6K Additive (ASX:6KA) Loss Deepens, Reinforcing Bearish Cash Runway and Balance Sheet Concerns

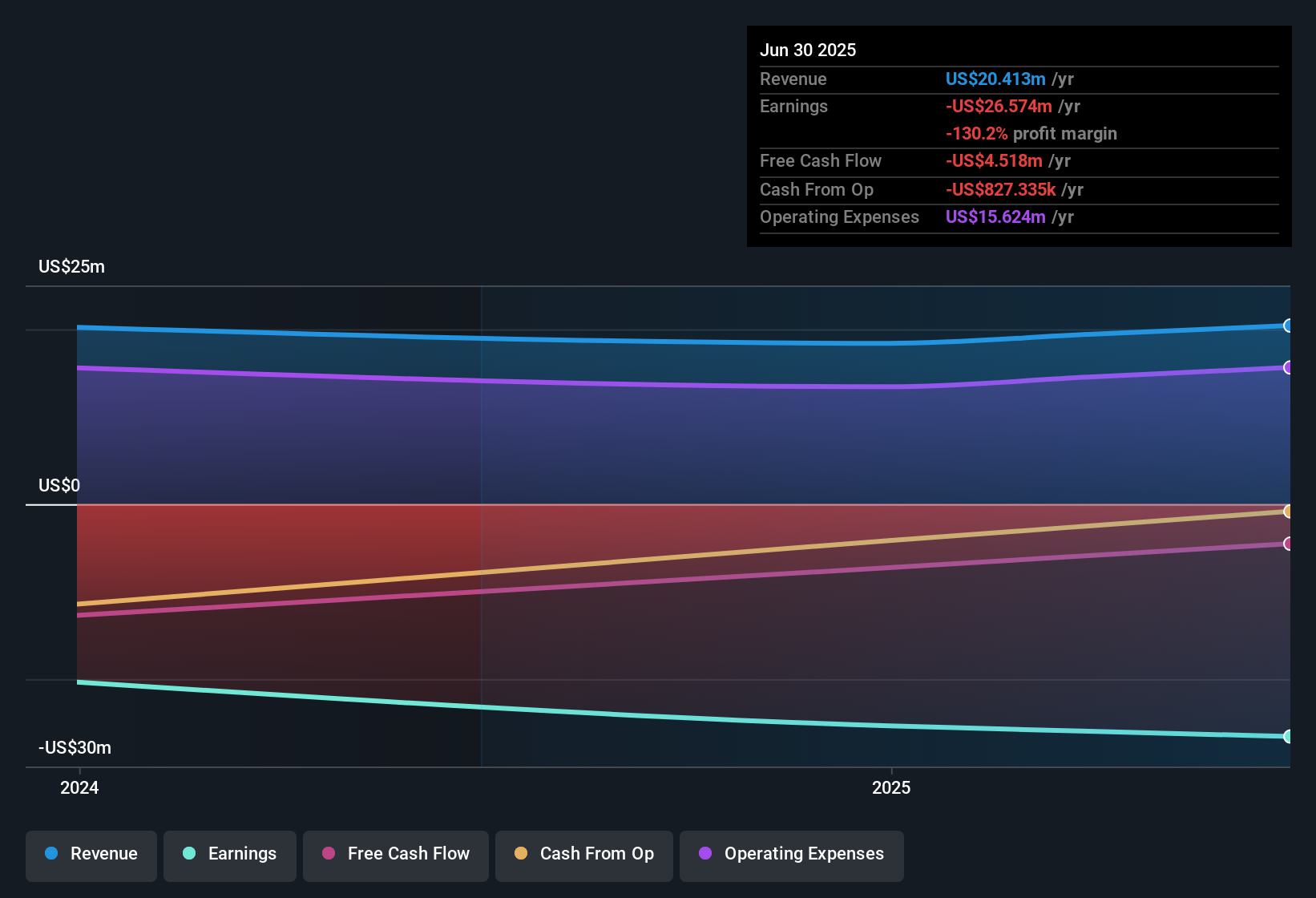

6K Additive (ASX:6KA) has released its H1 2025 numbers, posting total revenue of about $9.7 million alongside a net loss of roughly $12.8 million. This leaves investors weighing modest top line progress against ongoing red ink. The company has seen revenue move from around $7.7 million in H1 2024 to $9.7 million in H1 2025. Meanwhile, trailing 12 month revenue sits near $20.4 million against a net loss of about $26.6 million, underscoring a business that is expanding sales but still running with heavy negative margins.

See our full analysis for 6K Additive.With the latest figures on the table, the next step is to compare these margins and growth trends with the dominant narratives around 6K Additive to see which stories hold up and which may need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Stay Large Despite Slightly Higher Sales

- On a trailing 12 month basis, revenue was about $20.4 million while net loss was roughly $26.6 million, meaning losses were larger than the total sales generated over the same period.

- Bears focus on this mismatch between growth and profitability, and the latest figures support that concern:

- Revenue grew only 5.7% over the last year to about $20.4 million, while the trailing net loss widened to roughly $26.6 million from about $25.3 million.

- Across the last three half year periods, net loss stayed in a tight range around $11.6 million to $13.7 million per half, showing that heavier revenue in late 2024 did not translate into meaningfully smaller losses.

Short Cash Runway Adds Financing Risk

- The analysis flags less than one year of cash runway and negative shareholders' equity, alongside highly illiquid shares, as major pressure points for the balance sheet.

- Critics highlight these balance sheet and liquidity issues as a key risk for shareholders, and the numbers back that view:

- With the business still unprofitable and reporting a trailing 12 month net loss of about $26.6 million, having under a year of cash coverage means the company may need fresh funding if losses continue at a similar pace.

- Negative shareholders' equity combined with highly illiquid shares makes any future capital raise more challenging, so financing risk becomes just as important as the income statement trend when judging the stock.

Low 6.9x Sales Multiple Versus Peers

- The stock trades on a Price to Sales ratio of 6.9 times, which is markedly lower than the Australian Metals and Mining industry average of 123.4 times and the peer average of 819.3 times.

- More optimistic investors argue that this relatively low multiple could offer value, but the earnings profile complicates that case:

- The 5.7% trailing 12 month revenue growth and modest step up in half year sales from about $7.7 million to $9.7 million show some progress, yet not the kind of rapid expansion that would clearly justify a big rerating on sales alone.

- Because the company remains loss making with around $26.6 million in trailing 12 month net losses and has negative equity, the discounted P to S multiple still needs to be weighed against the elevated balance sheet and cash runway risks.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on 6K Additive's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

6K Additive is growing sales slowly while racking up losses larger than its revenue, with a weak balance sheet and short cash runway amplifying risk.

If that fragile financial profile worries you, use our solid balance sheet and fundamentals stocks screener (1943 results) to quickly focus on companies with stronger balance sheets, healthier liquidity and resilience when conditions turn tough.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal