if revenue expands more slowly than the broader market. The latest dividend declaration at US$1.70 per share reinforces the income angle, while the new US$850.0 million 4.700% senior notes underline that this is still a highly leveraged REIT relying on debt markets to fund its plans. Those moves do not fundamentally alter the near term catalysts, which remain execution against the raised 2025 guidance and how the market reassesses a stock trading well below both analyst and estimated fair values after a 1-year total return decline of around 11%. The bigger swing factor is how investors weigh dependable payouts against balance sheet risk.

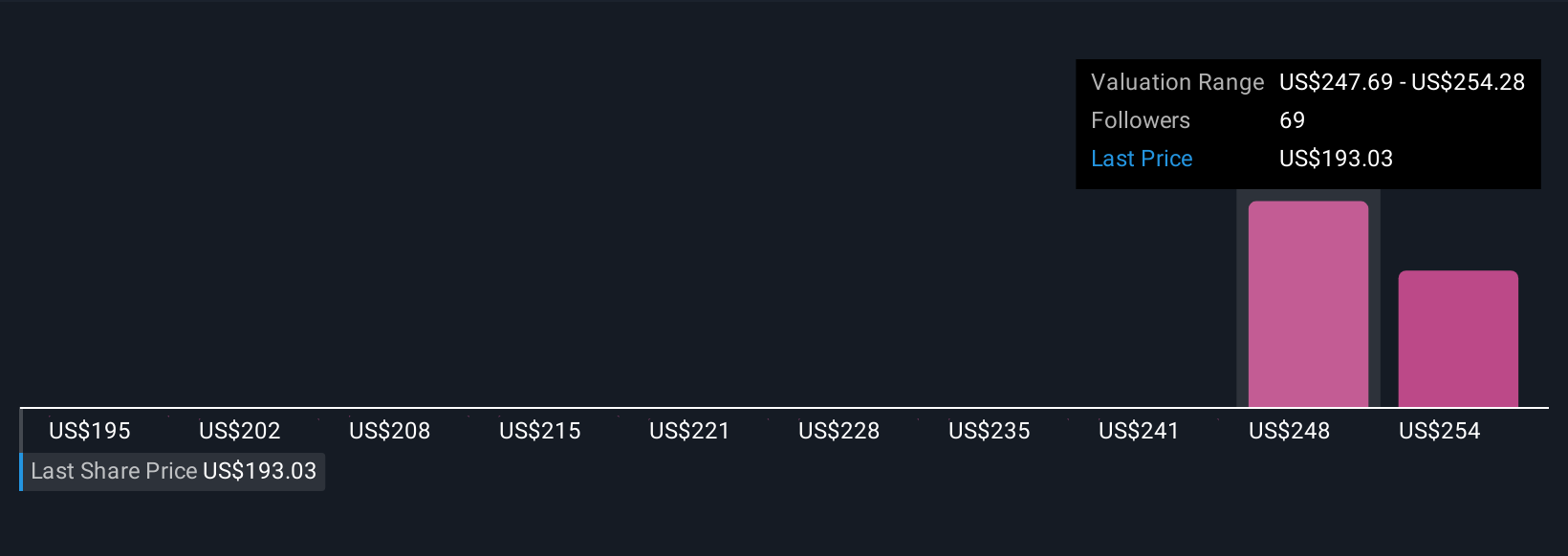

However, investors should also be aware of how American Tower’s heavy use of debt shapes future outcomes. Despite retreating, American Tower's shares might still be trading 32% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 5 other fair value estimates on American Tower - why the stock might be worth just $195.00!

Build Your Own American Tower Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Tower research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Tower research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Tower's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal