Assessing Air Products and Chemicals (APD) Valuation After Recent Share Price Rebound

Air Products and Chemicals (APD) has quietly produced steady revenue growth and a significant increase in annual net income growth, even as the stock has lagged over the past year.

See our latest analysis for Air Products and Chemicals.

In that context, the recent 1 month share price return of 8.66 percent to 261.62 dollars looks more like a rebound than a new uptrend. This is especially true given the 1 year total shareholder return of negative 16.67 percent and slightly negative 3 year total shareholder return, which suggests momentum is still rebuilding rather than firmly established.

If APD’s recent move has you thinking about where else steady growth and sentiment shifts might be emerging, it could be worth exploring fast growing stocks with high insider ownership for other under the radar ideas.

With earnings still growing, a modest intrinsic value discount, and analyst targets sitting well above today’s price, is Air Products and Chemicals a quietly undervalued compounder, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 15.8% Undervalued

With Air Products and Chemicals last closing at 261.62 dollars against a narrative fair value near 310.76 dollars, the valuation hinges on ambitious growth and margin assumptions.

Analysts expect earnings to reach $3.8 billion (and earnings per share of $16.99) by about September 2028, up from $1.6 billion today.

Curious how earnings could more than double while the valuation multiple steps down, yet still point to upside? The answer lies in tightly engineered margins, disciplined growth, and a surprisingly moderate future price to earnings assumption. Want to see the exact profit and revenue path that makes this math work? Dive in to see what underpins that fair value jump.

Result: Fair Value of $310.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy capital needs and potential project delays, particularly across large hydrogen and ammonia developments, could strain free cash flow and derail the current earnings momentum.

Find out about the key risks to this Air Products and Chemicals narrative.

Another View: Market Ratios Look Less Forgiving

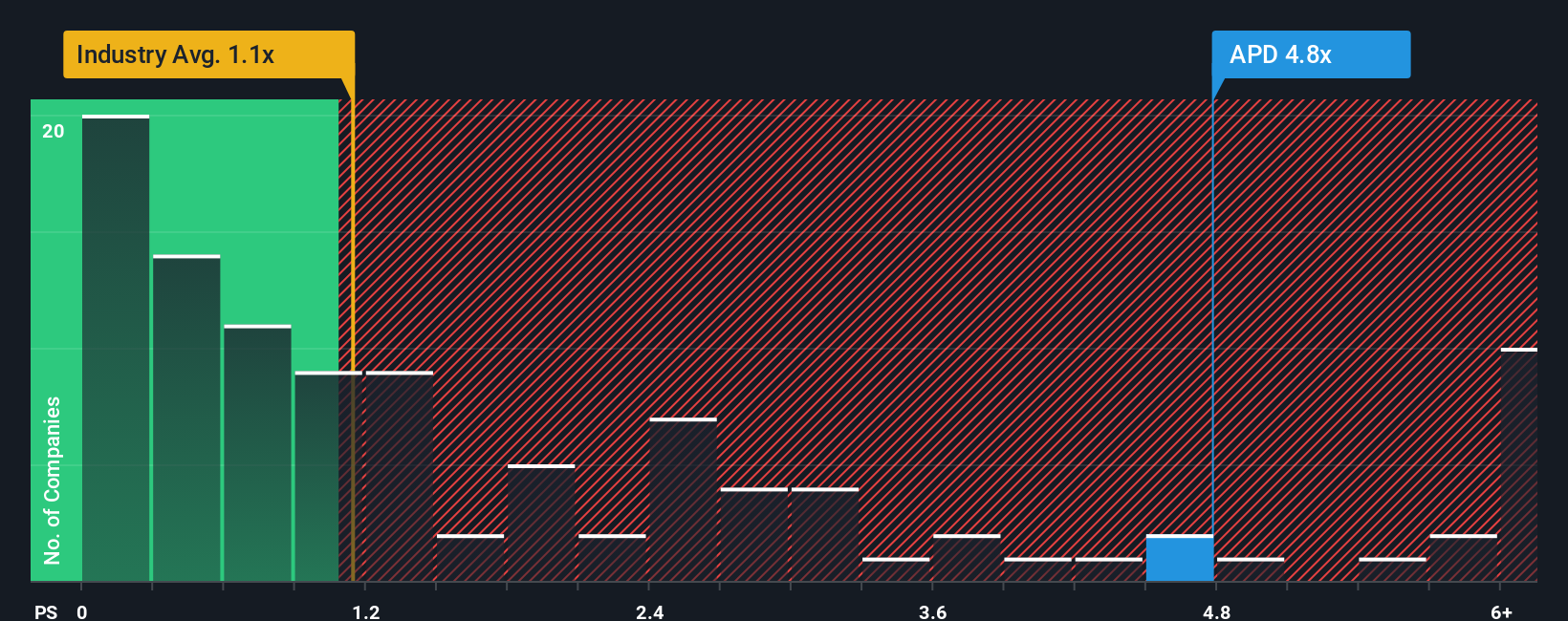

While our fair value work suggests APD is only about 1.4 percent below intrinsic value, its 4.8 times price to sales ratio looks demanding next to the US Chemicals industry at 1.1 times, the peer average at 4.1 times, and a fair ratio of just 2.5 times. That gap raises the question of whether today’s price bakes in more growth and execution than the narrative implies.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Air Products and Chemicals Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put Simply Wall St to work for you and uncover fresh opportunities that could reshape your portfolio’s returns over the next few years.

- Target reliable income streams by scanning these 15 dividend stocks with yields > 3% that combine attractive yields with solid underlying businesses.

- Capitalize on innovation by reviewing these 26 AI penny stocks positioned at the forefront of artificial intelligence transformation.

- Strengthen your value playbook by filtering for these 909 undervalued stocks based on cash flows where market pessimism may have pushed prices below intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal