RGC Resources (RGCO) Q4 Loss Tests Bullish Narratives on Earnings Stability and Valuation

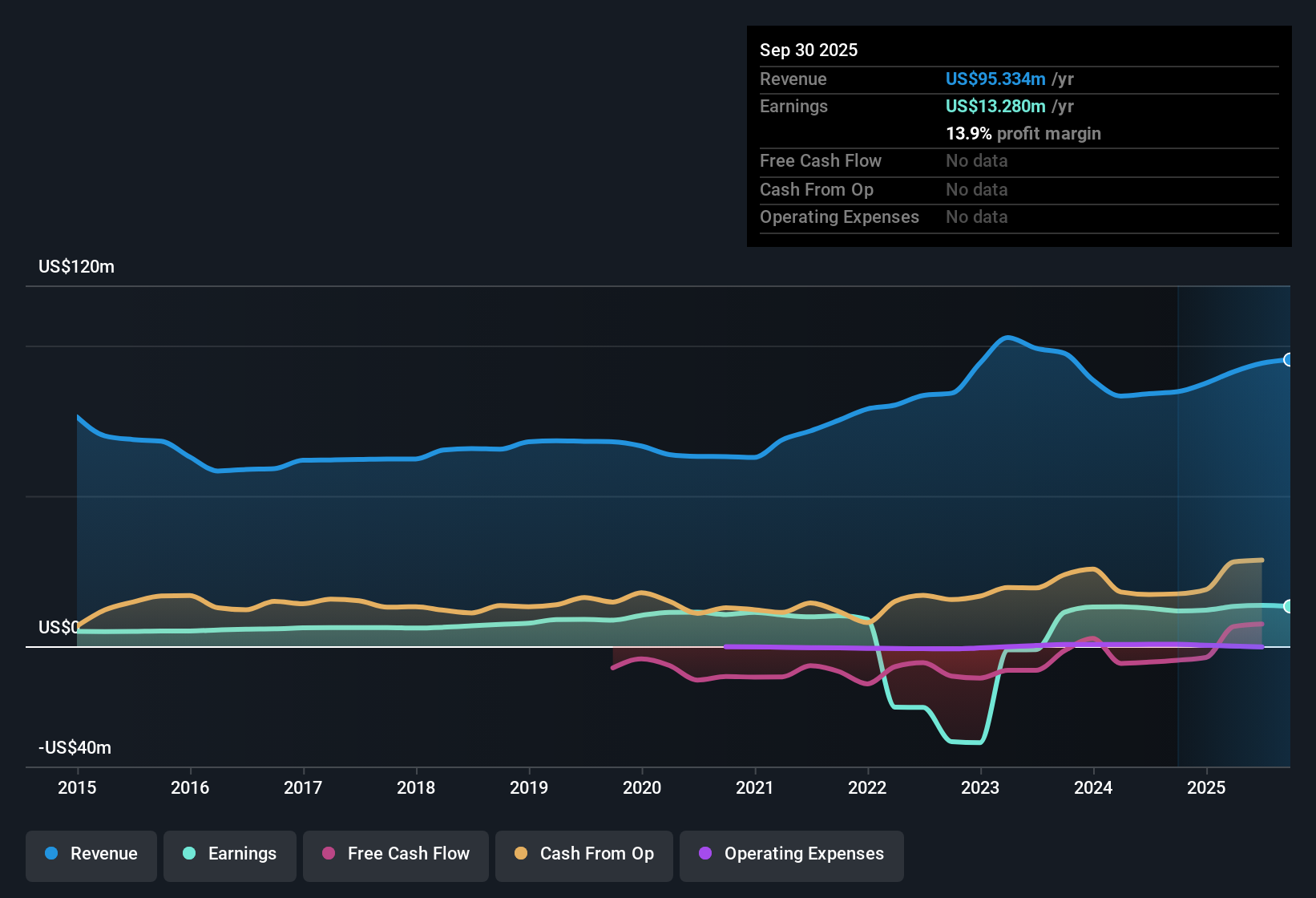

RGC Resources (RGCO) just posted a soft finish to FY 2025, with Q4 revenue of about $14.3 million and a small net loss of roughly $0.2 million, or EPS of around -$0.02, even as trailing twelve month net income sits near $13.3 million on revenue of about $95.3 million and EPS of roughly $1.29. The company has seen quarterly revenue range from about $27.3 million to $36.5 million earlier in the year, with EPS between roughly $0.51 and $0.74. This sets up a mixed picture where healthy full year profitability contrasts with a weaker final quarter, leaving investors to focus on how sustainably those margins can be maintained.

See our full analysis for RGC Resources.With the latest numbers on the table, the next step is to see how this earnings profile lines up with the most common narratives around RGC Resources and where the data starts to push back on prevailing views.

See what the community is saying about RGC Resources

Five Year Growth vs 2025 Slowdown

- Over the past five years, earnings grew about 18.1% a year, but the most recent twelve month growth was 12.9%, even though trailing twelve month net income is still around $13.3 million on $95.3 million of revenue.

- Consensus narrative leans positive on long term earnings stability, and this slower 12.9% growth rate interacts with that story in specific ways:

- Stronger regional development and infrastructure programs are expected to support recurring revenue, while the flat net profit margin at roughly 13.9% suggests profitability has held steady rather than accelerating in line with the five year trend.

- Forecasts call for earnings to reach about $14.5 million and EPS of roughly $1.41 by around 2028, which assumes the recent moderation in growth does not derail the longer term expansion embedded in those projections.

13.9% Margin Meets Interest Strain

- The business is currently running at about a 13.9% net profit margin on a trailing twelve month basis, but interest payments are flagged as not well covered by earnings, which makes that level of profitability more important to watch.

- Bears focus on financial risk, and the numbers give them some concrete talking points as well as limits:

- Critics highlight that weak interest coverage means more of that 13.9% margin has to go to lenders, and if earnings growth continues to run below the earlier 18.1% trend, it could constrain how much room there is to handle debt costs.

- At the same time, consensus expects revenue to grow by about 5.9% annually over the next few years with margins only slipping from roughly mid teens to near 13%, which assumes that current interest coverage pressures do not materially erode overall profitability.

Premium Valuation and 3.68% Dividend

- At a share price of $22.55, the stock trades above a DCF fair value of about $12.68 and carries a P/E of 17.5 times, while the dividend yield sits near 3.68% but is not well covered by free cash flow.

- Bulls emphasize resilient demand and regulated growth, and these valuation and payout metrics both support and challenge that optimistic angle:

- Supportive factors include steady trailing earnings near $13.3 million and expectations for revenue to reach about $111.9 million by 2028, which help explain why investors are willing to pay a P/E slightly below the broader US market despite the DCF fair value gap.

- On the other hand, the combination of a 3.68% dividend that is not backed by strong free cash flow and an above fair value share price leaves less room for error if earnings or margins come in below the projected mid teens level in the coming years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for RGC Resources on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the numbers that others might be missing, turn that into your own narrative in just a few minutes and Do it your way.

A great starting point for your RGC Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

RGC Resources combines premium pricing, thin interest coverage and a dividend not backed by strong free cash flow, which leaves limited room for missteps.

If those trade offs feel uncomfortable, use our solid balance sheet and fundamentals stocks screener (1940 results) today to quickly zero in on companies with stronger finances and more reliable cushions against shifting rates or earnings shocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal