Should Court‑Backed Debt Restructuring and Governance Changes Reshape Country Garden (SEHK:2007) Investors’ Strategy?

- Country Garden Holdings said that in early December 2025 the court sanctioned its offshore debt restructuring scheme, while bondholders approved changes to nine onshore corporate bonds and shareholders backed loan capitalisation, new share issuance, and a management incentive plan at an extraordinary general meeting.

- Together with November 2025 contracted sales of about RMB 2.35 billion and leadership changes including a new Co‑Chairman, these steps show the group reshaping its balance sheet and governance while maintaining ongoing operations.

- We’ll now examine how the court-backed restructuring, especially the offshore debt scheme, reshapes Country Garden’s investment narrative and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Country Garden Holdings' Investment Narrative?

To stay in Country Garden now, you have to believe the court‑sanctioned offshore restructuring, onshore bond changes and equity-linked measures can collectively stabilise a heavily stressed balance sheet while the core development business remains viable despite shrinking scale and ongoing losses. The offshore scheme and loan capitalisation look material for near term catalysts, because they directly address default risk and liquidity pressure that previously dominated the story, even if the company is still unprofitable and flagged at risk of default. At the same time, November’s contracted sales of about RMB 2.35 billion and leadership changes suggest operations are continuing, but not yet transforming the earnings picture. The bigger question for shareholders is whether this financial reset reduces the chance of further dilution or disorderly asset sales.

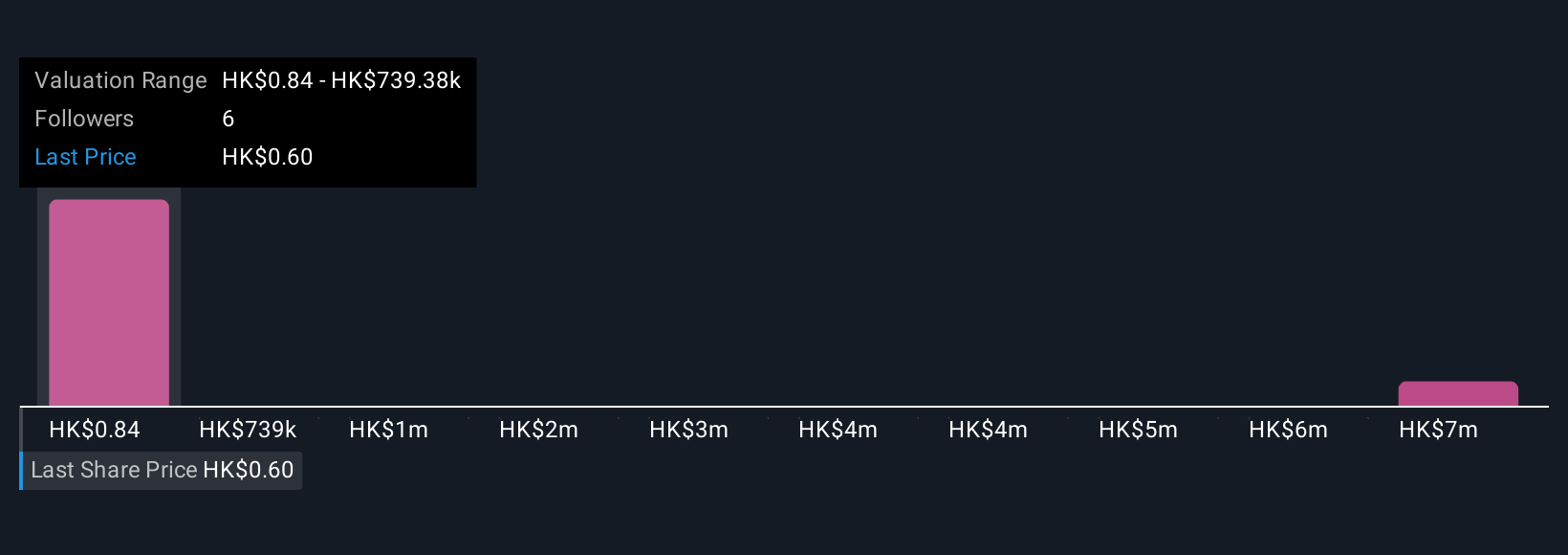

However, the debt load and risk of further dilution are still issues investors should understand. Insights from our recent valuation report point to the potential undervaluation of Country Garden Holdings shares in the market.Exploring Other Perspectives

Explore 5 other fair value estimates on Country Garden Holdings - why the stock might be worth just HK$0.84!

Build Your Own Country Garden Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Country Garden Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Country Garden Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Country Garden Holdings' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal