Is EQT’s Earnings Beat and Portfolio Shuffle Altering The Investment Case For EQT (EQT)?

- EQT Corporation recently reported third-quarter earnings per share that exceeded analyst expectations, while revenue lagged, and advanced asset sales and stock offerings as part of its ongoing portfolio optimization.

- This performance comes as new US liquefied natural gas export capacity and AI-related power demand are expected to lift long-term natural gas usage.

- We’ll now examine how EQT’s stronger earnings and asset reshaping could influence its investment narrative and long-term gas-demand thesis.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

EQT Investment Narrative Recap

EQT’s story still rests on a simple belief: that rising US LNG exports and AI-driven power needs will support durable demand for its low-cost Appalachian gas. The latest quarter’s EPS beat and revenue miss do not materially change that near term, but they do sharpen focus on the key catalyst of LNG export ramp-up and the key risk that decarbonization policies and renewables could eventually cap gas demand.

Against that backdrop, EQT’s continued dividend growth, including the October 2025 increase to an annualized US$0.66 per share, stands out as the most relevant recent move. It reinforces the company’s emphasis on returning cash to shareholders at a time when investors are closely watching how rising LNG capacity and AI-related power demand might translate into sustained free cash flow.

But while optimism around LNG and AI power demand is building, investors should also be aware that faster decarbonization efforts could still...

Read the full narrative on EQT (it's free!)

EQT's narrative projects $9.8 billion revenue and $3.8 billion earnings by 2028.

Uncover how EQT's forecasts yield a $64.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

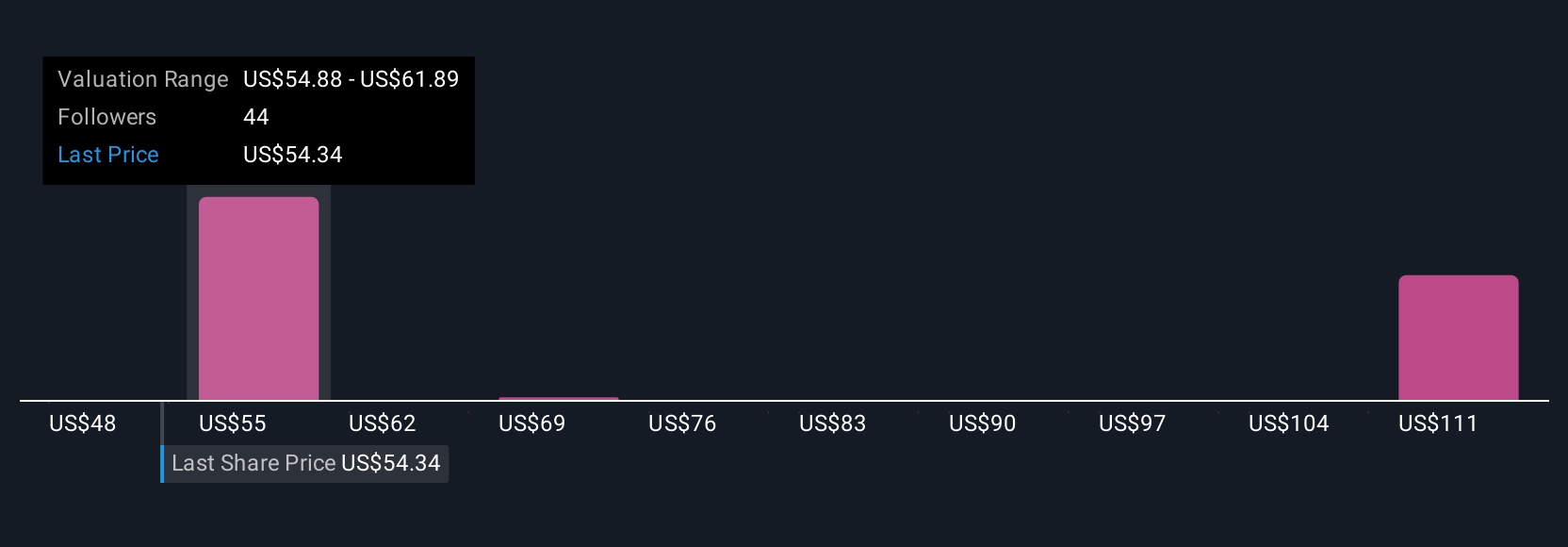

Five members of the Simply Wall St Community value EQT between US$47.87 and US$87.57, highlighting how far opinions on upside can stretch. Set these views against the risk that more aggressive decarbonization or methane rules could raise costs and pressure margins, and it becomes clear why you may want to compare several different takes on EQT’s future.

Explore 5 other fair value estimates on EQT - why the stock might be worth 21% less than the current price!

Build Your Own EQT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EQT research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EQT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EQT's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal