AI giants borrow heavily, and Wall Street is busy protecting itself: preparing risk transfers, wild buying default swaps...

The Zhitong Finance App learned that while Wall Street is preparing to provide huge loans to giants in the field of artificial intelligence (AI), it is also trying to protect itself from any bubble that its financing may fuel. The urgency for banks to reduce their risk exposure is evident throughout the credit market. The cost of using derivatives to protect Oracle (ORCL.US) debt from default has risen to its highest level since the 2008 global financial crisis. Morgan Stanley has considered using significant risk transfers (a form of insurance against loan losses) to spread some of its risks associated with tech company borrowers.

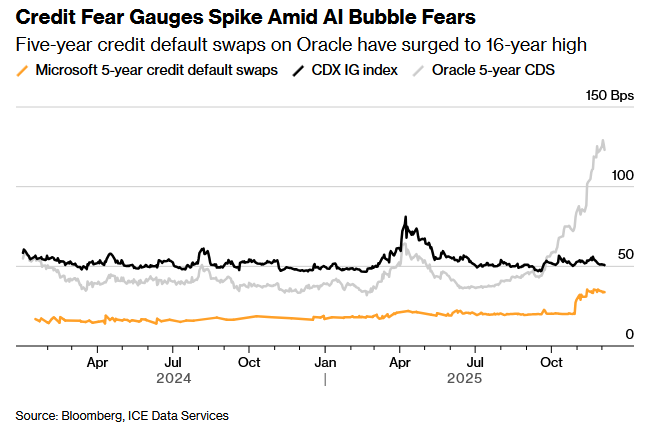

Oracle's 5-year credit default swap price soars to 16-year high

Tech giants including Oracle, Meta Platforms (META.US), and Google (GOOGL.US) issued large-scale bonds for their AI capital expenses, which contributed to global bond issuance exceeding $6.46 trillion in 2025. These hyperscale tech companies, along with power companies and others, are expected to invest at least $5 trillion to build data centers and other infrastructure to support AI technology that has the potential to revolutionize the global economy.

The amount of investment is so huge that issuers will have to enter almost every major debt market. J.P. Morgan notes that these technology investments may take years to pay off—if they actually pay off in the end. Steven Gray, chief investment officer at Grey Value Management, also said, “(AI) This technology is impressive. But that doesn't mean you're going to profit from it.”

This AI investment boom has exposed some lenders to excessive risk exposure, so they are using a range of tools — credit derivatives, complex bonds, and some newer financial products — to transfer the risk of the AI investment boom to other investors.

Real risk

These risks became more real last week. At the time, a major interruption led to the suspension of CME Group transactions, which reminded investors that data center customers could be lost if there were repeated failures. Since then, Goldman Sachs has suspended data center operator CyrusOne's planned $1.3 billion mortgage-backed securities sales.

Banks are turning to the credit derivatives market to reduce their risk exposure. According to Barclays credit strategist Jagar Patel's analysis of transaction report data, in the nine weeks ending November 28, Oracle's credit default swap transaction volume surged to about $8 billion, far higher than the level of about 350 million US dollars in the same period last year.

According to a recent Morgan Stanley research report, banks provided most of the huge construction loans for data centers, and that Oracle is the expected tenant, which is probably the main reason driving Oracle's hedging transactions. This includes a $38 billion loan portfolio and a $18 billion loan to build multiple new data center facilities in Texas, Wisconsin, and New Mexico.

The cost of default swaps is rising

In addition to Oracle, the price of other default swaps is also rising. On Thursday, the annualized cost of a five-year credit default swap to protect Microsoft (MSFT.US)'s $10 million debt from default was about $34,000 (or 34 basis points), up from nearly $20,000 in mid-October.

Andrew Weinberg, portfolio manager at hedge fund management company Saba Capital Management, said that for an AAA-rated company, the profit differences in Microsoft's default swaps are often wide. By contrast, the annual cost of the default swap for Johnson & Johnson, another US AAA rating company, was about 19 basis points on Thursday. He said, “Selling Microsoft's default swap at a spread of 50% or more compared to Johnson & Johnson, which also has an AAA rating, is a rare opportunity.”

Similar opportunities exist for Oracle, Meta, and Google. Weinberg said that although they borrow on a large scale, their credit default swap deals have high interest spreads compared to their default risk, so sales protection is meaningful. He added that even if these companies were downgraded, these positions should perform well because they already reflect so much potentially bad news.

Increased urgency

The sheer scale of the latest debt issuance has added to this urgency. Not long ago, investors also thought that a $10 billion transaction in the US high-grade bond market was a huge amount. However, Teddy Hodgson, global co-head of the investment grade debt capital market at Morgan Stanley, said that for companies with a market capitalization of trillions of dollars and capital requirements of hundreds of billions of dollars, 10 billion US dollar bond sales are only “a drop in the ocean.”

Hodgson said, “We raised $30 billion for Meta through 'bridge financing' — this means a one-day bond sale. This has always been unusual. Investors will have to get used to larger deals from hyperscale tech companies because they've become so huge, and seizing the AI opportunity will require huge investment.”

Reduce risk exposure

As a key player in AI competition financing, Morgan Stanley has considered divesting part of its data center risk exposure through a deal called a “significant risk transfer (SRT).” This type of transaction can provide banks with default protection against 5% to 15% of a given loan portfolio. SRT generally involves the sale of a type of bond called a credit-linked note, which may have credit derivatives associated with a company or loan portfolio embedded in it. If the borrower is in default, the bank can get compensation to cover the loss. Under these circumstances, it is reported that Morgan Stanley has conducted preliminary negotiations with potential investors on an SRT linked to AI infrastructure-related corporate loan portfolios.

Mark Clegg, a senior fixed income trader at Global Investments, said: “Banks are fully aware of the market's recent concerns about possible overinvestment and overvaluation in the AI sector. They may be exploring hedging or risk transfer mechanisms, and this should come as no surprise to anyone.”

People familiar with the matter revealed that private equity firms, including Ares Management Corp., have been trying to take on some of the risk exposure in SRT linked to banks and data centers. The company has been in talks with the bank about a possible deal.

Additionally, banks are looking to create other products that will enable them to divest the credit risk associated with hyperscale technology companies. People familiar with the matter say at least two companies are trying to package a set of credit derivatives linked to technology companies, similar to stock industry exchange-traded funds. Citadel Securities began marketing two groups of corporate bonds from hyperscale technology companies, enabling investors to quickly increase or decrease their risk exposure to these companies.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal