Rapid7 (RPD) Valuation Check as HITRUST Partnership Targets Automated Compliance and Cyber Resilience

Rapid7 (RPD) just teamed up with HITRUST to plug its Surface Command platform directly into HITRUST’s assurance framework, aiming to automate compliance workflows and cut the friction of continuous security validation.

See our latest analysis for Rapid7.

The HITRUST tie up lands as Rapid7’s 1 month share price return of 13.1 percent contrasts sharply with a deeply negative 1 year total shareholder return, which hints that sentiment might be stabilizing after a rough stretch.

If this compliance push has you rethinking where growth could come from next, it might be worth scanning high growth tech and AI stocks to spot other software driven security and infrastructure names catching market interest.

With shares still down sharply over one and three years despite a recent rebound and a sizable gap to analyst targets, is Rapid7 quietly undervalued, or is the market already discounting all the growth this new compliance push could deliver?

Most Popular Narrative: 20.8% Undervalued

With Rapid7 closing at $16.12 against a narrative fair value of $20.37, the gap suggests markets may be underrating its earnings power and platform leverage.

Rapid7's unified Command platform and MDR-led solutions are increasingly winning larger, strategic consolidation deals as enterprises seek to reduce fragmentation and simplify compliance in complex, highly regulated environments, pointing to an expanding addressable market, higher average revenue per customer, and sustained revenue growth opportunity.

Want to see the math behind that optimism? The narrative quietly leans on improving margins, disciplined discounting, and a future earnings multiple usually reserved for sector leaders.

Result: Fair Value of $20.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, extended deal cycles and ongoing execution challenges mean revenue could stay choppy, which may undermine the margin expansion and valuation multiple that this undervaluation case assumes.

Find out about the key risks to this Rapid7 narrative.

Another View On Valuation

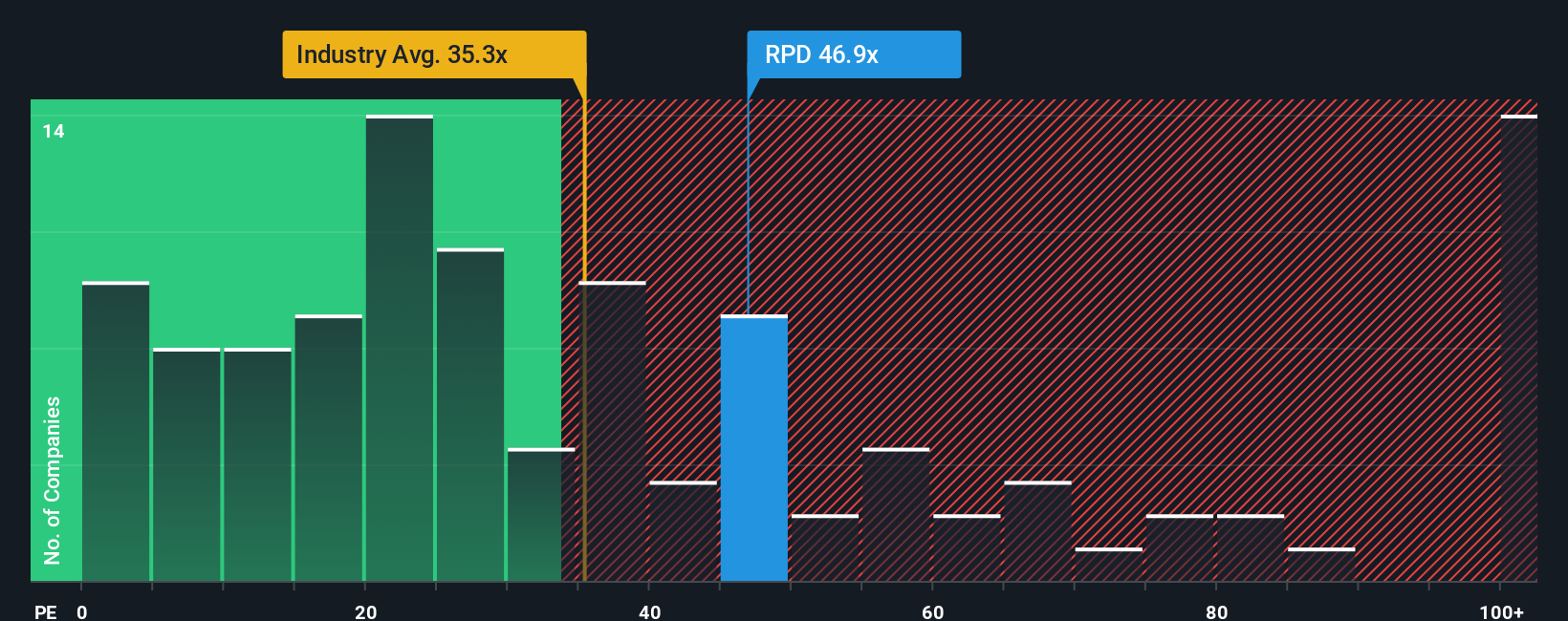

Look past narrative fair value and Rapid7’s earnings multiple tells a tougher story. At about 47 times earnings versus roughly 32 for US software and a fair ratio of 34.6, the stock screens as expensive, raising the risk that any stumble could hit the share price hard.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rapid7 Narrative

If you see the story differently or want to stress test your own assumptions using our tools, you can build a custom view in minutes: Do it your way.

A great starting point for your Rapid7 research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider building a shortlist of fresh opportunities with our powerful stock screeners, so Rapid7 is just one smart move in a stronger portfolio.

- Target potential bargains early by scanning these 912 undervalued stocks based on cash flows that may be pricing in too much pessimism relative to their cash flow strength.

- Explore structural technology shifts by focusing on these 26 AI penny stocks that are positioned to benefit as intelligent automation influences software and security.

- Review these 15 dividend stocks with yields > 3% to help strengthen your income stream with stocks that combine current yields with room for sustainable payout growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal